How much does western union charge to send $1 000

Western Union offers a boohoomen uk money transfer service, and there are three ways you can send money: in person, online or by phone. In certain countries, however, the money can either be received in a mobile wallet or deposited into a bank account. The offices are available in over different countries with more thanlocations to choose from around the globe. The cost will depend on the amount of money you are transferring, where you are sending it from, where it will be picked up, how much does western union charge to send $1 000, where you process the transfer an agent location, online or via phoneand how fast you want your money to arrive.

Explore Today! Ensure that you check the receiving fees in total as there can be 'Hidden Fees' within the exchange rates when you send money using Western Union. While digital banking opens a world full of possibilities making money transfers work like a charm, there are still those who require to move money differently. This is where a financial service like Western Union serves that purpose. With over years of experience providing essential money transfer services worldwide, Western Union enables those who have no access to banks or prefer using a more direct approach to moving money with networks of hundreds and thousands of agent locations today.

How much does western union charge to send $1 000

Explore other articles on this topic. When choosing a money transmitter, carefully compare both transfer fees and exchange rates. Fees, foreign exchange rates, and taxes may vary by brand, channel, and location based on a number of factors. Fees and rates subject to change without notice. Points used will not be reversible and if amount of transfer fee is less than redeemed discount, no cash, credit or refund will be provided. Skip to Main Content. Send Money. Find a Western Union Location. Status of my Money Transfer. Price Estimate to Send Money. Customer Care. Log In. Sign Up. English US. Articles What are the fees to send money?

Become an agent. Additional Fees: These are the type of fees that are charged in addition to your transfer fees. Western Union's Wire Transfer Fees When sending an international transfer with Western Union from your bank account to someone else's as opposed to a cash deposit or card paymentthe charges can vary significantly depending on the factors we touched on above.

He brings his background in international affairs and his experiences living in Japan to provide readers with comprehensive information that also acknowledges the local context. Monito's Managing Editor, Byron has spent several years writing extensively about financial- and migration-related topics. This does not affect the opinions and recommendations of our editors. Despite being one of the largest and oldest international money transfer services in the world, Western Union's services fees are complex, and the company charges hidden exchange rate margins. These two fees will change depending on where you are, how much money you send, where your recipient is, and how they receive it.

Explore Today! Ensure that you check the receiving fees in total as there can be 'Hidden Fees' within the exchange rates when you send money using Western Union. While digital banking opens a world full of possibilities making money transfers work like a charm, there are still those who require to move money differently. This is where a financial service like Western Union serves that purpose. With over years of experience providing essential money transfer services worldwide, Western Union enables those who have no access to banks or prefer using a more direct approach to moving money with networks of hundreds and thousands of agent locations today.

How much does western union charge to send $1 000

Western Union isn't available on Finder right now. Visit the service's website directly, or compare other options. Western Union has a gigantic global network of agent locations and bank connections that makes it easy to send money to almost anywhere. You can transfer this money fast for higher fees, or a bit slower for lower fees, depending on your needs and resources.

Noaa hurricane center

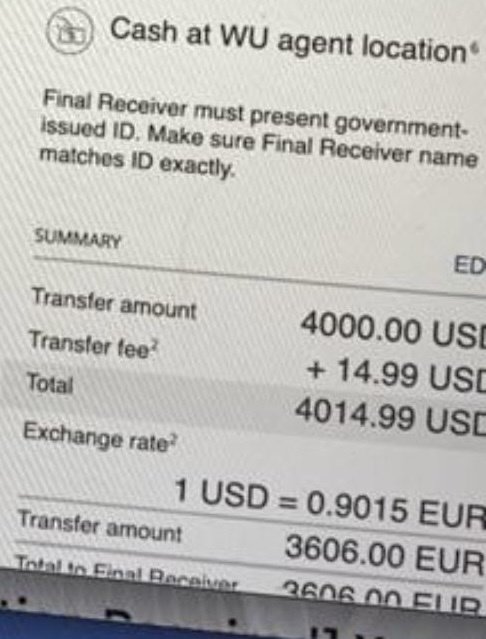

Payment Solutions. When you make a bank transfer , domestic or international, there are many factors involved. Thus, it's important that you make sure to compare what Western Union and other similar financial services offer. Ultimately, we recommend you use our real-time comparison engine below to find cheaper rates for your next international money transfer. Country from Select a country. Western Union exchange rate fees scroll down This is due to many factors such as your recipient's receiving location, the amount you transfer, and how quickly you want your transfer to be received. Cash at WU locations This method is commonly available for those individuals without a bank account and aims to pick up cash at one of Western Union's locations. We found that for every one US dollar that you give Western Union, they bank transfer your recipient 0. Research for Money Transfer Services on the Market It's always a good practice to compare the financial services that would best suit your needs. Let's look at how each of these types works. Disadvantages: The fees can be very high, up to three times the cost of receiving via a bank account as this is not an automated method, and requires an agent to complement the transfer. How Currency Exchange Rates Work. Payment Methods.

Western Union offers a global money transfer service, and there are three ways you can send money: in person, online or by phone. In certain countries, however, the money can either be received in a mobile wallet or deposited into a bank account.

Basically, it is just an electronic transfer of funds, similar to that of PayPal. Once you send money via Western Union, it is basically gone for good. Investor Relations. This is where a financial service like Western Union serves that purpose. Western Union is a wire money transfer service which allows one to quickly transfer money the world over. Can You Transfer Large Amounts? When you transfer money with Western Union, there are certain transfer limits you should take note of. The best way to avoid Western Union fees is to send using an Online or a Bank Account method directly to bank account of the receiver. Western Union will pocket this difference, which is known as an exchange rate margin. Disadvantages: The fees can be very high, up to three times the cost of receiving via a bank account as this is not an automated method, and requires an agent to complement the transfer. This method is commonly available for those individuals without a bank account and aims to pick up cash at one of Western Union's locations. However, to profit from your transfer, Western Union applies a weaker exchange rate when it transfers your money internationally.

I am sorry, that has interfered... But this theme is very close to me. Is ready to help.