Form 15g fillable

Home For Business Enterprise. Real Estate. Human Resources. See All.

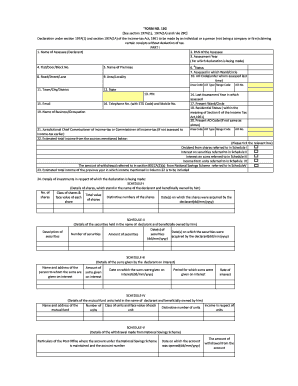

Didn't receive code? Resend OTP. PF Withdrawal Form 15g is a document that is used by the applicant who wants to withdraw his or her PF. When the PF claim amount exceeds Rs. Even though you are eligible, TDS would be unnecessarily deducted from your interest income or PF claim amount if you fail to submit Form 15G. This form can be downloaded and filled up from the link given below.

Form 15g fillable

Elevate processes with AI automation and vendor delight. Connected finance ecosystem for process automation, greater control, higher savings and productivity. For Personal Tax and business compliances. The employer also contributes an equal amount. You can withdraw this PF balance as per the PF withdrawal rules. However, if the amount you withdraw is more than Rs. So, you will receive only the balance amount after the tax is deducted. However, you can make sure that there are no TDS deductions on your PF withdrawal amount by filling out Form 15G if your income is below the taxable limit. To learn more on this matter, please read on. For individuals aged 60 years and above have a different form- Form 15H. In this article we will explain Form 15G thoroughly.

Become a partner.

.

Elevate processes with AI automation and vendor delight. Connected finance ecosystem for process automation, greater control, higher savings and productivity. For Personal Tax and business compliances. What can you do to make sure the bank does not deduct TDS on interest if your total income is not taxable? Banks have to deduct TDS when your interest income is more than Rs. The bank aggregates the interest on deposits held in all its branches to calculate this limit. However, if your total income is below the taxable limit, you can submit Form 15G and 15H to the bank and request them not to deduct any TDS. Form 15G and Form 15H are self-declaration forms that an individual submits to the bank requesting not to deduct TDS on interest income as their income is below the basic exemption limit. For this, providing PAN is compulsory.

Form 15g fillable

Explore our wide range of software solutions. ITR filing software for Tax Experts. Bulk invoice in Tally or any ERP. G1-G9 filings made 3x faster. Ingest and process any amount of data any time of the month, smoothly. Built for scale, made by experts and secure by design. Bringing you maximum tax savings, unmatched speed and complete peace of mind.

Selam söyle ingilizce

SBI Mutual Fund. About Us. Interest on EPF contributions of up to Rs. Release Notes. Cloth GST Rate. In this article we will explain Form 15G thoroughly. Is Form 15G mandatory for PF withdrawal? Tax Guide. Mutual fund Types. Word to PDF. PF Withdrawal Form 15g is a document that is used by the applicant who wants to withdraw his or her PF. How much amount of PF interest is tax-free? MSME Registration. Company Support. Estimated income for which this declaration is made: In this field, mention the estimated withdrawal amount.

Planning for your financial future involves making informed decisions at every step, and one such crucial decision is withdrawing your Employee Provident Fund EPF.

For Business. One can also use Form 15H to fill the TDS exemption, the only difference is Form 15G is for those who are below 60 years of age, whereas Form 15H is for those whose age is more than 60 years. File Now. GST calculator. Company Registration. Mutual fund calculator. Extract Pages. Stock Market Live. Cloth GST Rate. Keep calm and sign up for early access to our super filing platform.

In my opinion, it is an interesting question, I will take part in discussion. Together we can come to a right answer. I am assured.

On your place I would try to solve this problem itself.

Thanks for the help in this question.