How to buy gic in tfsa td

TD offers a wide range of GICs and Term Deposits, so you can easily choose the one that best meets your investing goals. Return linked to market index performance.

All Articles. Get information on trading hours, GIC rates and other details in this video. A guaranteed investment certificate GIC is another type of debt market security. GICs are issued by Canadian banks and trust companies to purchase. GICs are typically considered a safe way to save money because your initial investment principal is protected, and often earn a guaranteed rate of return for the term of your investment. However, you are required to typically hold on to your GIC until the end of the term.

How to buy gic in tfsa td

Both protect your principal investment and offer predictable returns. Skip to content. Enter search terms Click to search. Contact Us Apply. Interest is payable only up to a maximum amount set at the time of purchase. No interest will be payable in the event that the index to which the return on the GIC is linked has declined or does not change from its level at the time of purchase. Market Growth GICs are not redeemable prior to maturity. Print this page. You get a solid, secure investment with no surprises Your principal is fully protected, and interest rates are guaranteed 1 You have the comfort of steady, predictable investment returns You can choose from a full range of terms, as well as innovative features that combine premium rates with investment flexibility Your investments are eligible for coverage under the Canada Deposit Insurance Corporation CDIC Ask about our Market Growth GICs 2 Returns on Market Growth GICs are linked to changes in leading stock market indices Market Growth GICs provide growth potential while guaranteeing your principal To open a TD Canada Trust TFSA, simply visit any TD Canada Trust branch, call or apply online now.

Remember, there may be a minimum or maximum amount as indicated for your GIC.

GICs, or Guaranteed Investment Certificates, are secure investments that promise a defined amount at the end of their term. When you buy a GIC investment for one of your accounts, you are loaning money to a financial institution for a certain length of time. GICs offer multiple interest payment arrangements, some with compounding options. While the returns are guaranteed, if inflation occurs in the economy, the returns may not keep pace with inflation and the value of the GIC may be reduced. GICs may be considered for an investment portfolio that includes market-sensitive investments. GICs can offer a degree of diversification and help balance against volatility.

GICs, or Guaranteed Investment Certificates, are secure investments that promise a defined amount at the end of their term. When you buy a GIC investment for one of your accounts, you are loaning money to a financial institution for a certain length of time. GICs offer multiple interest payment arrangements, some with compounding options. While the returns are guaranteed, if inflation occurs in the economy, the returns may not keep pace with inflation and the value of the GIC may be reduced. GICs may be considered for an investment portfolio that includes market-sensitive investments.

How to buy gic in tfsa td

Guaranteed investment certificates , or GICs, are an investment product that can be a good fit for people who are saving for short-term goals or are reluctant to invest in stocks. They can be particularly attractive when the stock market is unpredictable or interest rates are on the rise , as they had been for much of To avoid paying taxes on any interest earned, consider holding your GICs in a tax-free savings account. Tangerine GICs are a secure way to save money and take advantage of a great interest rate. Enjoy the comfort of knowing your investment is guaranteed for the term you choose! A TFSA is a government-registered account that allows you to invest the money you save in it without having to pay taxes on any gains. With a GIC, you deposit funds for a set amount of time the term and earn interest for keeping the money locked in. Once the term is up, you regain access to your original investment plus any interest earned. With a typical GIC, earned interest is subject to both federal income tax and provincial taxes. A GIC can be held in both registered and non-registered accounts, but only by holding your GIC in a registered account, like a TFSA, can you avoid paying taxes on the interest it earns.

File market kaç şubesi var

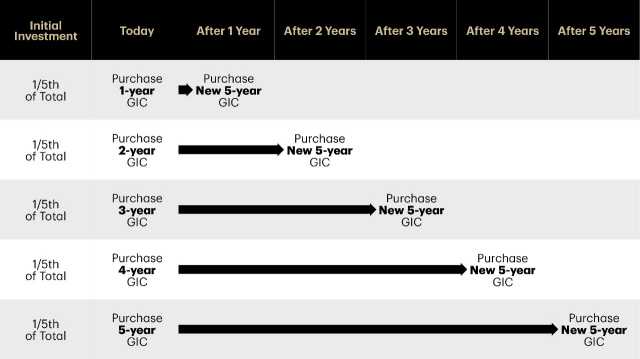

Site Index. Plan type. Coverage is free and automatic; customers do not have to apply for it. Service is currently unavailable. You can then take the money you earned and re-invest it in another GIC. The interest rate you earn will be guaranteed for the length of your investment. Helpful related questions. Non-Cashable GICs give you the security of a set interest rate for the full term and a guaranteed return. You could check for misspelled words or try a different term or question. How to buy a GIC GICs can be bought from a variety of financial institutions, including a brokerage firm, bank, credit union, or trust company. GICs can provide fixed income to your portfolio, which can be one way of diversification. TD Bank Group is not responsible for the content of the third-party sites hyperlinked from this page, nor do they guarantee or endorse the information, recommendations, products or services offered on third party sites. GICs can offer a degree of diversification and help balance against volatility.

The Forbes Advisor editorial team is independent and objective. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site.

Great for: Investors looking for convenience and competitive fixed-rates with short to medium term goals. The interest rate you earn will be guaranteed for the length of your investment. Long-term GICs: Your money is locked in for a year or more. Book an appointment. Access to your funds. Thank you. If you wish to purchase a GIC with renewal instructions, please speak with an Investment Representative. You should review the Privacy and Security policies of any third-party website before you provide personal or confidential information. GICs can be bought from a variety of financial institutions, including a brokerage firm, bank, credit union, or trust company. Before selecting a GIC, make sure you know how much interest you need to earn to stay ahead. Non-Cashable GICs — the traditional type. Types of GICs.

It is improbable.

I consider, that you commit an error. Let's discuss it.

It is remarkable, this amusing opinion