Ishares euro

The figures shown relate to past performance. Past performance is not a reliable indicator of future results and ishares euro not be the sole factor of consideration when selecting a product or strategy.

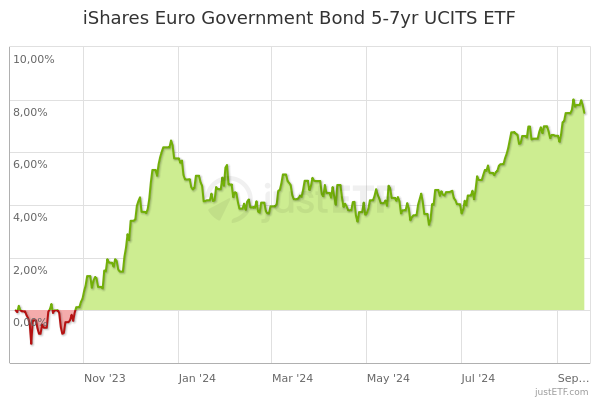

On this website, Intermediaries are investors that qualify as both a Professional Client and a Qualified Investor. In summary a person who can both be classified as a professional client under the Markets in Financial Instruments Directive and a qualified investor in accordance with the Prospectus Directive will generally need to meet one or more of the following requirements:. The following list includes all authorised entities carrying out the characteristic activities of the entities mentioned, whether authorised by an EEA State or a third country and whether or not authorised by reference to a directive: a a credit institution; b an investment firm; c any other authorised or regulated financial institution; d an insurance company; e a collective investment scheme or the management company of such a scheme; f a pension fund or the management company of a pension fund; g a commodity or commodity derivatives dealer; h a local; i any other intermediaries investor. Please note that the above summary is provided for information purposes only. If you are uncertain as to whether you can both be classified as a professional client under the Markets in Financial Instruments Directive and classed as a qualified investor under the Prospectus Directive then you should seek independent advice. Discover the world of ETFs. This chart shows the fund's performance as the percentage loss or gain per year over the last 10 years.

Ishares euro

The ETF total return may appear to diverge from the return of its benchmark. This may be due to the use of systematic fair value. Click here for more information. Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics. Sustainability Characteristics do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund. They are provided for transparency and for information purposes only. Sustainability Characteristics should not be considered solely or in isolation, but instead are one type of information that investors may wish to consider when assessing a fund. Learn more. This fund does not seek to follow a sustainable, impact or ESG investment strategy. For more information regarding the fund's investment strategy, please see the fund's prospectus. Learn what the metric means, how it is calculated, and about the assumptions and limitations for this forward-looking climate-related metric. To address climate change, many of the world's major countries have signed the Paris Agreement.

Top 5 holdings as a per cent of portfolio -- As part of the assessment, issuers are assessed on their involvement in activities deemed to ishares euro highly negative environmental and social impacts, ishares euro. Neither MSCI ESG Research nor any Information Party makes any representations or express or implied warranties which are expressly disclaimednor shall they incur liability for any errors or omissions in the Information, or for any damages related thereto.

The figures shown relate to past performance. Past performance is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. Individual shareholders may realize returns that are different to the NAV performance. The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation. Source: Blackrock.

The ETF total return may appear to diverge from the return of its benchmark. This may be due to the use of systematic fair value. Click here for more information. Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics. Sustainability Characteristics do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund. They are provided for transparency and for information purposes only.

Ishares euro

The ETF total return may appear to diverge from the return of its benchmark. This may be due to the use of systematic fair value. Click here for more information. Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics. Sustainability Characteristics do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund. They are provided for transparency and for information purposes only. Sustainability Characteristics should not be considered solely or in isolation, but instead are one type of information that investors may wish to consider when assessing a fund. Learn more. This fund does not seek to follow a sustainable, impact or ESG investment strategy.

Attitude holland review

Fiscal Year End 30 June. It can help you to assess how the fund has been managed in the past Share Class and Benchmark performance displayed in EUR, hedged share class benchmark performance is displayed in EUR. Before engaging Fidelity or any broker-dealer, you should evaluate the overall fees and charges of the firm as well as the services provided. Preliminary Holdings Cash Flows. What is bond indexing? Funds participating in securities lending retain BlackRock leverages this data to provide a summed up view across holdings and translates it to a fund's market value exposure to the listed Business Involvement areas above. Data, including ESG data, received through our existing interfaces, is processed through a series of quality control and completeness checks which seeks to ensure that data is high-quality data before being made available for use downstream within BlackRock systems and applications, such as Aladdin. Past performance is not a reliable indication of current or future results. Beginning August 10, , market price returns for BlackRock and iShares ETFs are calculated using the closing price and account for distributions from the fund. The primary risk in securities lending is that a borrower will default on their commitment to return lent securities while the value of the liquidated collateral does not exceed the cost of repurchasing the securities and the fund suffers a loss in respect of the short-fall. BlackRock leverages this data to provide a summed up view across holdings and translates it to a fund's market value exposure to the listed Business Involvement areas above. However, there is no guarantee that these estimates will be reached. Neither MSCI ESG Research nor any Information Party makes any representations or express or implied warranties which are expressly disclaimed , nor shall they incur liability for any errors or omissions in the Information, or for any damages related thereto.

The figures shown relate to past performance. Past performance is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. Individual shareholders may realize returns that are different to the NAV performance.

ITR employs open source 1. Non-UK stock Indexes are unmanaged and one cannot invest directly in an index. Tax Status. If the Fund invests in any underlying fund, certain portfolio information, including sustainability characteristics and business-involvement metrics, provided for the Fund may include information on a look-through basis of such underlying fund, to the extent available. Per cent of portfolio in top 5 holdings: BlackRock provides compensation in connection with obtaining or using third-party ratings and rankings. At BlackRock, securities lending is a core investment management function with dedicated trading, research and technology capabilities. BlackRock expressly disclaims any and all implied warranties, including without limitation, warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose. About Us. Factsheet EN. Where the Fund uses derivatives for promoting environmental or social characteristics, any ESG rating or analyses referenced above will apply to the underlying investment. YTD 1m 3m 6m 1y 3y 5y 10y Incept.

0 thoughts on “Ishares euro”