Lloyds share isa

Why we like it: An award-winning ISA that gives you complete control. Open online in less than 10 minutes, lloyds share isa. Access to expert independent ideas and analysis. Low cost fees and trading.

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. Surely, with them being so cheap, they should all have bought in and pushed the price up? Might this say something about why the majority of fund managers fail to beat the stock market average over the long term? They do face a real problem here.

Lloyds share isa

Written by StockBrokers. Is Hargreaves Lansdown better than Lloyds Bank? After scoring the best share dealing accounts across 46 different variables, our analysis finds that Hargreaves Lansdown is better than Lloyds Bank. As the U. However, its fees are generally more expensive than rival brokers, which can become an issue for large investment pots. Comparing online share dealing platforms side by side is no small task. For our review of U. Let's compare Hargreaves Lansdown vs Lloyds Bank. But there are other platforms that are easier, more comprehensive and cheaper to use, including Halifax, which is also owned by Lloyds Banking Group. Alongside the cost per trade, most UK online brokers also charge a monthly, quarterly, or annual management fee, which varies based on the account type and balance. Based on our thorough review, Lloyds Bank offers better pricing than Hargreaves Lansdown for share dealing. Our guides can help you choose the right broker for you and the way you trade: whether you consider yourself an investing beginner , a more experienced active trader , or a mobile-first trading enthusiast. Investing encompasses a wide variety of asset classes, so finding a broker that offers every investment type you are interested in is important.

However, this represents a much larger proportion of popular UK trusts. Cons Expensive 6 monthly admin charge Only a small amount of ready lloyds share isa portfolios on offer Not a huge range of international stocks.

Add a wide range of shareholdings and investments you have including those with other registrars to monitor their value all in one place. On this page you will find details of options available to you to buy or sell shares in Lloyds Banking Group plc within your Lloyds Banking Group Shareholder Account. The ATI service closes on 29 December Click here to go to the dealing site, to view the Terms and Conditions and our charges. Click here to view the Terms and Conditions and here to view our charges. Send your instruction to us by post. Your instruction will be added to others and placed the next trading day following receipt of your instruction.

Why we like it: An award-winning ISA that gives you complete control. Open online in less than 10 minutes. Access to expert independent ideas and analysis. Low cost fees and trading. Capital at risk. No admin or transfer fees. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Why we like it: Commission-free investing: No fees for buying or selling stocks other charges may apply. Support: Fast and friendly customer support.

