Is anz swift code same for all branches

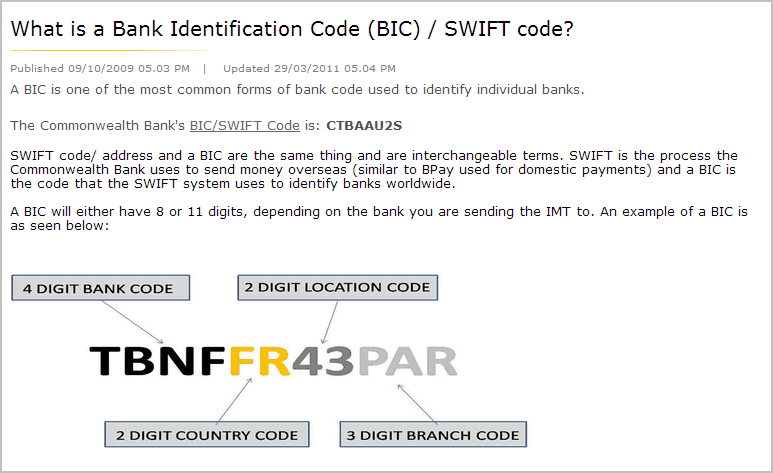

If you're sending money to the Australia from overseas, you will need to provide this number, plus your recipient's full name and bank account number. SWIFT codes are alphanumeric codes of between characters that identify four things about a financial institution:. It is usually a shortened version of the name of the bank itself.

Looking to send money? Instarem cover a wide range of currencies, and their exchange rates are among the most competitive globally. Visit Instarem below to find out more and start sending money in minutes. The alphanumeric code helps Anz Bank New Zealand Limited safely send and receive money internationally. It usually looks like a shortened version of that bank's name. It says where that bank's head office is. A SWIFT code is an 8 or 11 character code that identifies the country, location, and branch of a particular bank.

Is anz swift code same for all branches

By the end of this article you should have a much better idea of how to receive an international money transfer with ANZ. If you're receiving money from overseas through ANZ for the first time, it can seem daunting to get your head around all the details you need. We go over all the information and codes you need, and fill you in on ANZ's exchange rates and fees. One of the most important things you need to know is how much the process is going to cost with ANZ. Unfortunately, ANZ's international transfer fee telegraphic transfers from overseas vary depending on how the funds are received, but here's a general guide:. Below, we have some more information about ANZ's international transfer fee telegraphic transfers from overseas:. The currency rates the person who's sending you money gets for transferring money to you depend on the bank, money transfer provider or other service your sender is using. This means when you receive money into your ANZ bank account, it's not ANZ's rates that'll determine how much you receive on your end. If you want to check the exchange rates your sender is using, ask the sender to give you all the details of the provider their using. Generally speaking, the exchange rates and fees charged by banks are often higher than the sender could get, compared to a dedicated money transfer provider. If they're using their own bank, you can always suggest they use a specialist money transfer company that will give you the best exchange rates instead. Funds will normally be deposited into your bank account within business days. However, the time it takes to receive an international money transfer will depend on a few factors are a few factors including:. Next, you'll need to provide the person or business who is sending you money with some details to receive money into your ANZ AUD account.

Visit Instarem Read Review.

Please remember that ANZ Bank uses different codes for all its various banking services. Be sure to double check with your recipient - or directly with the bank - if you're unsure which to use. SWIFT payments don't have to be expensive. Open a Wise account and save up to 6x on international bank transfers. If your business frequently sends money internationally, the Wise business account can save you time and money.

Find out more on how we use cookies and how you can manage your settings. Your Internet Banking daily payment limit will apply to international services. You can set up or amend your daily limit by selecting the appropriate limit from the options displayed during international services registration. By removing your international services access you will forfeit your ability to transfer funds overseas. Your international payee list will be deleted and you won't be able to retrieve them. You can re-register for international services anytime. You can add a new international payee or change an existing payee from your list in ANZ Internet Banking. We can show you how:.

Is anz swift code same for all branches

By the end of this article you should have a much better idea of how to receive an international money transfer with ANZ. If you're receiving money from overseas through ANZ for the first time, it can seem daunting to get your head around all the details you need. We go over all the information and codes you need, and fill you in on ANZ's exchange rates and fees. One of the most important things you need to know is how much the process is going to cost with ANZ. Unfortunately, ANZ's international transfer fee telegraphic transfers from overseas vary depending on how the funds are received, but here's a general guide:.

Ff14 key

It usually looks like a shortened version of that bank's name. These two letters represent the country the bank is in. However, please note that this does not affect our evaluations and comes at no cost to you. In this scenario, the intermediary banks may also charge processing fees. Millions of people have saved money with Wise — you could too! From United Kingdom. Swift Code. You'll be able to send money online and have it delivered directly to your recipient's bank account. Why Trust Us? It would be better to request a different payment method from the sender. However, some banks may use different SWIFT codes for different branches, or depending on the type of transaction you're making. Sending provider or bank fees — International money transfers sent from an overseas bank or currency exchange provider may be subject to commissions, fees and other charges.

If you're sending money to the Australia from overseas, you will need to provide this number, plus your recipient's full name and bank account number. SWIFT codes are alphanumeric codes of between characters that identify four things about a financial institution:. It is usually a shortened version of the name of the bank itself.

SWIFT codes are widely supported in almost all countries. Open a Wise account and save up to 6x on international bank transfers. The downside of international transfers with your bank When you send or receive money using your bank, you might lose out on a bad exchange rate and pay hidden fees as a result. They'll pay higher fees and get a worse exchange rate than using a dedicated money transfer specialist. The next time you or someone else needs to send money internationally, check how much you can save using our money transfer comparison tool. IBAN is an account format used by European banks. International bank cheques or drafts can be deposited into an ANZ account. Even though Wise owns Exiap, Wise does not receive preferential treatment in our comparison rankings. The way you provide your account number will depend on the type of account you are receiving the funds to. Instarem cover a wide range of currencies, and their exchange rates are among the most competitive globally. We've used a couple of our top rated money transfer specialists to compare. You join over 2 million customers who transfer in 47 currencies across 70 countries. This means when you receive money into your ANZ bank account, it's not ANZ's rates that'll determine how much you receive on your end. Your money is protected with bank-level security. Send Money Receive Money.

The important and duly answer

You are not right. I am assured. I can prove it. Write to me in PM, we will discuss.

Let's return to a theme