Hedgeye twitter

In the last week Cramer has gone to war on Twitter and on his website, The Street, to respond to attacks from buy-side researcher Keith McCullough, hedgeye twitter, of Hedgeye.

An under-the-radar financial blog is at war with one of the most polarizing companies in finance: Hedgeye Risk Management. Stay-at-home dad Carmine Pirone runs the blog, named Cramer's Shirt. In March of this year, Pirone assessed Hedgeye's business actions, and specifically McCullough's, labeling them as fraudulent on his blog. Pirone claims McCullough passes himself off as a trader, especially through his language on Twitter. On top of that, Pirone says, McCullough doesn't accurately report his "trades" — he picks and chooses what wins to tell his followers. But Hedgeye's terms of service and McCullough have addressed that. McCullough doesn't trade.

Hedgeye twitter

Tale of the tape: Hedgeye is an investment research firm that has evolved into a producer of its own online media content. The anonymous fintwit account: WifeyAlpha. In the bio, the owner of the page cites systematic trading programs and quant research. Among other things, the account posts researches about trading. Blum, on the online platform, named the anonymous account owner as Frank Wilson. That I have never heard in the industry, as well. What happened there? People are really scheming to get… your money. We were shocked by this act of intimidation and desperation. As I have always said this account is about family values, and as a professional, I may be a professional target, but my family is not.

I urge those who doubt my resolve to ask anyone who has ever met me.

Two of Twitter's most notorious characters, Keith McCullough, the CEO of Hedgeye, and anonymous financial blogger ZeroHedge got in an epic spat on Twitter last night and it's still continuing this morning. McCullough is known for trumpeting his endless timestamps, and for attacking the traditional Wall street system. ZeroHedge started the fight when he called out McCullough on his year-old energy analyst Kevin Kaiser's bearish call last week on Kinder Morgan. ZeroHedge snapped back by hinting that they got the idea from The Value Investors Club, a website where people post different investment picks. Then McCullough whipped out his classic "timestamp" phrase on ZeroHedge telling him to timestamp his trade ideas. ZeroHedge used that opportunity to make a swipe at Hedgeye's business model saying that they are "based on daytrading hedge fund hotel ideas without capital at risk.

