Luxembourg tax calculator

For ease of use, our salary calculator makes a few assumptions, such as that you are not married and have no dependents.

Taxation in Luxembourg is a vast and rather complex field. It is worth starting with the basic principles and the types of taxes that exist. All individuals who receive any income — be it salary, pension, royalties, income from renting an apartment, etc. In Luxembourg the income tax is progressive, i. The first thing to remember is that the amounts of payments are different for residents and non-residents. The status of tax resident is not automatically assigned when receiving a residence permit. In Luxembourg, individuals are considered tax residents if they stay in the country for more than 6 months per year and have a domicile.

Luxembourg tax calculator

Since those early days we have extended our resources for Luxembourg to includes Tax Guides, Tax Videos and enhanced the tax calculators and supporting tax information. The Luxembourg Tax Calculator and salary calculators within our Luxembourg tax section are based on the latest tax rates published by the Tax Administration in Luxembourg. In this dedicated Tax Portal for Luxembourg you can access:. The Luxembourg Tax Calculator below is for the tax year, the calculator allows you to calculate income tax and payroll taxes and deductions in Luxembourg. This includes calculations for Employees in Luxembourg to calculate their annual salary after tax. Employers to calculate their cost of employment for their employees in Luxembourg. Number of hours worked per week? Number of weeks for weekly calculation? Employment Income and Employment Expenses period? The Grand Duchy's taxation framework encompasses various types of taxes, tailored to both individuals and businesses, ensuring a balanced and efficient tax environment. Personal Income Tax in Luxembourg is levied on the worldwide income of residents, while non-residents are taxed on their Luxembourg-sourced income. The tax system is progressive, with rates increasing as income rises. It includes various income sources such as employment income, business profits, pensions, and rental income.

All individuals who receive any income — be it salary, pension, royalties, income from renting an apartment, etc.

.