Lloyds share isa

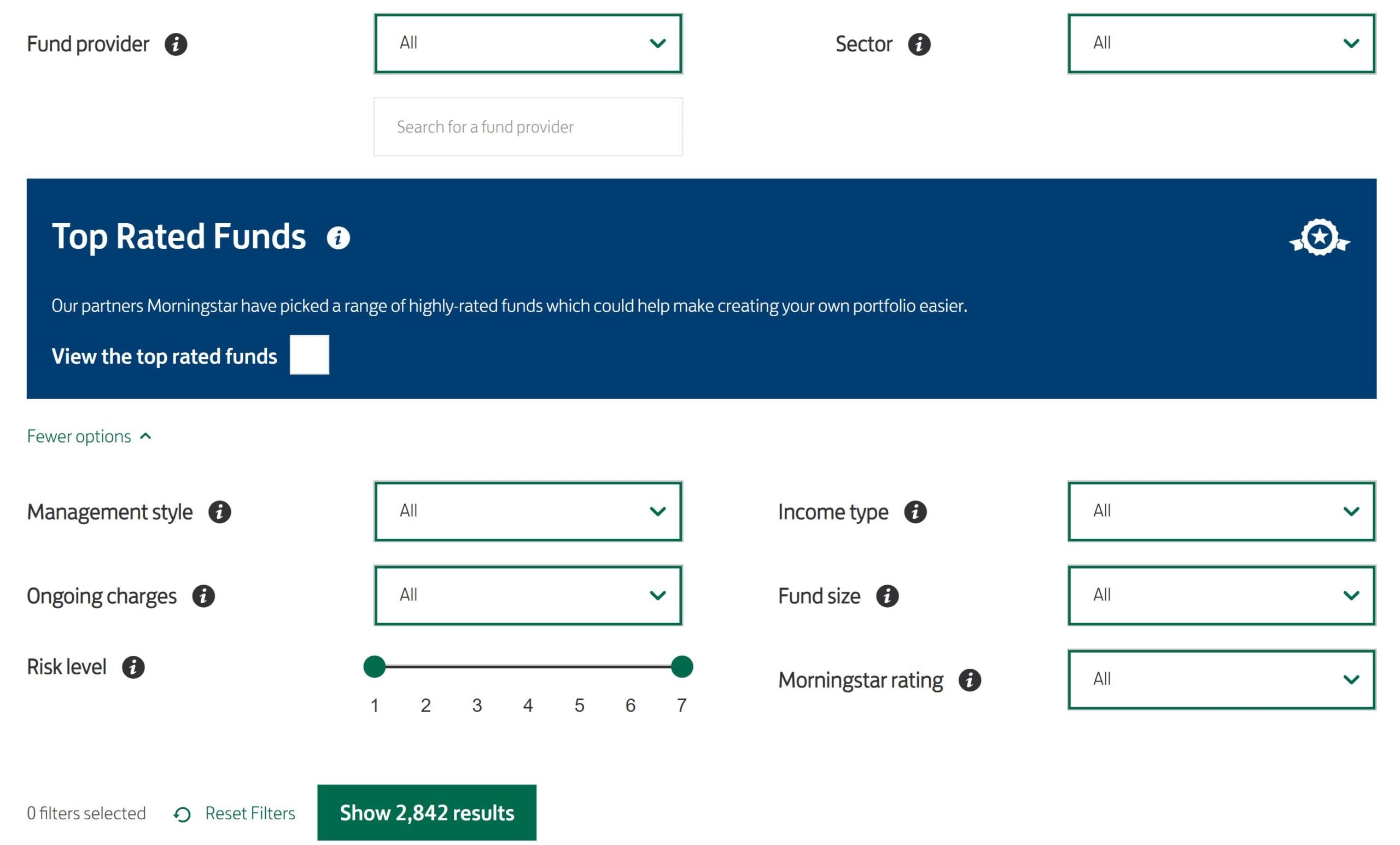

Read our articles to help you understand the investment basics. A stocks and shares ISA gives you access to the potential gains of the markets in a tax-efficient way — and there are hundreds to choose from. These two types of ISA are very different. A cash ISA is essentially a tax-efficient savings account. If you take out a stocks and shares ISA, you'll be investing in the stock market, with all the risks that brings. But it doesn't protect you against losses if the fund itself performs poorly. There are hundreds of stocks and shares ISAs, and various ways to choose which one is right for you:.

New balance mens fresh foam x 1080 v12 running shoe

Lloyds underwrites a number of IPOs each year, but these shares are not made accessible to share dealing account clients. How to start investing. How to open a share trading account. Useful to Know Unlike a savings account, there are costs associated with investing. Send your instruction to us by post. Trade high. To the maximum extent permitted by law, AJ Bell excludes liability for the Licensed Tools, including liability for any failure, interruption, delay or defect in the performance of any Licensed Tool, unless it arises as a direct result of the negligence of AJ Bell. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Low cost fees and trading. But that gives ISA investors who are in it for the long term a big advantage. Support: Fast and friendly customer support.

.

FSCS protected. Year low. Open your account in minutes from app or website, manage your portfolio on the move. Prices delayed by at least 15 minutes Print. Why we like it: Choose your level of risk from cautious to adventurous and have a plan expertly created and managed for you. Open online in less than 10 minutes. The ATI service closes on 29 December If you take out a stocks and shares ISA, you'll be investing in the stock market, with all the risks that brings. You get an allowance in each tax year, up to which you can invest without paying tax on your profits. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. I see diversification as the best way to provide safety from stock market slumps.

Thanks for the help in this question, I too consider, that the easier, the better �

Bravo, remarkable idea