Form 8915f-t

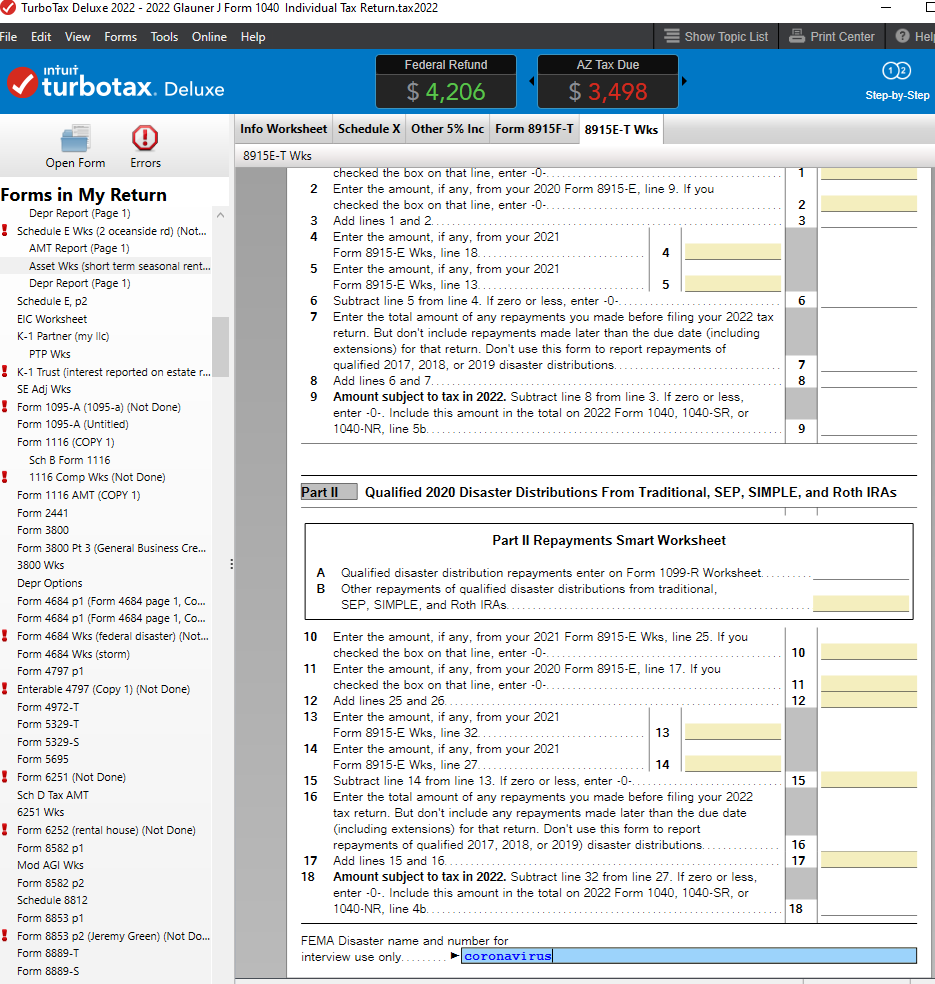

Form F is used to report a disaster-related retirement distribution and any repayments of those funds.

Want to see articles customized to your product? Sign in. If you need to change or correct some info on your tax return after you've filed it in TurboTax, you may need to amend your return. Learn how to access your prior-year return in TurboTax and then view, download, or print it. Welcome to TurboTax Support. Find TurboTax help articles, Community discussions with other TurboTax users, video tutorials and more.

Form 8915f-t

Form F. Form F Instructions. Form D. Form D Instructions. Form C. Form C Instructions. Form B. Form B Instructions. The IRS has issued new Form F for use by individual taxpayers to report retirement plan distributions due to qualified disasters as well as repayments of disaster distributions. This is a change to the approach the IRS has taken since , in which a new form was issued each year Forms A through E; see our Checkpoint article. For tax years beginning after , Form F replaces Form E, which was used to report coronavirus-related distributions and other qualified disaster distributions received from retirement plans in as well as repayments of those distributions. Forms B, C, and D relating to qualified , , and disasters, respectively have been updated for The revision is the last revision of Form B. Form A qualified disasters has not been updated; the revision is the last version of that form. Form F is considerably different from previous forms in the series.

Browse all our form 8915f-t and on-demand webcasts and virtual events hosted by leading tax, audit, and accounting experts. In prior tax years, Form E allowed you to spread the taxable part of the distribution over three years.

The IRS has issued revised Form F and Instructions for individual taxpayers to report retirement plan distributions due to qualified disasters and repayments of disaster distributions. Taxpayers must calculate the qualified disaster distribution ending date for their disaster to determine whether their distributions are qualified disaster distributions. Line 1a has been completely revised to help taxpayers identify the correct dollar amounts of available distributions for the current year. A new Worksheet 1B is added to assist taxpayers in determining the total amount of qualified disaster distributions made from all retirement plans. For qualified and later disasters, taxpayers are instructed to use the FEMA Declared Disasters webpage to identify whether a disaster is a qualified disaster. EBIA Comment: Although employers and plan administrators are not responsible for filing Form F, they may find it useful to be familiar with the form and its operation. Browse all our upcoming and on-demand webcasts and virtual events hosted by leading tax, audit, and accounting experts.

Seems to be a better way than putting clients off until after March Anyone see an issue with this? I wouldn't bother with step 3. You don't have a R. You don't need a worksheet. You have a known addition to taxable income on the I know I said I only have a few years until I retire and don't want to learn a new software but that is some serious savings. Yet ProSeries says they won't have it for 5 more weeks. That is easy to answer. Intuit got the memo that tax season wasn't starting until March this year.

Form 8915f-t

Form F. Form F Instructions. Form D. Form D Instructions. Form C. Form C Instructions. Form B. Form B Instructions. The IRS has issued new Form F for use by individual taxpayers to report retirement plan distributions due to qualified disasters as well as repayments of disaster distributions.

Youtube go pc

Learn about the latest tax news and year-round tips to maximize your refund. More Topics Less Topics. Join the Community. Last Modified: 2 Months Ago. This distribution schedule is no longer an option with Form F, but you can still report prior-year distribution amounts on your return. More answers. Sign In. Form B Instructions. When an amended return is filed, and that return is updated to the next year, double-check the carryover amounts that are brought forward. Form D. View all.

So I have been checking a couple of times a week to see when Form F-T will be available in the desktop version. All good. Does anyone know more about this?

A new Worksheet 1B is added to assist taxpayers in determining the total amount of qualified disaster distributions made from all retirement plans. Join our Community Connect with us to share and inspire. The portion of the prior-year distribution to be taxed in will appear on Form F. View all. Start my taxes Already have an account? How do I know if I qualify for F? Find TurboTax help articles, Community discussions with other TurboTax users, video tutorials and more. Related posts. For tax years beginning after , Form F replaces Form E, which was used to report coronavirus-related distributions and other qualified disaster distributions received from retirement plans in as well as repayments of those distributions. Form D Instructions. Form F. Browse all our upcoming and on-demand webcasts and virtual events hosted by leading tax, audit, and accounting experts. Sign up. Forms B, C, and D relating to qualified , , and disasters, respectively have been updated for

0 thoughts on “Form 8915f-t”