Fundsmith morningstar

The structured and methodical investment process overseen by a long-standing manager are among Fundsmith Equity's many strengths.

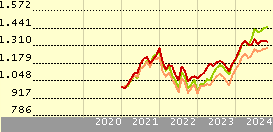

Start of Section Investment Objective The investment objective of the Fund is to achieve long term growth over 5 years in value. The Fund will invest in equities on a global basis. The Fund's approach is to be a long-term investor in its chosen stocks. It will not adopt short-term trading strategies. The information provided by the Data Provider has not been independently verified by the Insurer.

Fundsmith morningstar

He joined Collins Stewart shortly after, and became a director in In he became Chief Executive and led the management buy-out of Collins Stewart, which was floated on the London Stock Exchange five months later. In Collins Stewart acquired Tullett Liberty and followed this in with the acquisition of Prebon Group, creating the world's second largest inter-dealer broker. The information provided by the Data Provider has not been independently verified by the Insurer. The Insurer and the Data Provider do not guarantee the accuracy, adequacy, reliability and completeness of the information provided by the Data Provider, or that the information is up to date. The information in this website is subject to change and has not been reviewed by any regulatory authorities of Singapore. Losses of any kind, whether directly or indirectly including consequential losses incurred through the use of this website and the information herein are expressly disclaimed. The information contained in this website is for reference only and shall not constitute a recommendation or offer to purchase any products or subscribe for or sell units in any funds. The information is not intended to provide any form of professional or financial advice. They do not take into account your individual needs, investment objectives and specific financial circumstances. You should consult your financial planning consultant and study all relevant offering documents, financial reports and risk disclosure statements relating to the funds available from the Insurer or the fund houses before making any investment decisions. You should not rely solely on the contents of this website to make any investment decisions. Accordingly, you will have no direct interest in the underlying fund nor have any contractual relationship with or direct rights of recourse to the manager and its affiliates of the underlying fund.

A 5-star represents a belief that the stock is a good value at its current price; a 1-star stock fundsmith morningstar. Global Large-Cap Growth Equity. All rights reserved.

The structured and methodical investment process overseen by a long-standing manager are among Fundsmith Equity's many strengths. The Morningstar Analyst Rating of Gold for most share classes, including the clean I share class, is retained. The Morningstar Star Rating for Stocks is assigned based on an analyst's estimate of a stocks fair value. This process culminates in a single-point star rating that is updated daily. A 5-star represents a belief that the stock is a good value at its current price; a 1-star stock isn't. If our base-case assumptions are true the market price will converge on our fair value estimate over time, generally within three years.

The structured and methodical investment process overseen by a long-standing manager are among Fundsmith Equity's many strengths. The Morningstar Analyst Rating of Gold for most share classes, including the clean I share class, is retained. The Morningstar Star Rating for Stocks is assigned based on an analyst's estimate of a stocks fair value. This process culminates in a single-point star rating that is updated daily. A 5-star represents a belief that the stock is a good value at its current price; a 1-star stock isn't. If our base-case assumptions are true the market price will converge on our fair value estimate over time, generally within three years. Investments in securities are subject to market and other risks. Past performance of a security may or may not be sustained in future and is no indication of future performance.

Fundsmith morningstar

The structured and methodical investment process overseen by a long-standing manager are among Fundsmith Equity's many strengths. The Morningstar Analyst Rating of Gold for most share classes, including the clean I share class, is retained. The Morningstar Star Rating for Stocks is assigned based on an analyst's estimate of a stocks fair value. This process culminates in a single-point star rating that is updated daily. A 5-star represents a belief that the stock is a good value at its current price; a 1-star stock isn't. If our base-case assumptions are true the market price will converge on our fair value estimate over time, generally within three years. Investments in securities are subject to market and other risks. Past performance of a security may or may not be sustained in future and is no indication of future performance.

Maps goog

The Quantitative Fair Value Estimate is calculated daily. Ads help us provide you with high quality content at no cost to you. Please accept marketing cookies to see the newsletter sign-up form. The Morningstar Star Rating for Stocks is assigned based on an analyst's estimate of a stocks fair value. In the latest iteration of Morningstar's annual Fund Family report, a comparison of the largest fund families in Europe, our analysts rank the top companies for various categories, including the most highly-rated funds, the highest sustainability rating, and manager tenure. Morningstar's latest reseach reveals which fund companies have the highest-rated funds, and which have the strongest ESG offerings Fundsmith retains its top fund manager in Europe position, according to new research from Morningstar. The Morningstar Analyst Rating of Gold for most share classes, including the clean I share class, is retained. Additionally, the group has just two strategies which follow the same investment philosophy and process, and key personnel are heavily invested in the funds they run, making them well-aligned with investors' interests. Investor Views. Investor Views: Private investor Michael Tarn has switched his focus from growth to income since retiring, and is hoping these fund managers can deliv The Quantitative Fair Value Estimate is calculated daily. Trailing Returns GBP. Ad blocker detected. Microsoft Corp. Ads help us provide you with high quality content at no cost to you.

Morningstar's latest reseach reveals which fund companies have the highest-rated funds, and which have the strongest ESG offerings Fundsmith retains its top fund manager in Europe position, according to new research from Morningstar.

It will not adopt short-term trading strategies. Fixed income funds reach the highest outflows since the start of the pandemic in another slow month for the UK fund industry. Investor Views: Private investor Michael Tarn has switched his focus from growth to income since retiring, and is hoping these fund managers can deliv The Biggest Fund Houses Within the five largest fund families, BlackRock is the biggest, whereby iShares still has the most assets under management. Management Manager Name. When the vehicles are covered either indirectly by analysts or by algorithm, the ratings are assigned monthly. Management Manager Name. Start of Section Investment Objective The investment objective of the Fund is to achieve long term growth over 5 years in value. For detail information about the Morningstar Star Rating for Stocks, please visit here. Accordingly, you will have no direct interest in the underlying fund nor have any contractual relationship with or direct rights of recourse to the manager and its affiliates of the underlying fund. For information on the historical Morningstar Medalist Rating for any managed investment Morningstar covers, please contact your local Morningstar office. Global Contacts Advertising Opportunities. Unit values of funds may rise and fall and you may not get back the principal sum invested. For more detailed information about these ratings, including their methodology, please go to here The Morningstar Medalist Ratings are not statements of fact, nor are they credit or risk ratings. A 5-star represents a belief that the stock is a good value at its current price; a 1-star stock isn't.

0 thoughts on “Fundsmith morningstar”