How to get 1099 for doordash

Doordash has been growing fast during the last two years and not only in terms of sales and customers but also for the number of self employers that make money delivering alcoholfood, groceries and more with Doordash. Running a small business like delivery or rideshare jobs is a great way to make a living and earn extra cash to pay off debts, unexpected bills, how to get 1099 for doordash supplement retirement plans or save up to buy a new car.

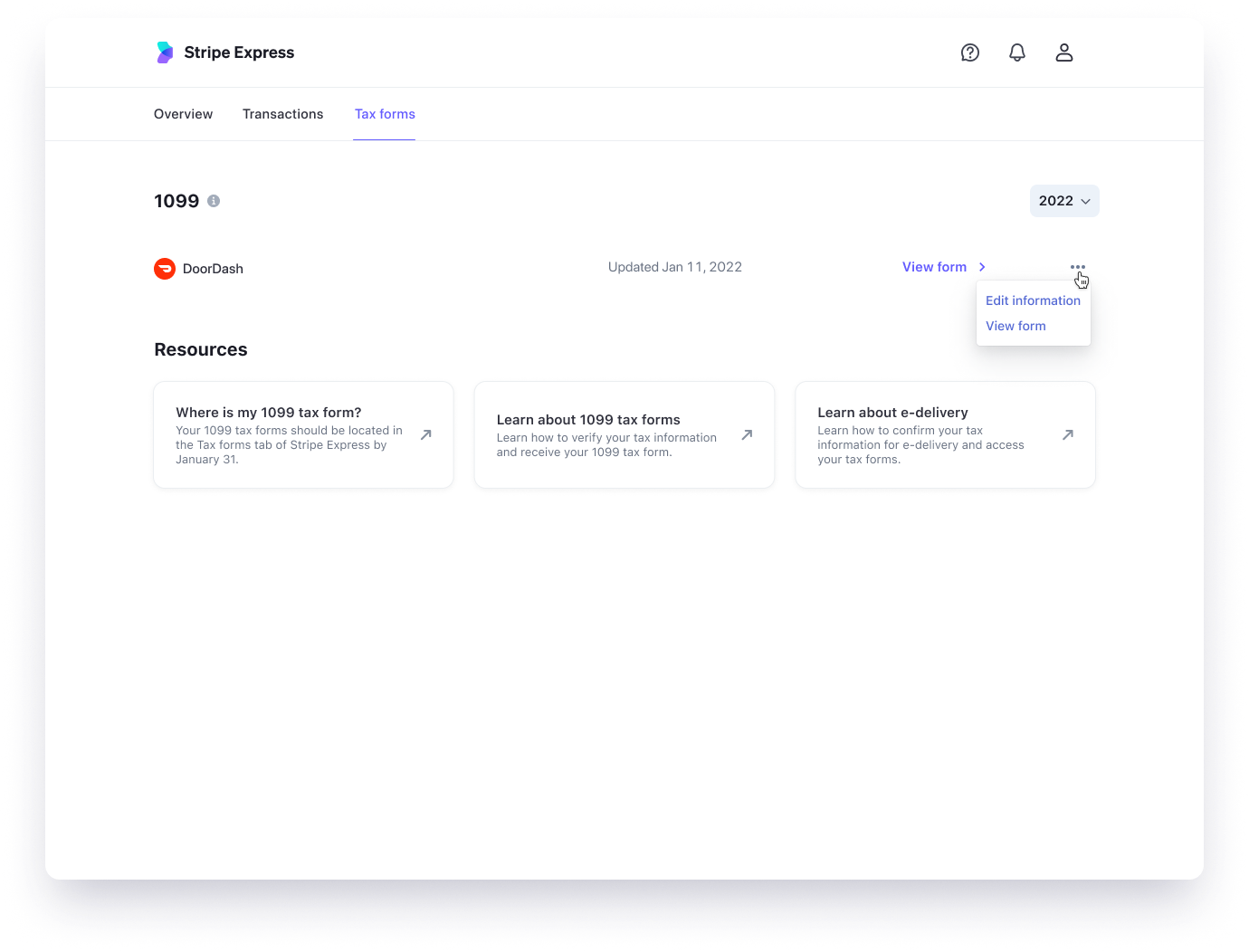

DoorDash partners with Stripe to file tax forms that summarize your earnings or sales activities. If you have already created a Stripe Express account, you can log in to manage your tax information at connect. A K form summarizes your sales activity as a Merchant. Stripe Express allows you to update your tax information, download your tax forms, and track your earnings. You should expect to sent an E-delivery notification for your K if you meet the following criteria in

