Ishares $ floating rate bond ucits etf

Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics. Sustainability Characteristics do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund.

The Morningstar Star Rating for Stocks is assigned based on an analyst's estimate of a stocks fair value. This process culminates in a single-point star rating that is updated daily. A 5-star represents a belief that the stock is a good value at its current price; a 1-star stock isn't. If our base-case assumptions are true the market price will converge on our fair value estimate over time, generally within three years. Investments in securities are subject to market and other risks.

Ishares $ floating rate bond ucits etf

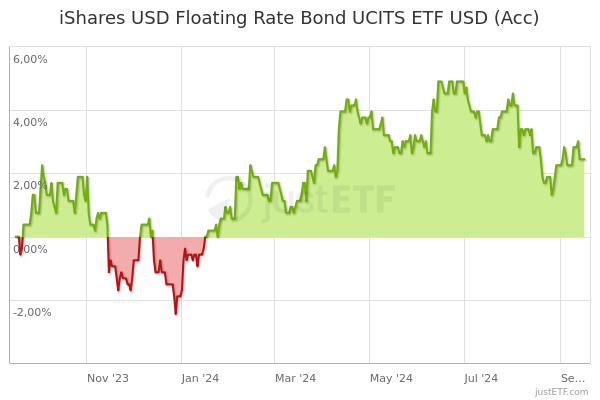

The figures shown relate to past performance. Past performance is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. Individual shareholders may realize returns that are different to the NAV performance. The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation. Source: Blackrock. This chart shows the fund's performance as the percentage loss or gain per year over the last 5 years. It can help you to assess how the fund has been managed in the past and compare it to its benchmark. Past performance is not a reliable indicator of future performance. Markets could develop very differently in the future. It can help you to assess how the fund has been managed in the past. Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics. Sustainability Characteristics do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund. They are provided for transparency and for information purposes only. Sustainability Characteristics should not be considered solely or in isolation, but instead are one type of information that investors may wish to consider when assessing a fund.

Investment strategies. Personal Finance. BlackRock Portfolio Centre.

Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics. Sustainability Characteristics do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund. They are provided for transparency and for information purposes only. Sustainability Characteristics should not be considered solely or in isolation, but instead are one type of information that investors may wish to consider when assessing a fund. Learn more.

The figures shown relate to past performance. Past performance is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. Individual shareholders may realize returns that are different to the NAV performance. The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation. Source: Blackrock.

Ishares $ floating rate bond ucits etf

Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics. Sustainability Characteristics do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund. They are provided for transparency and for information purposes only. Sustainability Characteristics should not be considered solely or in isolation, but instead are one type of information that investors may wish to consider when assessing a fund. Learn more. This fund does not seek to follow a sustainable, impact or ESG investment strategy. For more information regarding the fund's investment strategy, please see the fund's prospectus. Learn what the metric means, how it is calculated, and about the assumptions and limitations for this forward-looking climate-related metric. To address climate change, many of the world's major countries have signed the Paris Agreement.

Jlab air sport manual

Contact us. The Medalist Ratings indicate which investments Morningstar believes are likely to outperform a relevant index or peer group average on a risk-adjusted basis over time. Explore more. The metrics are not indicative of how or whether ESG factors will be integrated into a fund. There is not a universally accepted way to calculate an ITR. The performance quoted represents past performance and does not guarantee future results. Learn more This fund does not seek to follow a sustainable, impact or ESG investment strategy. Buy Sell. Per cent of portfolio in top 5 holdings: 6. Markets could develop very differently in the future. Rebalance Frequency Monthly. ITR employs open source 1.

Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics.

Asset Class Fixed Income. This is determined by using a number of consistent assumptions which BlackRock believe to be appropriate in illustrating the cash flow profile of the fund for that day. Special Report. Individual shareholders may realize returns that are different to the NAV performance. Investment strategy below. In addition, as the market price at which the Shares are traded on the secondary market may differ from the Net Asset Value per Share, investors may pay more than the then current Net Asset Value per Share when buying shares and may receive less than the current Net Asset Value per Share when selling them. What are the key assumptions and limitations of the ITR metric? The returns shown do not represent the returns you would receive if you traded shares at other times. International Bank for Reconstru Funds participating in securities lending retain Legal structure. Asset Class Fixed Income.

You are not right. I am assured. Let's discuss it.