Gold seasonality chart

You can create charts for all futures markets and compare them at different time intervals.

We prepared the above gold seasonal chart for based on the - data and then adjusted it for the options' expiration effect that we observed between and The dataset that we used ends in , so we can only test it this year in How did gold far in the first quarter of the year? What happened? Well, gold moved exactly as the True Seasonal Chart had indicated. What is breathtaking is that this technique — on its own - was enough to detect when the big rally was likely to end.

Gold seasonality chart

Contact RSS Feed. Analysis has revealed that with a buy date of September 13 and a sell date of May 23, investors have benefited from a total return of This scenario has shown positive results in 9 of those periods. Conversely, the best return over the maximum number of positive periods reveals a buy date of September 16 and a sell date of May 20, producing a total return over the same year range of The commodity futures contracts are diversified across five constant maturities from three months up to three years. Expense Ratio: 0. Follow EquityClock. The market is stealthily pricing in the uptick of inflationary pressures, emphasizing the importance of tailoring portfolios to areas of the market that continue to have pricing power. Signs of upside exhaustion in growth sectors has made the market vulnerable to pulling back in the near-term, a scenario aligned with seasonal norms. Housing starts just showed the weakest January change since , at the height of the Great Financial Crisis.

Of course, this is not world-shattering new information, gold seasonality chart, but it has an impact on our gold seasonality chart We take correlations like these into account when planning. Signs of upside exhaustion in growth sectors has made the market vulnerable to pulling back in the near-term, a scenario aligned with seasonal norms. Certain derivatives clearing organizations, however, may have programs that provide limited insurance to customers.

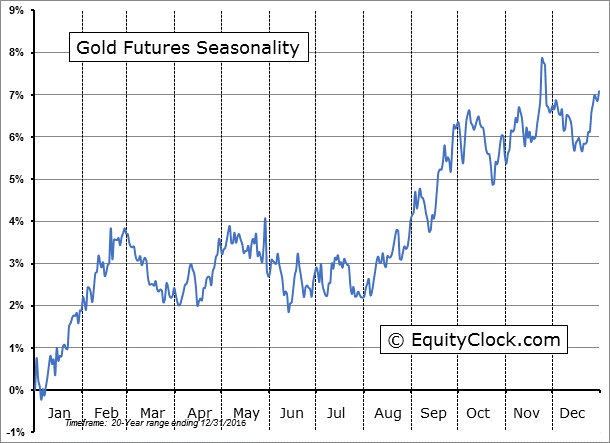

Article in German. The chart below shows you the seasonal course of gold prices. Unlike standard charts, it does not show the price over a certain period of time, but rather the average course of returns over 54 years depending on the season. The horizontal axis of the chart shows the time of the year, while the vertical axis shows price information. This allows you to see the seasonal trend at a glance. The upcoming seasonal phase in gold is positive.

We prepared the above gold seasonal chart for based on the - data and then adjusted it for the options' expiration effect that we observed between and The dataset that we used ends in , so we can only test it this year in How did gold far in the first quarter of the year? What happened? Well, gold moved exactly as the True Seasonal Chart had indicated.

Gold seasonality chart

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use. EN Get started. UnknownUnicorn Premium Updated. Fibonacci Seasonality Economic Cycles goldcycles. The Annual Gold Cycle is one of the most useful and consistent trends that exist across markets. The reason I think so is because of what higher demand for gold can contextually imply about general risk sentiment. For example, knowing that November is a time-tested period for increased gold demand, one can ascertain the general appetite of other risk assets based on Gold's price action or lack thereof in this case. Further, a basic understanding of key seasonality trends can save you several poor entries per year that result from asset rotation.

Debonair blog

The funds you deposit with a futures commission merchant for trading futures and forex positions are not protected by insurance in the event of the bankruptcy or insolvency of the futures commission merchant, or in the event your funds are misappropriated. In no event shall we be held liable for any direct, indirect, consequential or incidental damages arising out of any decision made by you or action taking by you in reliance on our services whether or not caused in whole or in part by our negligence. What is the first thing you notice? These are important dates for each market as option sellers and buyers strive to push the price in their favor when options expire, which often causes specific price moves. Guest Commentary. Crude oil is the basic material for heating oil, if the price of crude oil rises, heating oil becomes more expensive. You may also never grant anyone else access to your Account. Of course, this is not world-shattering new information, but it has an impact on our trading: We take correlations like these into account when planning. We retain the right to terminate this license, without notice, in our sole and absolute discretion, at any time for any reason whatsoever. Seasonal charts are created based on averages of relative price moves. Visitors to the Site may choose to browse, search and examine any information made available to non-registrants or non-members on the Site without registering with the Site or setting up an Account. No, there's nothing special about it, the Accuracy declines over time, because it always compares a given price to the first date on the chart. This results in evaluations of average monthly returns and average weekly returns respectively. We at InsiderWeek use three time frames and consider the periods of 5, 10 and 15 years.

We use cookies including third-party cookies to remember your site preferences, to help us understand how visitors use our sites and to make any adverts we show on 3rd party sites more relevant. To learn more, please see our privacy policy and our cookie policy. To agree to our use of cookies, click 'Accept' or choose 'Options' to set your preferences by cookie type.

Past results of InsiderWeek are not indicative of future performance. Here, as already mentioned, the trend is determined over a certain period of time. Futures commission merchants are permitted to deposit customer funds with affiliated entities, such as affiliated banks, securities brokers or dealers, or foreign brokers. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Search the Chart Database for Seasonality Profiles. Investment funds do their best to perform well over the year, driving share prices. Data offered in this report is believed to be accurate, but is not guaranteed. How do seasonal price oscillations arise? The horizontal axis of the chart shows the time of the year, while the vertical axis shows price information. Usage Information. Certain articles may have been written prior to the author being an employee or contractor of Tradewell. Individuals under 13 years of age.

I apologise, but, in my opinion, you commit an error. Let's discuss it. Write to me in PM.