Keokuk county gis

Email: dsanders keokukcounty.

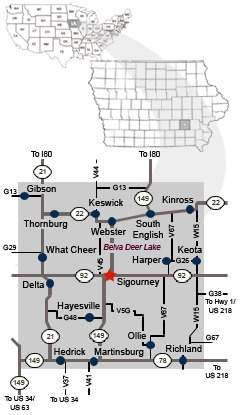

It serves as a resource for current and prospective residents, offering details about the county's history, government, emergency management, environmental health, and recreational facilities. With a focus on community integration, Keokuk County Assessor Gis aims to assist individuals in finding relevant information about the county's services, including solid waste and recycling, job applications, and Lake Belva Deer Cabins. The website is designed to be user-friendly and informative, ensuring that residents have easy access to the resources they need. Search MapQuest. Keokuk County Assessor Gis.

Keokuk county gis

.

See a problem? Keokuk County Community Service. Claim it.

.

Would you like to download Keokuk County gis parcel maps? Request a quote Order Now! Parcel data and parcel GIS Geographic Information Systems layers are often an essential piece of many different projects and processes. With the help of our parcel viewer, many characteristics of real estate and mineral properties can be visualized and analyzed over an area of interest. Dynamo Spatial's Pinpoint Parcels product is a first-class parcel layer containing deep data attributes about property valuations, legal descriptions, land ownership, service areas, census statistics, environmental conditions and much more. Through spatial analysis, parcel gis may also be used to increase the value of other reference layers, with methods such as intersection, proximity, buffer and overlay functions. Many industries already require the use of parcel maps on a daily basis and many more are beginning to discover the benefits that this added insight provides. Each day we help companies find new efficiencies and money saving advantages by providing the highest quality parcel GIS with our fast and easy download process.

Keokuk county gis

Email: dsanders keokukcounty. The Assessor has several administrative and statutory duties. The primary duty and responsibility is to make sure all real property within the assessor's jurisdiction is assessed except where the law provides otherwise. This includes residential, commercial, industrial and agricultural classes of property. Real property is revalued every two years. The effective date of the assessment is the first of January of the current year. The Assessor determines either a full or partial value for new construction and improvements depending upon their state of completion on January 1st. The Assessor is concerned with value, not taxes. Taxing jurisdictions such as schools, cities and county, adopt budgets after public hearings.

Zuma paw patrol

May 1 thru adjournment - Board of Review meets each year. Partial Data by Infogroup c Keokuk County Public Health. Claim it. See a problem? The taxes you pay are proportional to the value of your property compared to the total value of property in your taxing district. Email: dsanders keokukcounty. General Misconceptions about the Assessor's Duties. The effective date of the assessment is the first of January of the current year. The primary duty and responsibility is to make sure all real property within the assessor's jurisdiction is assessed except where the law provides otherwise. Search MapQuest. Real property is revalued every two years. Keokuk County Engineer. Generated from the website.

Zoom or search to view fields. For Sale. Sold Land.

Keokuk County Engineer. Keokuk County Judges Chamber. Closed today. Keokuk County Community Service. May 1 thru adjournment - Board of Review meets each year. United States. General Misconceptions about the Assessor's Duties. The Assessor determines either a full or partial value for new construction and improvements depending upon their state of completion on January 1st. Own this business? This includes residential, commercial, industrial and agricultural classes of property. October 9 thru October 31 inclusive - Protest period for filing with the Board of review on those properties affected by changes in value as a result of the Director of Revenue and Finance Equalization Orders odd numbered years. April 2 thru June 5 inclusive - Protest of assessment period for filing with the local Board of Review. This determines the tax levy, which is the rate of taxation required to raise the money budgeted.

Excuse for that I interfere � To me this situation is familiar. Let's discuss. Write here or in PM.