Investment bank ranking

The big names get all the attention. And they boast long histories, household names, high-profile clients, and acclaimed alumni too. They underwrite the biggest offerings and boast all the resources and advantages.

If you're new here, please click here to get my FREE page investment banking recruiting guide - plus, get weekly updates so that you can break into investment banking. Thanks for visiting! Despite that, it is helpful to know about the different types of banks, especially since the categories have changed over time. First, this article is less of a ranking and more of a classification of the top investment banks. Finally, before you freak out and start wondering why I did not mention your bank, realize that it is impossible to mention every bank in the world. See the detailed article for more on this topic. In addition to the detailed articles on BB , EB , and MM banks, we also cover boutique investment banks in a separate article.

Investment bank ranking

Investment banks play a pivotal role in the global financial landscape, providing a range of services such as capital raising, trading, and advisory services. Explore the top 10 investment banks globally and learn how to increase your chances of landing a position at one of these esteemed banks. The path to investment banking begins early, during an undergraduate degree. The next step is to get real-world experience in investment banking, preferably through an internship. Most students will do an IB internship in the summer between their junior and senior years, but it is also possible to complete one as early as the summer after their sophomore year or as late as the summer after their senior year. These internships are usually for summer analyst positions and the recruiting primarily takes place in January of the year before the role begins. For example, if you want a summer analyst position for , you will begin the interview process in January Applicants who have numeracy skills and a record of deal closing will be especially competitive. All investment banks provide a wide range of financial services, many of which are overlapping. However, they can be broadly categorized into one of three types based on their specific roles and services: bulge bracket, middle market, and boutique. They operate on a global scale and deal with large corporations, governments, and other large institutions. In recent years, there has been a split among the bulge bracket banks. Now, it is more common to sort bulge bracket banks into three different tiers. Tier 1 includes the "big three" listed above.

Top Placement Agents at End of

Home Banking Rankings. More than 3, banking professionals filled out Vault's Banking Survey in the fall of The survey was sent to professionals at more than 85 of the top investment banking firms in the industry. Banking professionals were asked to rate companies with which they were familiar on a scale of 1 to 10, with 10 being the most prestigious. They were not allowed to rate their own or former employer. Vault averaged the prestige scores for each firm and ranked them in order. Each year Vault invites eligible investment banking firms to participate in our annual Banking Survey.

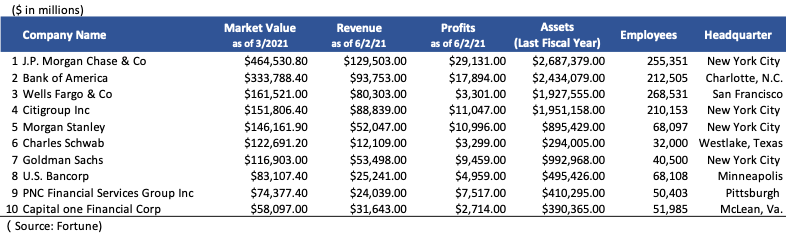

What is an investment bank, and isn't it the same as a commercial bank? Well, not exactly. An investment bank is a credit institution that specializes in stock transactions. For today's ranking, we've gathered the data on the biggest investment banks based on their market cap. Country: USA. It offers a wide range of investment banking products and services in all major capital markets, including consulting on corporate strategy and structure, raising capital in the stock and debt markets, risk management, and creating a securities market. In the Bank of America completed its rebranding and as a result, two main divisions emerged — Bank of America Securities and Merrill. The first branch is focusing on investment banking and the second one has transformed into a wealth management division. BofA Securities provides services in global asset and investment management, capital markets research and analysis, as well as lending and trading. Operating in more than 40 countries with 68, employees, this investment bank offers its services to large corporations, government and financial institutions, as well as individuals.

Investment bank ranking

If you're new here, please click here to get my FREE page investment banking recruiting guide - plus, get weekly updates so that you can break into investment banking. Thanks for visiting! Despite that, it is helpful to know about the different types of banks, especially since the categories have changed over time. First, this article is less of a ranking and more of a classification of the top investment banks. Finally, before you freak out and start wondering why I did not mention your bank, realize that it is impossible to mention every bank in the world. See the detailed article for more on this topic. In addition to the detailed articles on BB , EB , and MM banks, we also cover boutique investment banks in a separate article. There are some other differences as well — for example, you often earn more at elite boutiques than at bulge bracket banks. The European banks have also moved away from investment banking and toward wealth management and other businesses, which has hurt their prospects. They also tend to work on smaller deals, overall , than the bulge brackets, but these deals are still bigger than what middle market and boutique banks work on.

Krookodile evolution

It will be almost impossible at this stage because junior-year recruiting now starts BEFORE your junior year even begins. Alternative Energy. Millstein started recently but are on very big deals, and Evercore while strong reputationally, are still establishing themselves. Get Started. Internet Content. This begs the question, how are the top banks any different? This multinational investment bank and financial services corporation was formed by the merger of banking giant Citicorp and financial conglomerate Travelers Group in So unless you really want to be in NY, Guggenheim may be better. Space Exploration. But you could ask the new bank about it as well. Richard September 8, Essentially, you are developing a very similar skill set to what PE desires, which would make your life, as the interviewee, easier. Great article, very helpful. They are significant vs.

Industry-specific and extensively researched technical data partially from exclusive partnerships. A paid subscription is required for full access. JPMorgan was the world's leading bank in terms of investment banking revenue in

Fitness and Sports Training and Coaching. Boutique banks can be further divided into elite boutiques EBs , which compete with bulge bracket banks in high-value deals, and regional boutiques, which focus on smaller, localized transactions. Does the deal experience from summer internship count? Also is it correct to assume they are a bit more selective than middle markets but less selective than EB? Hi Brian, I would like your view about moving into an EB eg. Elder Care. Take a look at some of our coverage of other readers from military backgrounds who got in:. A top BB or EB is almost always a better bet. Restaurants and Food Services. Would an analyst at top merchant banks get the same looks at Megafunds and Top VCs similar to analysts at a bulge bracket?

I apologise, but, in my opinion, you are mistaken. Write to me in PM, we will talk.

At all is not present.

It is a pity, that now I can not express - it is very occupied. I will return - I will necessarily express the opinion.