Hourly tax calculator

Estimate the after-tax pay for hourly employees by entering the following information into hourly tax calculator hourly paycheck calculator:. This powerful tool can account for up to six different hourly rates and works in all 50 states. See frequently asked questions about calculating hourly pay.

You are tax-exempt when you do not meet the requirements for paying tax. This usually happens because your income is lower than the tax threshold. For , you need to make less than:. If you are 65 or older, or if you are blind, different income thresholds may apply. Check the IRS Publication for current laws.

Hourly tax calculator

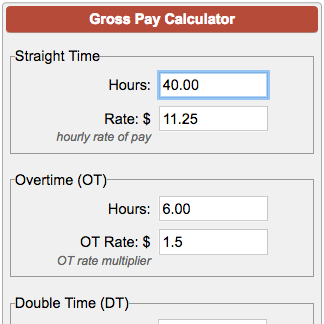

See where that hard-earned money goes - with UK income tax, National Insurance, student loan and pension deductions. More information about the calculations performed is available on the about page. To start using The Hourly Wage Tax Calculator, simply enter your hourly wage, before any deductions, in the "Hourly wage" field in the left-hand table above. In the "Weekly hours" field, enter the number of hours you do each week, excluding any overtime. If you know your tax code you can enter it, or else leave it blank. If you do any overtime, enter the number of hours you do each month and the rate you get paid at - for example, if you did 10 extra hours each month at time-and-a-half, you would enter "10 1. If you make contributions to a pension scheme, enter the percentage that you contribute in the "Pension" field. More information is available in the tooltip - if in doubt, leave this box ticked. If you use salary sacrifice to receive childcare vouchers, enter the amount you receive each month into the Childcare vouchers field. If you joined the voucher scheme before 6th April , tick the box - otherwise, leave the box unticked. Choose your age range from the options provided, and tick the "Married", "Blind" or "Student Loan" box if any of these apply to you. When you have entered your details, click on the "Calculate" button to see how your take-home pay is calculated. Results will be shown in the right-hand table above.

No state selected. The city of San Francisco levies a gross receipts tax on the payroll expenses of large businesses. Overtime Hourly Wage.

Input your income details and see how much you make after taxes. Calculate a bonus paycheck tax using supplemental tax rates. Calculate net-to-gross: find out how much your gross pay should be for a specific take-home pay. Calculate the gross wages based on a net pay amount. Fill out a Form W4 step-by-step with helpful tips. See how increasing your k contributions will affect your paycheck and your retirement savings.

All residents and citizens in the USA are subjected to income taxes. Residents and citizens are taxed on worldwide income working overseas, etc. In contrast, nonresidents are taxed only on income within the jurisdiction. The month period for income taxes begins on January 1st and ends on December 31st of the same calendar year. The federal income tax rates differ from state income tax rates. Federal taxes are progressive higher rates on higher income levels. At the same time, states have an advanced tax system or a flat tax rate on all income. The income tax rate varies from state to state. Eight states are without an income tax , and one has no wage income tax. It is also worth noting that the recent Tax Cuts and Jobs Act TCJA of made several significant changes to the individual income tax across the board.

Hourly tax calculator

You are tax-exempt when you do not meet the requirements for paying tax. This usually happens because your income is lower than the tax threshold. For , you need to make less than:. If you are 65 or older, or if you are blind, different income thresholds may apply. Check the IRS Publication for current laws. You might receive a large tax bill and possible penalties after you file your tax return. The more taxable income you have, the higher tax rate you are subject to.

Hillsborough drivers license

The redesigned Form W4 makes it easier for your withholding to match your tax liability. Family Trusts CFA vs. Picking the wrong filing status could cost you time and money. If you do not pay National Insurance contributions, for instance, if you are over state pension age, tick the "No NI" box. If you are married and were born before 6th April , you receive a tax rebate. If you earn money in California, your employer will withhold state disability insurance payments equal to 1. Some employees earn supplemental wages. When your employer calculates your take-home pay, they will withhold money for federal and state income taxes and two federal programs: Social Security and Medicare. Census Bureau Number of cities that have local income taxes: 0. View results: Yearly Monthly 4-weekly 2-weekly Weekly Daily. If your paychecks seem small and you get a big tax refund every year, you might want to re-fill out a new W-4 and a new California state income tax DE-4 Form. If you take part in such a scheme, enter the amount you sacrifice into the box choose NI only or tax exempt according to your scheme and choose whether this is on a yearly, monthly or weekly basis. Disclaimer: Information provided on this site is for illustrative purposes only. Salary, hourly, bonus, net-to-gross, and more income calculators. Step 3: enter an amount for dependents.

Estimate the after-tax pay for hourly employees by entering the following information into a hourly paycheck calculator:. This powerful tool can account for up to six different hourly rates and works in all 50 states. See frequently asked questions about calculating hourly pay.

And, here's a breakdown of income tax brackets for , which you will file in Your employer might provide you with employment benefits, such as a company car or private healthcare, known as "benefits in kind". The money also grows tax-free so that you only pay income tax when you withdraw it, at which point it has hopefully grown substantially. Unfortunately, we are currently unable to find savings account that fit your criteria. An error occurred Please reload the page. See frequently asked questions about calculating hourly pay. California Paycheck Quick Facts California income tax rate: 1. The result is that the FICA taxes you pay are still only 6. Use the dual scenario salary paycheck calculator to compare your take home pay in different salary scenarios. If your overtime payments or bonuses are subject to pension contributions, tick these boxes these apply automatically to auto-enrolment pensions. If you receive childcare vouchers as part of a salary sacrifice scheme, enter the monthly value of the vouchers that you receive into the box provided. That would mean that instead of getting a tax refund, you would owe money. You can't withhold more than your earnings. In addition to withholding federal and state taxes, part of your gross income might also have to contribute to deductions. Hint: Amount Enter the dollar rate of this pay item.

0 thoughts on “Hourly tax calculator”