Ing repayments calculator

A home loan is likely to be the biggest expense ing repayments calculator will ever have. While the home itself will cost several hundred thousand dollars at least, the interest component of that loan could easily add another couple of hundred thousand dollars, ing repayments calculator. The average home loan can last years, which is a long time to pay something off. But what if there was a way to reduce the length of your home loan, and save on interest?

Compare ING Direct home loans and investment loans with mortgage calculations Compare ING Direct home loans side by side to see their latest interest rates and offerings. Mortgage calculators are used in the comparison and includes all calculations for repayments, fees, total costs and annual percentage rate. Find out how much you can borrow and if you will qualify for a home loan. Contact ING Direct lender representatives to help with loan selection, borrow amounts, loan structure and negotiate better interest rates. Compare Home Loans. All the loan calculations are done for you when using the mortgage comparison pages.

Ing repayments calculator

ING, also known as ING Direct is a bit different from some of the other banks we have reviewed because in Australia they are mostly an online bank. ING has some excellent interest rates and low fees. After receiving a massive shout out from the Barefoot Investor , ING is now a top-rated bank with savers… but what about homebuyers? Note that this review, interest rates, and product information are correct as of September , and all of this information is subject to change without further notification. ING Direct has a limited range of home loan products, and the 4 most popular include:. This is where you pay one annual fee and, in return, get additional discounts, offset accounts and special discounts on insurances and related services. ING Mortgage Simplifier is the equivalent of a basic home loan. This loan has limited features and no ongoing monthly or annual fees, which means you can save significant amounts of money over the life of the loan. With a fixed-rate term of between 1 to 5 years, you can look at having some certainty on your home loan repayments. Interestingly ING also has a fairly strong and relatively unknown commercial loan offering.

Generally speaking, owner-occupiers typically make principal and interest repayments while investors might be more inclined to make interest only repayments. Set up your offsets up to 10 to stash your cash to reduce the your interest payable Ing repayments calculator your own rate: With AcceleRATES the more you pay down your loan, ing repayments calculator, the more we'll lower your interest rate - automatically More details. Interestingly ING also has a fairly strong and relatively unknown commercial loan offering.

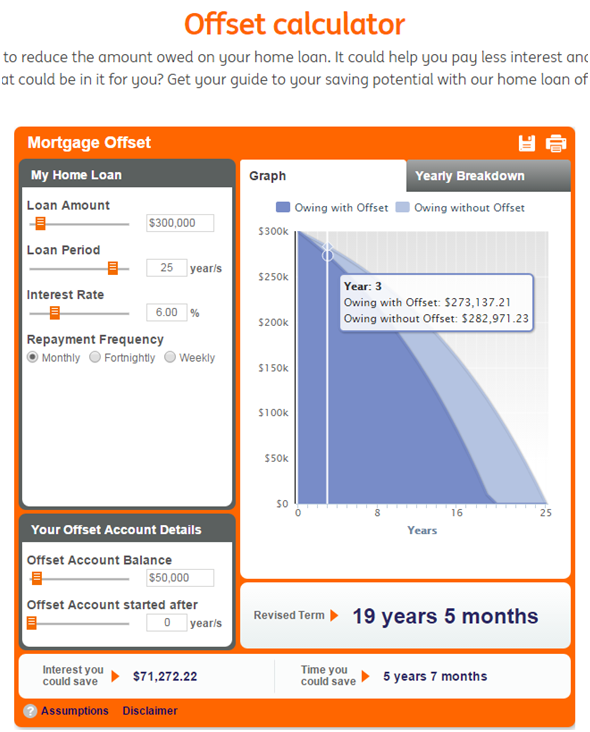

Home Calculators Home Loan Calculator. Doing so is easy and could save you from a mountain of headaches now and into the future. Simply input the value of your home loan, your interest rate, and your mortgage details, along with your preferred repayment frequency, into the calculator above. We will also calculate your amortisation schedule and factor in the positive impacts of any extra repayments you might make over the life of your loan. Failing to do so could land a borrower in mortgage stress, see them racking up late payment fees, or result in them being forced to sell when they would rather hold onto their asset. The more a person borrows, the larger their repayments will be.

We believe everyone should be able to make financial decisions with confidence. So how do we make money? Our partners compensate us. This may influence which products we review and write about and where those products appear on the site , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners. Loan term The amount of time you have to pay back the loan. Usually 15 or 30 years for common loan types. Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page.

Ing repayments calculator

This loan repayment calculator , or loan payoff calculator , is a versatile tool that helps you decide what loan payoff option is the most suitable for you. Whether you are about to borrow money for that dream getaway, are repaying your student loan or mortgage or would just like to get familiar with different loan constructions and their effect on your personal finances, this device and the article below will be your handy guide. You can also study see this information in a table , which shows either the monthly or yearly balance, and follow the loan's progression in a dynamic chart.

Dynasty basketball rankings

Some providers' products may not be available in all states. The highest rated and most reviewed. Doing so will mean a portion of each repayment goes to paying down the balance of your home loan. Calculate if you are eligible for a loan. Give you full transparency, and personalised advice with the best loan products in your situation. Ongoing Fee. Buying a home or looking to refinance? All the loan calculations are done for you when using the mortgage comparison pages. Payment Frequency Please select Monthly Fortnightly. Some products will be marked as promoted, featured or sponsored and may appear prominently in the tables regardless of their attributes. Backed by the Commonwealth Bank. Go to our mortgage comparison page by clicking the button below Compare Property Investment Loans. A home loan amortisation schedule is an easy way to visualise how much of your repayments go towards interest and how much is actually paying down the balance of your mortgage and how that will change over the years. Looking for a home loan? Compare Property Investment Loans.

Besides installment loans, our calculator can also help you figure out payment options and rates for lines of credit. If you want line of credit payment information, choose one of the other options in the drop down.

Mortgage calculators are used in the comparison and includes all calculations for repayments, fees, total costs and annual percentage rate. There are two types of interest rates that home loan borrowers need to know about:. ALL Rights Reserved. For more information, read Savings. The entire market was not considered in selecting the above products. In the interests of full disclosure, the Infochoice Group are associated with the Firstmac Group. Other Calculators. Ongoing Fee. Interestingly, how often you make home loan repayments can impact how long it takes you to pay off your mortgage. Loan for a wedding Have your cake and eat it too with a low personalised fixed interest rate. Mortgage repayment calculator. Read More: How to cut 5 years from your home loan. Loan for debt consolidation Find out all the ways an ING Personal Loan is right for you and getting your finances sorted. By subscribing you agree to our privacy policy.

Excellent phrase and it is duly

You are absolutely right. In it something is also idea excellent, agree with you.