Lloyds ready-made investments

Get advice from the Yodelar Investments expert advice team.

Lloyds is one of the largest financial institutions in the world. In addition to offering banking, lending, insurance, and much more, Lloyds also offers retail brokerage accounts for everyday trading and investing. Even better, this broker has more than 2, mutual funds available for trading and ready-made portfolios to make investing simple. The downside to Lloyds Bank share dealing is that a brokerage account comes with quite a few fees. Although trading commissions are low, these charges can add up over time and may not be worthwhile for those who only place a few trades each year. Lloyds is a retail and commercial bank headquartered in London, but it has branches all across the UK. Lloyds was founded in and has since grown into one of the largest financial institutions in the world.

Lloyds ready-made investments

Jamie Gordon. The Quicklist is designed to offer a handful of the ETFs on the Lloyds execution-only platform as potential building blocks for an investment portfolio. They are simple to understand and offer investors a low-cost, diversified set of holdings. Such moves coincide with challenger fintech banks stepping in to provide investment offerings through their banking apps. Following the launch, more than , Monzo customers were on the waiting list to access the service. Get your daily round-up of market news and features with our daily bulletin or dive deeper into weekly industry trends with our Editor's note and top story picks, delivered every Friday at 7am. Giving you access to the latest online, in-person and hybrid ETF Stream events. Industry Updates. Featured in this article. Jane Sloan Manuel Pardavila-Gonzalez. Theo Andrew 21 Feb Theo Andrew 20 Feb Jamie Gordon 19 Feb

Facebook Twitter Linkedin Telegram E-mail. Lloyds ready-made investments can you speculate on emerging markets through riskier shares for companies in Southeast Asia or Africa. To access these markets, you will need to invest through funds.

Read our articles to help you understand the investment basics. A stocks and shares ISA gives you access to the potential gains of the markets in a tax-efficient way — and there are hundreds to choose from. These two types of ISA are very different. A cash ISA is essentially a tax-efficient savings account. If you take out a stocks and shares ISA, you'll be investing in the stock market, with all the risks that brings. But it doesn't protect you against losses if the fund itself performs poorly.

This British financial institution that was founded in gives you access to a wide range of financial products, including individual shares UK and International , funds, exchange-traded funds ETFs , and Investment Trusts. In this review, we cover everything you need to know about Lloyds bank. We will explore their share dealing service, the available investment options, fees and commission, trading platform and features, pros and cons to trade with Lloyds, and more. Lloyds Bank is a British retail bank established in in Birmingham at the time the city was a dominant force of the Industrial Revolution. Since then, Lloyds has largely expanded its services, and today, it is one of the largest retail and commercial banks in the United Kingdom and globally with more than 30 million customers. In , the Lloyds Banking Group was formed following the acquisition of well-known investment banks that include Lloyds, Halifax, Bank of Scotland, and Scottish Widows. Apart from being a retail bank, Lloyds also offers clients access to thousands of assets to trade on and research tools to help investors find the right securities and understand market sentiment. In terms of the regulation, you would rightfully expect Lloyds to be regulated by top-tier regulatory agencies in the UK and internationally. Simply put, Lloyds Bank provides a variety of ways to help clients investing through their platforms. Apart from being one of the biggest retail and commercial banks in the world, Lloyds Bank offers investment accounts for investing in shares, funds, FX pairs, Investment Trust, and more.

Lloyds ready-made investments

By Helen Kirrane. Updated: GMT, 28 September It follows Monzo launching its DIY service, Monzo Investments , also in partnership with BlackRock, in a sign banks are looking to build business in this area.

Power ranger ml

Worse, our Lloyds share dealing review revealed that the broker does not offer a mobile investment app , which is a significant drawback for many investors. When investing your capital is at risk. Get your daily round-up of market news and features with our daily bulletin or dive deeper into weekly industry trends with our Editor's note and top story picks, delivered every Friday at 7am. You can get in touch at any time by phone or live chat, or reach out to the bank on social media. You will find all your share dealing account details once you login. Investment Ideas. However, the pricing structure for these three brokerages is very different even though they are all part of Lloyds. He has also won accolades as a photographer and videographer for his work covering communities on both coasts of the US. However, they do manage 11 unit trust funds which are currently only available to their customers. All rights reserved. Currently, Santander has 38 funds under their management, however, as 18 of these funds are presently unclassified and do not belong to any investment sector we were unable to analyse them for comparative performance.

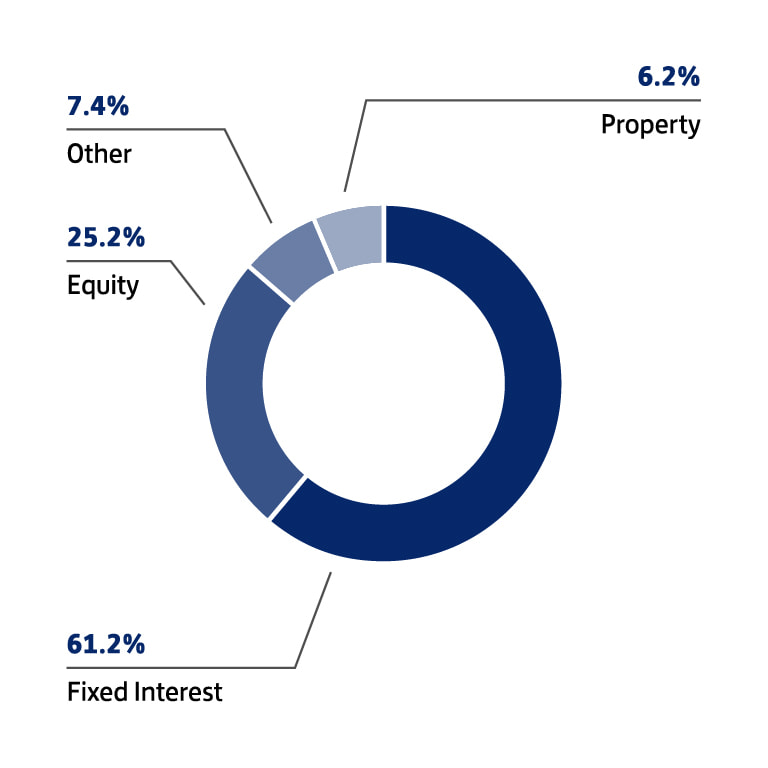

Except of course, when I have to listen to Capital London, when my kids are in the car, which is a bit more fast-paced, more like trading. The more risk you want take on the more exposure you have to equities in your portfolio. If you are a Lloyds Banking customer and just want a simple way to invest in the long-term these ready-made investments are a good choice.

Telephone : Write to Yodelar. The new portfolios, simply called "Ready Made Investments", offer a range of "growth" and "income" funds tailored to investors who see themselves as having a low, moderate or high tolerance for risk. Top Funds Report Monthly analysis on every investment sector and universe highlighting the ranking and performance of each fund. Free for 7 days. When investing your capital is at risk. However, the pricing structure for these three brokerages is very different even though they are all part of Lloyds. If you have any doubts about making your own investment decisions, seek financial advice. Investing is speculative. Once you've selected your stocks and shares ISA, you can choose to invest with a lump sum, or by making regular monthly payments. Past performance is not a reliable indicator of future returns. Michael Graw. Read our articles to help you understand the investment basics. Registered in England and Wales no. Tax treatment depends on individual circumstances and may be subject to change in the future. You may want to do your own research first.

0 thoughts on “Lloyds ready-made investments”