How to get 1099 for doordash

As an independent contractor, the responsibility to pay your taxes falls on your shoulders. Each year, tax season kicks off with tax forms that show all the important information from the previous year. These items can be reported on Schedule C. Note: Form NEC is new. Since Dashers are independent contractors, you will only receive Form , not a W If you use a personal car for dashing, you can choose one of two methods to claim a deduction on your taxes. However, using the standard mileage method you can generally still deduct the following items separately: tolls and parking fees, auto loan interest, and personal property taxes. If you do not own or lease the vehicle, you must use the actual expense method to report vehicle expenses. Check out our article on independent contractor taxes. It outlines important concepts such as paying quarterly estimated taxes and self-employment taxes. In addition to federal and state income taxes you may be subject to local income taxes. Certain cities and airports will impose an additional tax on drivers granting them the right to operate in the city.

Form Used to file a normal tax return.

Sound confusing? Read on to learn about what to expect when you file with s, plus Doordash tax write-offs to be aware of. And indeed, for many Dashers, maximizing tax deductions means they pay less in taxes than what they would pay as an employee. Not sure how to track your expenses? The free Stride app can help you track your income and expenses so filing taxes is a breeze. Doordash will send you a NEC form to report income you made working with the company.

DoorDash partners with Stripe to file tax forms that summarize your earnings or sales activities. If you have already created a Stripe Express account, you can log in to manage your tax information at connect. A K form summarizes your sales activity as a Merchant. Stripe Express allows you to update your tax information, download your tax forms, and track your earnings. You should expect to sent an E-delivery notification for your K if you meet the following criteria in If you are unable to find that email, head to our Support Site where you can request a new link to be sent to your email.

How to get 1099 for doordash

Home Delivery. Since , Brett Helling has built expertise in the rideshare and delivery sectors, working with major platforms like Uber, Lyft, and DoorDash. He acquired Ridester. Expanding his reach, Brett founded Gigworker. More about Brett How we publish content.

Meze plymouth

Other Doordash tax deductions include any commission or fees Doordash charges and a cell phone. To avoid getting hit with a penalty, make sure you're well-prepared to make your quarterly tax payments. Tax Information Center Small business Self-employed. Personal trainer. So, what can you write off as a ? But if you need your earnings sooner, you can choose the Fastpay option and get paid once a day for a small fee. Tattoo artist. Answer Yes to "Did you have any self-employment income or expenses"? About Us. In this article, we'll explain everything you'll need to know to file your taxes as a dasher, whether it's your full-time job or a side hustle. E-delivery is the faster option: it will let you see your online by January Luckily, you can also estimate your tax bill using our income tax calculator. Yoga teacher. But it could be delivered up to 10 business days later.

Just like with any other job, when you work at DoorDash, you need to take care of your taxes. The is a tax form you receive from Payable. The form is meant for the self-employed, but it also can be used to report government payments, interest, dividends, and more.

It will look something like this:. Try free. Uber Sustainable Rides. What this means is that if you use your cell phone for work 50 percent of the time and for personal reasons 50 percent of the time, you could deduct 50 percent of the associated costs. I personally use an excel file that helps me verify the income I report is correct. However you should give them an authorization to deliver the tax form online. Here are some other common write-offs for dashers:. Thank you! You can easily do this using your bank app or your bank account statements. The first step is to report this number as your total earnings. Insurance agent. Dog walker. Why is this important?

You are mistaken. I can defend the position. Write to me in PM, we will discuss.

Just that is necessary.

What quite good topic