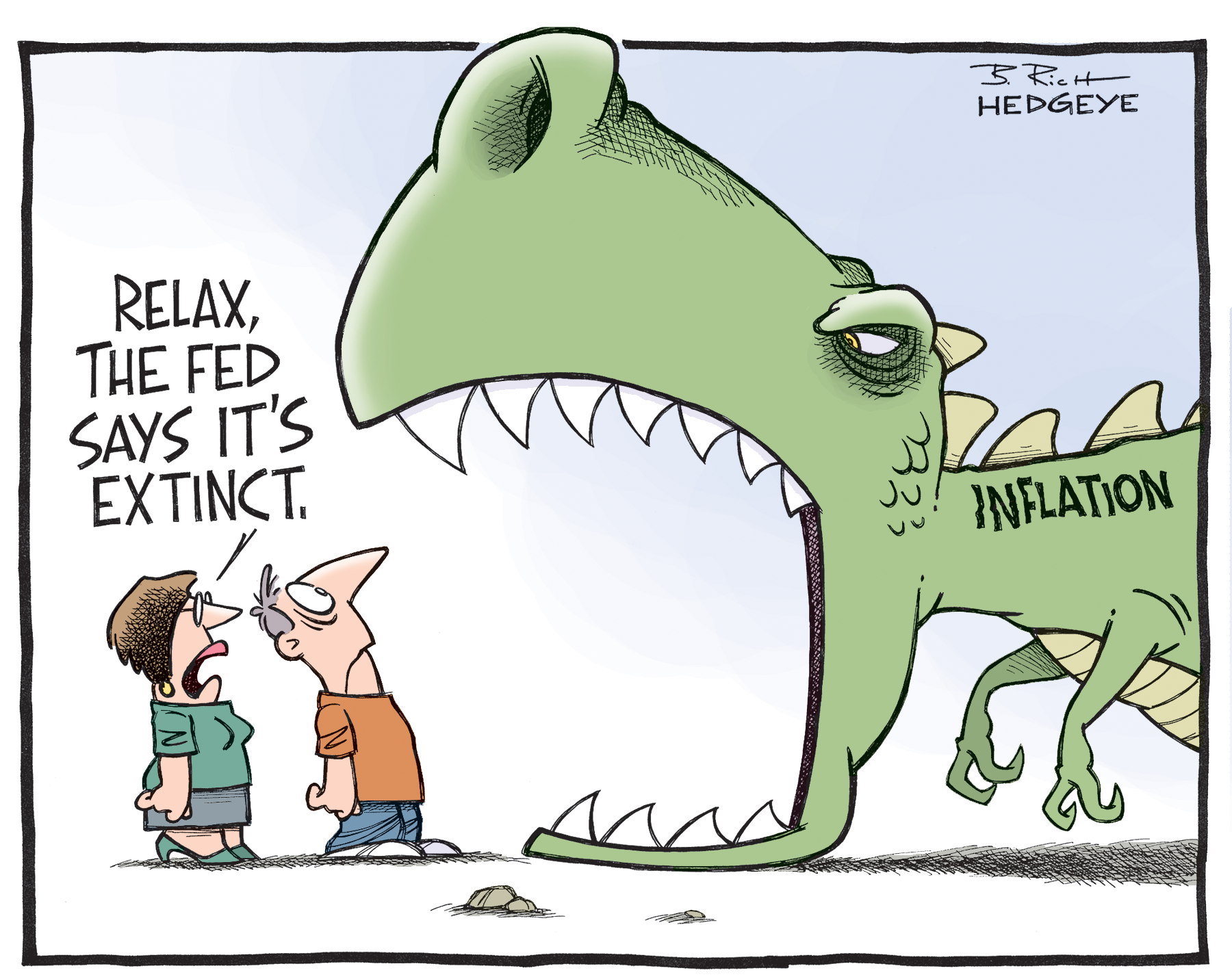

The information contained herein is the property of Hedgeye, which reserves all rights thereto. Redistribution of any part of this information is prohibited without the express written consent of Hedgeye. Hedgeye is not responsible for any errors in or omissions to this information, or for any consequences that may result from the use of this information. Below is a brief roundup of the economic outlook he shared on Twitter this morning. They might not "see" bond volatility breaking out ahead of Friday's Nonfarm Payroll jobs report or the fact that eight of this year's nine NFP reports have been negatively revised after the fact , but one week into December, the recession is becoming harder to ignore.

Hedgeye twitter

Hedgeye is an investment research and financial media company founded in Our core principles are transparency, accountability and trust. LEGALThe opinions expressed in Hedgeye Real Conversations are those of the individual speaking and not of Hedgeye, and should not be construed as specific investment advice. All Hedegye Real Conversations are the intellectual property of Hedgeye. All rights reserved. For more information, and to subscribe, go to www.

Holden beach oceanfront rentals with pool

Communications Pro boils down a universe of tickers into top investment ideas that include, but are not limited to:. Continue Browsing. Thank You! Hedgeye's real-time alerts also omit details — dividends, trading commissions, capital-gains taxes — from financial advice, Pirone points out. Blum mablum December 14, These exclusive intelligence sessions will provide a unique opportunity to hear from leaders of the Hedgeye research team directly. Rigorous top-down and bottom-up sector-level and individual stock analysis. I support anonymous followers who have principles. Pellegrino's firm filed the suit as of May 5, , but wouldn't comment on an ongoing case. People are really scheming to get… your money. I don't run a portfolio," McCullough noted. We revealed his identity. This isn't about women or wives — this is about two people defaming, lying, and deceiving While corroborating with a Nefarious thief! We didn't publish his residential address history which we have.

The information contained herein is the property of Hedgeye, which reserves all rights thereto.

Email Twitter icon A stylized bird with an open mouth, tweeting. Access to a growing video library of current and new best idea presentations, updated three to four times each quarter. Suddenly, McCullough doesn't seem to want to talk about it. Toggle menu. On the other hand, if you short often, as McCullough seems to encourage, paying dividends can gouge profits. And as a result, the company has lost subscribers and money. Behind Hedgeye Communications Pro. McCullough is a former hedge-funder — as you can read in his book " Diary of a Hedge Fund Manager " — but Hedgeye doesn't run any money. Latest Macro. I don't run a portfolio," McCullough noted. It is and has been my public trading journal and my research which I have spent many hours to collect and arrange in hopes of helping traders in the bear market from an educational point of view. Toggle categories.

It is interesting. Tell to me, please - where I can find more information on this question?