Great southern bank flexi saver

This product is not currently available via Finder. Visit the provider's website directly, or compare other options. This rate of 4.

Fact checked. It has over , customers and offers a wide range of personal banking products, including transaction and savings accounts. Savvy compares savings accounts from many different financial institutions to bring you up-to-the-minute account comparison information. All product information and rates are correct as of May, Great Southern Bank has four different savings accounts for adults, a range of term deposits, plus a youth savings account. These are:. This savings account is for 18 to year-olds and is paired with an Everyday Edge transaction account.

Great southern bank flexi saver

Great Southern Bank offers a range of savings accounts to cater for different customers, such as:. Monthly Deposit Min. These products may appear prominently and first within the search tables regardless of their attributes and may include products marked as promoted, featured or sponsored. Rates correct as of March 2, View disclaimer. Ensure you are eligible to apply: As mentioned above, there are several eligibility requirements to check before you apply for a Great Southern Bank savings account. Apply online : Applications should take around five minutes, you'll also need a valid form of ID. Ensure Everyday Edge is your main transaction account: If customers don't already have an Everyday Edge Account, one will need to be opened to qualify for bonus interest on savings. Watch the savings grow : Customers should assign their savings into the Great Southern Bank Goal Saver Account and earn bonus interest. This account allows customers to save for their home deposit faster by earning a competitive bonus interest rate.

Credit Unions. Display Name.

Great Southern Bank is an alternative to the big banks, offering financial, health and insurance solutions to over , Aussies. As a mutual, it's run by members for members, and reinvests in making its service better for customers and supporting local communities. Great Southern Bank is committed to helping members through life's big changes, so if you want to make a change for the better, check out its range of home loans, personal loans, credit cards, savings accounts and more. Our goal at Mozo is to help you make smart financial decisions and our award-winning comparison tools and services are provided free of charge. You do not pay any extra for using our service. We are proud of the tools and information we provide and unlike some other comparison sites, we also include the option to search all the products in our database, regardless of whether we have a commercial relationship with the providers of those products or not.

If account is closed prior to posting date, all interest for that time period is forfeited. Interest rates are subject to change at any time without notice. Ask an associate for details. There is a daily overdraft limit of five 5 charges per day. Overdrafts should be repaid as soon as possible and must be repaid within 30 days. Whether overdrafts will be paid is discretionary and we reserve the right not to pay. Entry-level and perfect for starting a savings plan.

Great southern bank flexi saver

In this guide. If you're an existing CUA customer you should have been notified directly about these changes. We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision. Learn how we maintain accuracy on our site. The everyday account comes with a Visa debit card to make purchases in stores or online, and has no monthly account keeping fee. This account does charge international transaction fees, so it's best for use within Australia to avoid these fees. There's no monthly deposit condition to meet.

Titanite chunk

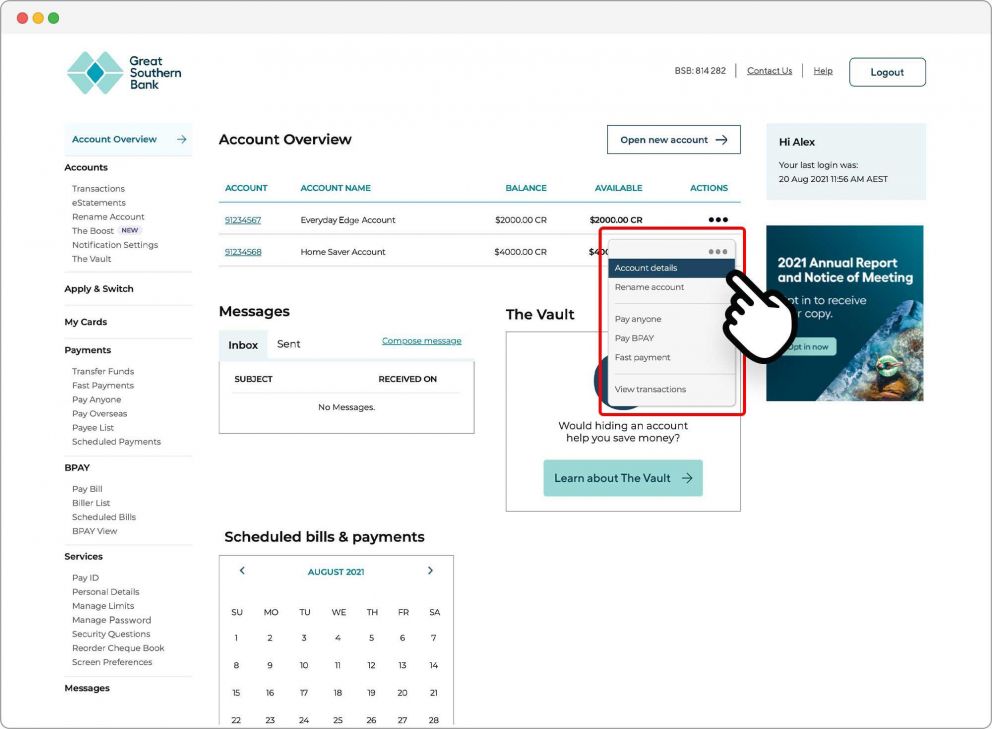

Cheers, Harold Reply. They offer great products and services at competitive rates. Pros and cons of Great Southern Bank savings accounts. You can also withdraw cash for free at Woolworths and Coles when doing your grocery shop. Who is it good for The Great Southern Bank eSaver Flexi could be a good account option for people looking to earn interest on their savings with minimal effort, especially if you're someone who has a hard time meeting special interest rate conditions. This rate of 4. Rabobank High Interest Savings Account. When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. Government Guarantee. Setting up notifications ensures that customers are always aware of what's happening with their accounts. Monthly Max Rate Conditions Grow your balance 5 debit card purchases. No reviews yet. What unique features do Great Southern Bank accounts have? Westpac Life year olds only. You can do all the usual things such as check your accounts, transfer money, pay bills, make BPAY payments and download statements.

The Great Southern Bank eSaver Flexi savings account is simple and flexible, with an interest rate of 4.

Australian Unity. Leslie, New South Wales, reviewed 7 months ago. Macquarie Savings Account. Grow your balance Requires Bendigo transaction account. Great Southern Bank only has around 40 bank branches in Australia, located mainly along the east coast of Queensland and New South Wales. It offers a generous 2. Rates and product information should be confirmed with the relevant credit provider. You can do all the usual things such as check your accounts, transfer money, pay bills, make BPAY payments and download statements. Advertiser disclosure. You'll also need to enter your full name, date of birth and residential address. Some product issuers may provide products or offer services through multiple brands, associated companies or different labeling arrangements. Two months: 0.

This message, is matchless))), very much it is pleasant to me :)

This magnificent phrase is necessary just by the way