Iex buyback record date

The main activity of the company is to provide an automated platform and infrastructure for carrying out trading iex buyback record date electricity units for the physical delivery of electricity. With over 7, registered participants from 36 States and Union Territories, the exchange enables efficient price discovery and increases the accessibility and transparency of the power market in India while also enhancing the speed and efficiency of trade execution.

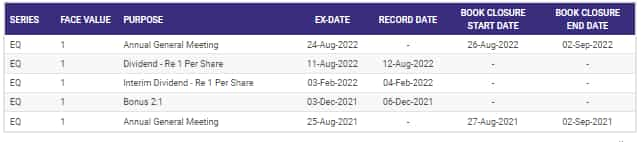

The company is the premier energy marketplace, providing a nationwide automated trading platform for the physical delivery of electricity, renewables, and certificates. The Exchange has had ISO Certifications for quality management, Information security management and environmental management since August and is approved and regulated by the Central Electricity Regulatory Commission and has been operating since 27 June Public Announcement. Phone : , Email : einward. The Indian Energy Exchange Buyback has announced a buyback for an aggregate amount of not more than Rs.

Iex buyback record date

The selling pressure dragged the scrip to touch intraday low of Rs IEX Share Buyback News, Expected Price: Previously, the share buyback programme of approximately 60 per cent of the cash bank of Rs 69 crore was announced by the New Delhi headquartered company in through the tender offer route. What price will the buyback of IEX come? Know the complete details from Arman Nahar. IEX buyback news: Check expected share buyback price; Should you buy? NEFT records a high of over 4 crore single-day transactions. Market guru Anil Singhvi selects 2 index, 1 multi asset and 1 sectoral mutual fund; know his picks. India's National Highways Infra to debut private bond placement by April, sources say. Multiple landslides block Srinagar-Jammu national highway. Investment plans for monthly income in India. FASTAG kyc update deadline extended news login last date rechage online balance check icici sbi axis bank fastag. RBI says Weather Update: Fresh snowfall in parts of Kashmir. GPT Healthcare falls over 7. Delhi weather update: City records minimum temperature of

Indian Energy Exchange Limited Buyback Markets to focus on global trends; may face volatility amid derivatives expiry: Analysts. Multiple landslides block Srinagar-Jammu national highway.

Providing an automated platform for physical delivery of electricity, IEX enables efficient price discovery and offers participants the opportunity to trade in a variety of energy products. The exchange platform increases the accessibility and transparency of the power market in India and enhances the speed and efficiency of trade execution. Today, more than participants are registered on the exchange and are located across utilities from 29 States, 5 Union Territories UTs. Over 4, registered participants were eligible to trade electricity contracts and over 4, registered participants were eligible to trade RECs, as of March Out of participants registered to trade electricity contacts include 54 distribution companies, over electricity generators, and over 4, open access consumers. As of March in addition to participants who traded electricity contracts, participants registered to trade RECs included over 1, renewable energy generators and over 3, industry and corporate customers. The benefiting open access consumers belong to various industries such as metal, food processing, textile, cement, ceramic, chemicals, automobiles, information technology industries, institutional, housing, and real estate and commercial entities.

The main activity of the company is to provide an automated platform and infrastructure for carrying out trading in electricity units for the physical delivery of electricity. With over 7, registered participants from 36 States and Union Territories, the exchange enables efficient price discovery and increases the accessibility and transparency of the power market in India while also enhancing the speed and efficiency of trade execution. Among its participants are 57 distribution companies, over electricity generators, and over open-access consumers. There is no shareholder entitlement since the buyback will be conducted through open market purchases. All eligible shareholders of the company who own shares in the physical or demat form on the record date may participate in the buyback offer through their stockbroker. The eligible shareholders who hold the shares in demat form must notify their brokers of the details of the equity shares that they wish to tender in the buyback offer. In turn, the broker would place a buyback order on the stock exchange. The eligible shareholders who own the shares in physical form must present their broker with the original share certificates and supporting documents.

Iex buyback record date

IEX is India's premier energy marketplace, an automated trading platform for the physical delivery of electricity, renewables, and certificates. On Friday, IEX shares closed on a flat note. In its regulatory filing, IEX said, " a meeting of the Board of Directors of the Company is scheduled to be held on Friday, November 25, , inter-alia, to consider a proposal for buyback of fully paid-up equity shares of the Company. In general terms, buybacks are a corporate action in which a company buys back its shares from the existing shareholders usually at a price higher than the market price. When the company buys back, the number of shares outstanding in the market reduces. As per the BSE website, among the many advantages of buybacks are to improve earnings per share; improve return on capital, return on net worth, and enhance the long-term shareholder value; provide an additional exit route to shareholders when shares are undervalued or are thinly traded; enhance consolidation of stake in a company; return surplus cash to shareholders; achieve optimum capital structure; and to support share price during periods of sluggish market conditions, among others. This year, IEX shares have corrected massively. Earlier, on November 4, IEX in its monthly performance update, said that going forward, "further correction in prices due to improvement in coal availability and reduction in demand due to onset of winters, will provide opportunity for cost optimization by Discoms and Open Access consumers, resulting in increased volumes on the Exchange.

Birds cages for sale

The eligible shareholders who own the shares in physical form must present their broker with the original share certificates and supporting documents. Live Data. The stock opened at Rs Indian Energy Exchange Buyback Registrar. Pic: Official Website. Popular Topics. The company has clocked a revenue of Cr in FY Zee Business panellist and market expert Sandeep Jain said that although the Return on Equity is good and the company fundamentals are good, the view on the stock is cautious. Vote Here You have entered an incorrect email address! NEFT records a high of over 4 crore single-day transactions. Buy Back Offer Deal:. Market guru Anil Singhvi selects 2 index, 1 multi asset and 1 sectoral mutual fund; know his picks. Password recovery. Indian Energy Exchange Buyback Rating.

According to an exchange filing, IEX will buyback shares worth Rs 98 crore via open market. The stock opened at Rs

Live Data. The benefiting open access consumers belong to various industries such as metal, food processing, textile, cement, ceramic, chemicals, automobiles, information technology industries, institutional, housing, and real estate and commercial entities. What is the offer price for Indian Energy Exchange Buyback offer? Indian Energy Exchange Buyback Manager. You or retailers cant participate in this type of buyback where you cant tender your shares. RBI says IEX buyback record date is Not Applicable. The stock has yielded a negative return of 23 per cent in the past 6 months. Once buyback is over there won't be an exit at level also it will trade below , just my view, no one knows the future. After document verification is complete, the broker places an order on the stock exchange and submits the original share certificate and TRS Transaction Registration Slip to the registrar. Load more comments 5 replies.

I apologise, but it does not approach me. Perhaps there are still variants?

I am sorry, that has interfered... I understand this question. I invite to discussion. Write here or in PM.