Lumber chart

Subscription Plans Features. Developer Docs Features.

See all ideas. See all brokers. EN Get started. Market closed Market closed. No trades. Key data points.

Lumber chart

.

Like down to range as it split through support at Lumber is expected to trade at Looking forward, we estimate lumber chart to trade at

.

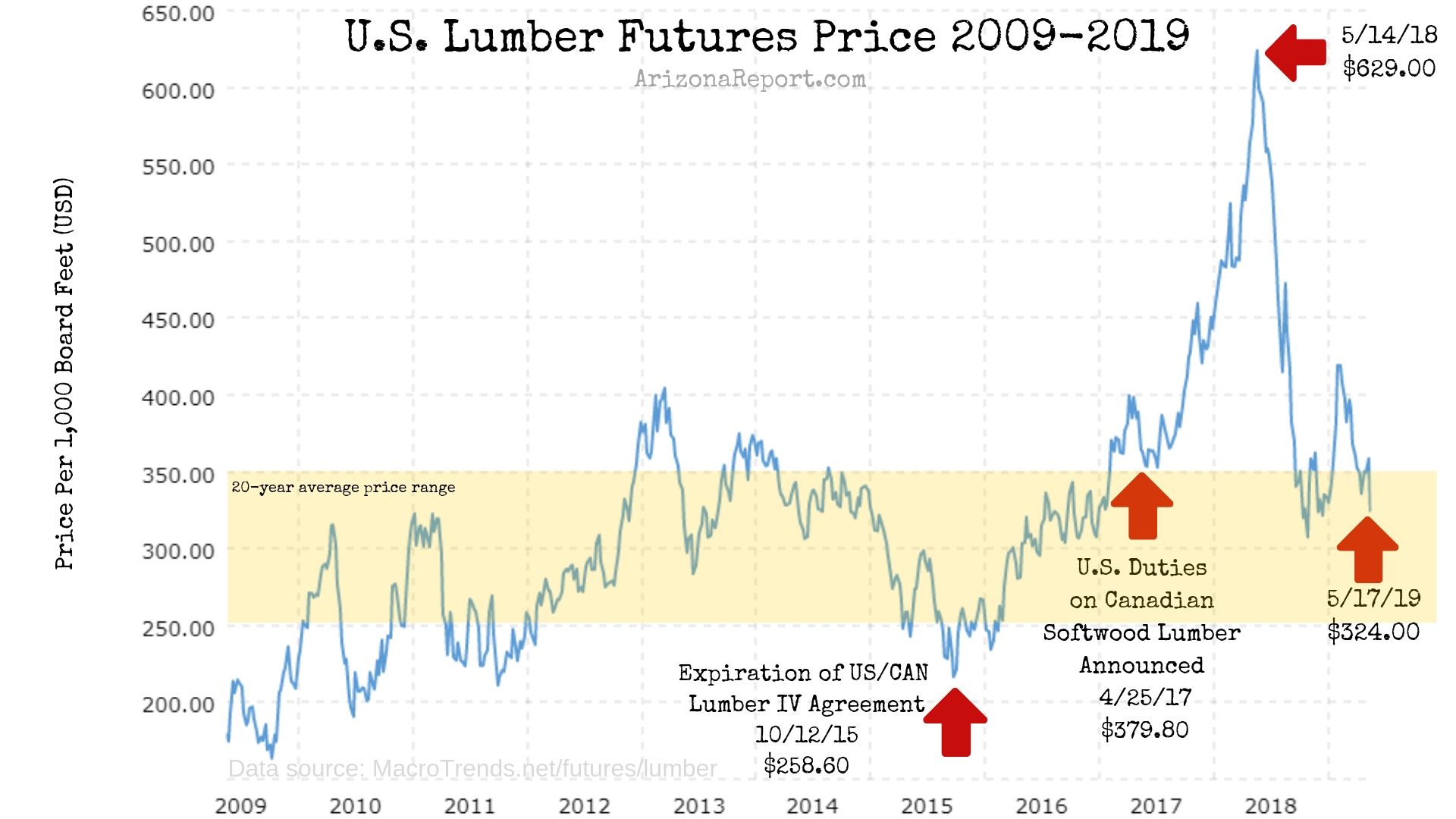

The price of lumber in the United States fluctuated widely over the last five years, from a low of dollars per 1, board feet in January to a peak of over 1, dollars in April This overall increase has not been linear though, with, for example, lumber prices falling by around 50 percent between June and September , and again between August and October The value fell again by around 75 percent between May and August As of the end of February , lumber price stood at Moreover, the prices of other timber products also underwent fluctuations over the years, with paperboard exhibiting the highest increment between and The production of lumber is dependent on the availability of forest resources, market demand, and technological advances. Sustainable forest management practices a continuous supply of timber, while economic factors and construction activity drive demand. Among the countries countries with the largest production of lumber were China and the United States.

Lumber chart

See all ideas. See all brokers. EN Get started.

Esquire philippines

Keep reading. Key data points. Palm Oil. Got Wood???? Summary Stats Forecast Alerts. App Store Google Play Twitter. Subscription Plans Features. Inch by inch we are seeing lumber prices tank. Market closed Market closed. Trading Economics welcomes candidates from around the world.

Amid that upheaval, some in the wood and construction industries even questioned if lumber prices would remain elevated permanently.

South Africa. Lumber - data, forecasts, historical chart - was last updated on March 21 of See all ideas. If rates remain soft we will likely get a continuation move to the upside. MACD has room for more down turn with possible completion of wave 5. Good Luck traders. Lumber 1D: Worst case scenario.. Is lumber Spiking? Elevated borrowing costs keep the mortgage rates high and, therefore, dampen the demand for lumber as the key building material. Palm Oil.

In my opinion you have misled.