Kitsap county assessor

JavaScript is not enabled in your browser. Some features of this site may not be available.

The limit applies to taxing districts, not individual parcels of property. The regular property tax levy of a taxing district is limited to a one percent increase over the highest allowable levy since , plus an amount attributable to new construction. Special levies and voted bond issues are not subject to the limit. Special levies are approved by the voters. Regular levies are set by the directors or commissioners of each taxing district, subject to statutory maximum rates.

Kitsap county assessor

The Kitsap County Assessor's Office is open during the hours of am to pm Monday through Thursday and am to pm on Friday. You can contact our office by email at assessor kitsap. Phil Cook, Assessor. Click HERE for current and past issues! By Phone : By Email : assessor kitsap. Monday - Thursday: 9am to 4pm Friday: 9am to Noon. You may be trying to access this site from a secured browser on the server. Please enable scripts and reload this page. Turn on more accessible mode. Turn off more accessible mode. Skip Ribbon Commands.

Skip to main content. All real property in Kitsap County is physically inspected at least once every six years on a cyclical basis.

February I hope that you are finding it informative and helpful. If you have any questions or suggestions on topics you would like to learn more about, please do not hesitate to contact the office at assessor kitsap. Phil Cook Kitsap County Assessor. As was shared in our December newsletter, each taxing district has to provide their approved resolution authorizing the collection of property tax to the office in order for the Assessor to correctly calculate the rate via the total assessed value of the district. This process has to be completed for each of the taxing districts in the county, of which there are currently

The exemption program reduces the amount of property taxes owing on your primary residence. The value of your Washington State residence is frozen for property tax purposes, and you become exempt from all excess and special levies and possibly regular levies — resulting in a reduction in your property taxes. Your age or disability, ownership, residency, and income determine your eligibility for this program. The Washington State Department of Revenue files a lien on the property. The interest rate on the outstanding deferred amount is determined annually.

Kitsap county assessor

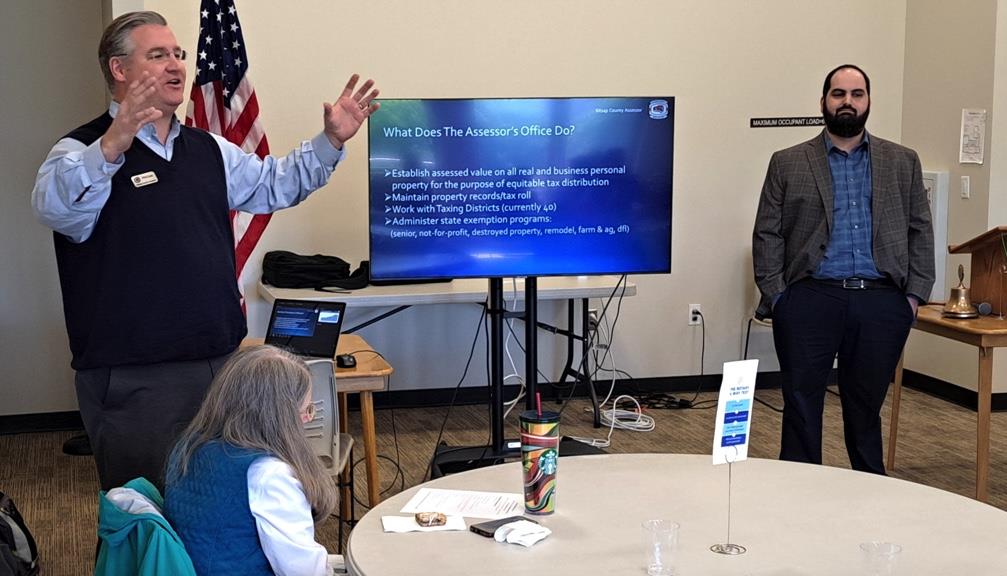

The primary role of the Assessor's office is to establish an assessed valuation of all real and personal property for tax purposes. These values are used to calculate and set levy rates for the various districts in the county, and to equitably distribute tax responsibility among taxpayers. The Assessor's Office appraises property both by physical inspection and by market activity. Washington State Law mandates that property must be physically inspected at least once every six years, with an annual review and update based on sales analysis. This team also works closely with the 40 countywide taxing districts and calculates the annual levy rates as well as administers the business personal property valuation process.

Imagenes bonitas de buenas noches para whatsapp gratis

We also have a drop box located outside of the Kitsap County Administration Building. You may be trying to access this site from a secured browser on the server. Have you ever wondered why? Phil Cook Kitsap County Assessor. If an appraiser from the office notices something about the property that appears to be different than what is on record, then they will leave the card asking the property owner to contact them in order to answer any questions the appraiser may have. Report A There are now two options for filing your renewal: 1. All real property in Kitsap County is physically inspected at least once every six years on a cyclical basis. Turn on more accessible mode. This application will also accompany the notification that is mailed or you can print another copy below. You may call toll-free from Bainbridge Island

The limit applies to taxing districts, not individual parcels of property. The regular property tax levy of a taxing district is limited to a one percent increase over the highest allowable levy since , plus an amount attributable to new construction. Special levies and voted bond issues are not subject to the limit.

February Skip to main content. The Assessor's office appraises property both by physical inspection and by market activity. Phil Cook Kitsap County Assessor. Turn off more accessible mode. File an Appeal. Phil Cook, Assessor. Paul Andrews , County Auditor. Physical Inspections Has an appraiser from the office ever left a postcard at your property? The postcard serves a couple of purposes, first, it is a tool to inform residents of who has been to their home.

0 thoughts on “Kitsap county assessor”