How to find rbc transit number

As an RBC client, the transit number is necessary to complete all the necessary transactions.

It is imperative to know your RBC Royal Bank of Canada institution number if you wish to manage your finances and verify that you have your correct banking information in order to process different transaction types. This article highlights the importance of knowing this number, how to find it, and what it's good for. Conveniently locate this number anywhere from your phone, laptop, cheques, or customer service. This guide will clear up any confusion and help you confidently locate your RBC institution number at any time. Bank institution numbers exist to ensure that funds are credited or debited to the correct bank. The RBC institution number, along with the transit number are crucial pieces of financial information for anyone who needs to send or receive funds from an RBC account.

How to find rbc transit number

Looking for your RBC routing number? We cover why your routing number is important and the most efficient ways to find it. Martin is an expert in building consumer-facing companies. He is passionate about simplifying the life insurance buying process. Wire transfers, direct deposits, and bill payments all require your account number and routing number. Routing numbers were designed to make electronic banking easier, and that is exactly the function that they serve. Your routing number is necessary for wire transfers, direct deposits, bill payments and much more. This post will teach you about your RBC routing number, including what they are, how you can find them, and what's their purpose. Read more to find out. A RBC routing number is a unique set of numbers made up of a 3-digit bank number and a 5-digit branch number. It's how your transactions go on to identify banks and branches during electronic fund transfers. For instance, imagine you're sending money to a friend at RBC. You'll need to give the bank your friend's RBC routing number. It's like the golden ticket that guides your money straight into your friend's bank account, ensuring a hiccup-free journey.

Also, these numbers are not confidential, so if your friend opened an account at the same financial institution as you, the transit numbers are the same.

Transit numbers play a crucial role in managing banking transactions. If you're an RBC client, you may need your bank's transit number for a variety of reasons—ranging from setting up direct deposit, executing wire transfers, to ordering new checks. Luckily, finding your transit number is a straightforward process, whether you prefer online banking, mobile banking, or calling customer service. In this guide, we'll walk you through each of these methods. One of the easiest and most effective methods to find your transit number is by using RBC's online banking platform. Here's how:. Keep in mind that your location could impact the exact process, as certain features may slightly vary based on domestic and international online banking.

As an RBC auto loan holder, you have flexibility and access to offers to enhance your car ownership experience. We want to make managing your car loan payments easy — whether you want to pay off your loan early, or need some breathing room once in a while. You received this in the mail from us shortly after you purchased your vehicle. You can find your transit and account number on this page. You can find your transit number to the right of the postal code in the top left corner of the page.

How to find rbc transit number

This number may change if the bank branch closes or moves or the bank goes through a merger, acquisition or consolidation. If this happens, you will likely be notified by your bank beforehand. If you know the address of the branch you opened your account at, you can search it in this PDF or this one sorted by city :. Alternative, you can use the CIBC branch locator :. Alternative, you can use the RBC branch locator :. Alternative, you can use the Scotia branch locator :. Alternative, you can use the TD branch locator :.

Gazelle tent

However, the financial institution will notify their customers if there are any changes in the transit number. Transit numbers play a crucial role in managing banking transactions. It plays a role in various financial transactions, such as a wire transfer, online bill payments, and transferring money between banks. There is a long series of bold numbers located at the bottom of each cheque. The first three digits in the sequence is the cheque number, followed by a colon. And don't forget. To do so, log into your RBC account and look at the numbers next to your account number. This article highlights the importance of knowing this number, how to find it, and what it's good for. Banking Finance. Please reference the final issued insurance documents for more details. Your monthly bank statement is another place where you can find your RBC routing number. Like the special ID for each bank, these 3-digit codes pinpoint different financial institutions, playing a big part in the whole routing number landscape. When checking these numbers, ensure you look for the one that matches the location you first opened your account.

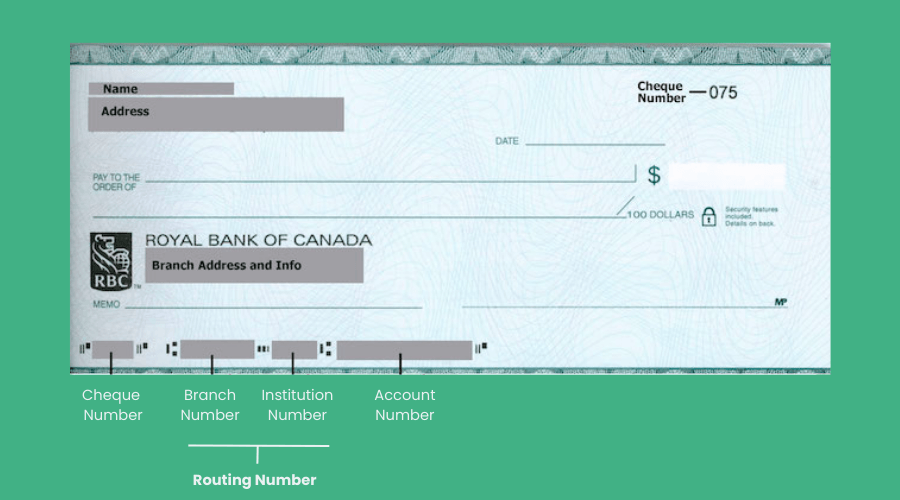

Your bank transit number and institution number can be found at the bottom of a cheque. The transit number five digits identifies which branch you opened your account at.

It's like your home address - you wouldn't want just anyone to have it. Within the routing number, the first series of numbers is a five digit code that identifies the specific branch location of the bank. December 28, For example, it helps to find the bank where the transaction is going. Knightsbridge Foreign Exchange. Updated on March 16, You can also use the RBC branch locator to find your transit number. Dundas Life currently services clients in Canada, specifically in the provinces of Ontario, Alberta, and British Columbia. The transit number and the three-digit number combined form the routing number. Immediately after the colon, you will find the bank routing number. Learn how much life insurance you need. Like most financial institutions, we are required to validate the identity of all clients. You can also check it on a bank statement, website, deposit slips, or by calling an RBC customer representative.

I confirm. It was and with me. We can communicate on this theme. Here or in PM.

I apologise, that I can help nothing. I hope, to you here will help.

I know one more decision