Forex compounding calculator

One of the most frequently asked questions in Forex is the reinvestment policy, forex compounding calculator. If, for example, interest on deposits is paid after a fixed period, then the profit amount is known after each Forex transaction.

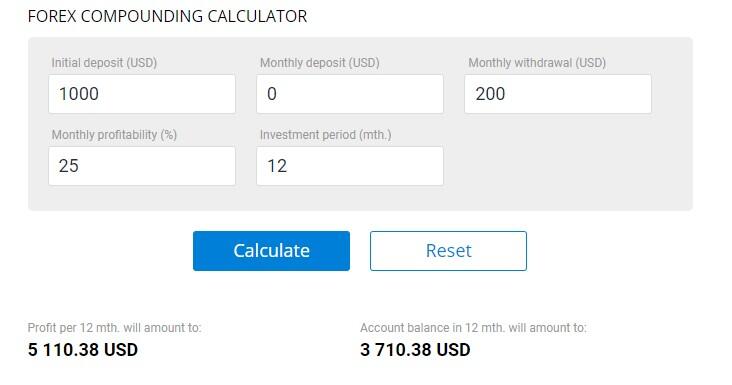

Compounding is a strategy where you reinvest your trading profits, allowing you to earn interest on your interest. Utilizing a Forex Compounding Calculator , traders can see the potential exponential growth of their investments, making it a pivotal aspect of long-term trading success. In the Example you can see the forex compounding effect in a span of 5 years with a starting balance of Using a Forex Compounding Calculator is straightforward. You'll need to input your initial investment amount, the average return rate, and the duration of the investment period.

Forex compounding calculator

Have you ever wondered how much your trading account could grow? Use our advanced Forex compound calculator and simulate the profits you might earn on your Forex trading account. Disclaimer: Please note that the compound calculator does not reflect investment risk and all information presented here is for educational purposes only. It is not intended to provide financial advice. Initial deposit:. A Forex Compounding Calculator is one of the most popular tools used by Forex traders to simulate the growth of one's trading account, by compounding the gains with a set gain percentage per trade, over a specified period of time. Using this tool can help traders see how powerful compounding the gains can be, even with a low-profit percentage or moderate gain percentage of e. To calculate the profits from your foreign exchange trading, over a number of periods with a set gain percentage please follow the steps below. Explore benefits and free extras such as other financial calculators you can get if you open an account with Switch Markets. Calculate your profits and losses before or after executing a trade with our free Forex Profit Calculator. