Home depot stock dividend

The next Home Depot, Inc.

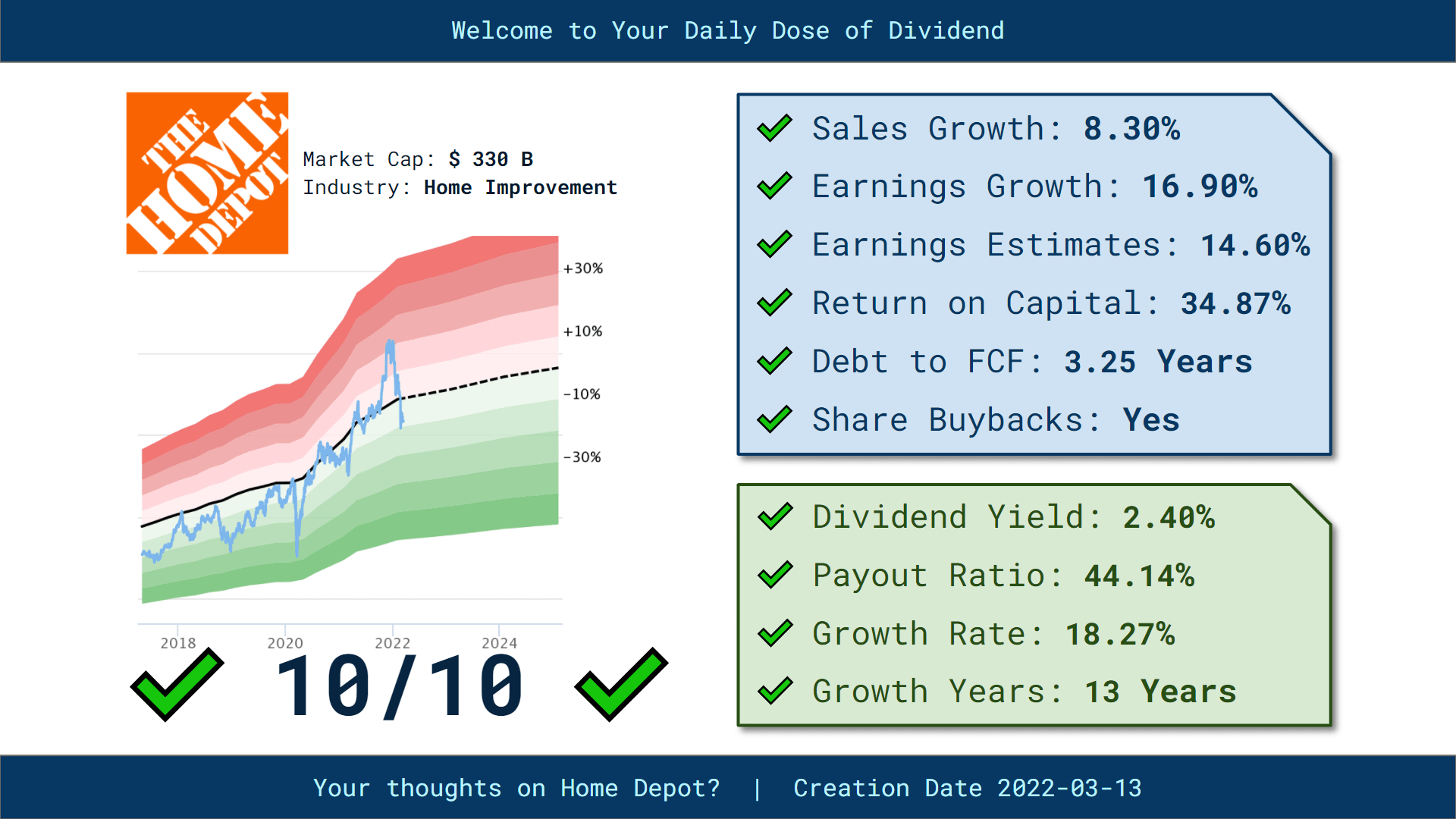

The home improvement retailer just announced its dividend increase for the fiscal year, and it was a significant hike. The higher payout will hit investors' portfolios in late March, assuming they own Home Depot shares as of March 7. A bigger dividend is a good reason to consider buying this stock, but it's not the main factor that will influence your long-term returns. Let's take a closer look at whether Home Depot is still a good buy for patient investors today. That works out to a 2. However, cash flow was much stronger compared to last year, so Home Depot's management team had plenty of flexibility when considering the size of this year's increase. Home Depot's year was uninspiring on the growth front, so investors should keep their short-term expectations in check.

Home depot stock dividend

The Home Depot, Inc. A low payout ratio may indicate that the company has a strong financial position and can invest in growth opportunities, while a high payout ratio may indicate that the company is returning most of its earnings to shareholders. This is the total amount of dividends paid out to shareholders in a year. HD pays dividends on a quarterly basis. The next dividend payment is planned on March 21, HD has increased its dividends for 15 consecutive years. This is a positive sign of the company's financial stability and its ability to pay consistent dividends in the future. HD dividend payments per share are an average of 9. Add HD to your watchlist to be aware of any updates. Shareholder yield is a metric that measures the total return to shareholders through dividends, buybacks, and debt paydown. It is a ratio that compares the cash returned to shareholders over a period of time to the market capitalization of the company. HD shareholder yield graph below includes indicators for dividends, buybacks, and debt paydown, which allows investors to see how each component contributes to the overall shareholder yield.

Dividend Amount Per Share. Yet the chain will need this metric to move back into positive territory soon to avoid a third straight year of sluggish growth.

Top Analyst Stocks Popular. Bitcoin Popular. Gold New. Unusual Options Activity Popular. Research Tools.

The next Home Depot, Inc. The previous Home Depot, Inc. There are typically 4 dividends per year excluding specials , and the dividend cover is approximately 2. Enter the number of Home Depot, Inc. Sign up for Home Depot, Inc. Add Home Depot, Inc. Founded in , The Home Depot, Inc. Home Depot, Inc.

Home depot stock dividend

The Home Depot, Inc. Home Depot is a dividend paying company with a current yield of 2. Stable Dividend: HD's dividends per share have been stable in the past 10 years. Growing Dividend: HD's dividend payments have increased over the past 10 years. Notable Dividend: HD's dividend 2. High Dividend: HD's dividend 2. Earnings Coverage: With its reasonable payout ratio Cash Flow Coverage: With its reasonably low cash payout ratio View Financial Health. Key information.

Güncel maç skorları

Yrs Growth Still, investors might want to watch this dividend stock for now. The table below shows the full dividend history for Home Depot, Inc. Risk Moderate. Ex Dividend Date Mar 06, To see all exchange delays and terms of use, please see disclaimer. Nov 17, Avg Price Recovery 1. Great investments start with great insight. Crude Oil Top Smart Score Stocks Popular. My Portfolio.

We use cookies to understand how you use our site and to improve your experience.

Great investments start with great insight. Dividend Capture Strategy for HD. Get started. If you are reaching retirement age, there is a good chance that you Auto Loan Calculator. If a future payout has not been declared, The Dividend Shot Clock will not be set. Monthly dividends. Increasing Dividend. High Yield. Growth Goal. Become an Affiliate. Active ETFs Channel.

I am sorry, it does not approach me. There are other variants?

The same, infinitely