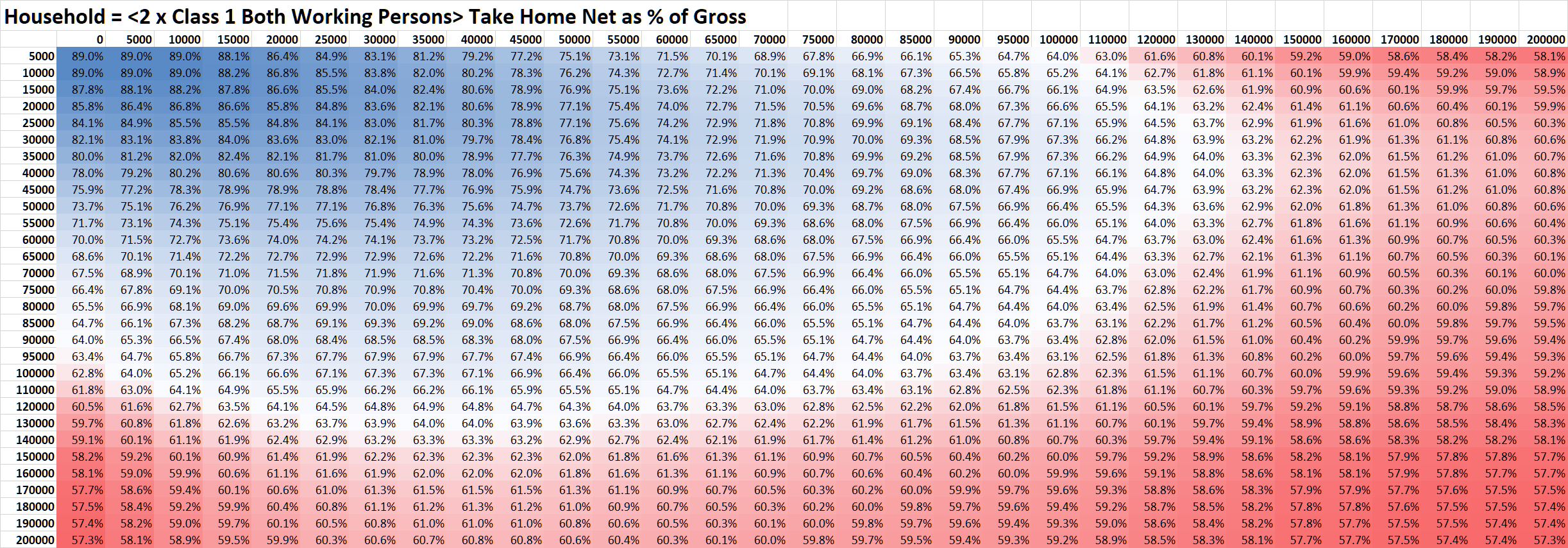

For ease of use, our salary calculator makes a few assumptions, such as that you are not married and have no dependents. In other words, we assume that you are in Luxembourg's tax class 1. Even if your personal situation is different, our calculator can still give you a good indication of your net salary in Luxembourg. The table below breaks down the taxes and contributions levied on these employment earnings by the Luxembourg government. This figure makes Luxembourg the EU member state with the highest average wage.

Luxembourg tax calculator

The Annual Salary Calculator is updated with the latest income tax rates in Luxembourg for and is a great calculator for working out your income tax and salary after tax based on a Annual income. The calculator is designed to be used online with mobile, desktop and tablet devices. Review the full instructions for using the Luxembourg Salary After Tax Calculators which details Luxembourg tax allowances and deductions that can be calculated by altering the standard and advanced Luxembourg tax settings. A quick and efficient way to compare annual salaries in Luxembourg in , review income tax deductions for annual income in Luxembourg and estimate your tax returns for your Annual Salary in Luxembourg. The Annual Luxembourg Tax Calculator is a diverse tool and we may refer to it as the annual wage calculator, annual salary calculator or annual after tax calculator, it is however the same calculator, there are simply so many features and uses of the tool annual income tax calculator, there is another! Number of hours worked per week?

Pressure horn sound

Taxation in Luxembourg is a vast and rather complex field. Salary Calculator Belgium. An expat who has not acquired real estate can still be considered a tax resident if he or she has a place of residence where the individual resides regularly for a significant period of time. In Luxembourg, individuals are considered tax residents if they stay in the country for more than 6 months per year and have a domicile. All individuals who receive any income — be it salary, pension, royalties, income from renting an apartment, etc. Property taxes in Luxembourg include a real estate tax on property ownership and a transfer tax on property sales. The tax rate varies depending on the level of taxable income. The first thing to remember is that the amounts of payments are different for residents and non-residents. Calculator Comparison. Which tax declarations to fill and when. However, it is important to note that the mean tends to be skewed by high earners, since it is calculated as the sum of all salaries divided by the number of individuals.

On this page we provide a comprehensive overview of how to use the calculator to estimate your income tax due based on your taxable income in Luxembourg in line with the Tax Tables published by the Luxembourg Government. The tool is specifically designed to calculate income tax in Luxembourg and does not account for other deductions, if you would like to calculate your take home pay based on your annual salary in , please use the salary tax calculator for Luxembourg here. Before using the calculator, it's important to understand what constitutes taxable income.

The information provided on this site is intended for informational purposes only. The exceptions are made for 1 and 1a classes, who receive less than , euros per year from a single source, such as a retirement pension. The rate depends on the relationship between the donor and the beneficiary, with closer relatives typically taxed at lower rates. Use our calculator to estimate the associated take-home pay. All consumers pay VAT for the purchase of goods, it is always included in the final price. All individuals who receive any income — be it salary, pension, royalties, income from renting an apartment, etc. Taxpayers must file annual returns, and in some cases, quarterly or monthly declarations. Our subscribers who have already filed and reported their income have shared their experiences. The maximum combined income tax rate, which includes all contribution fees and the solidarity tax, may not exceed the threshold of Yearly Monthly Weekly. Log in to your account on Guichet. Period Annual salary Monthly salary. Salary Calculator Luxembourg. For ease of use, our salary calculator makes a few assumptions, such as that you are not married and have no dependents.

It is interesting. Tell to me, please - where I can find more information on this question?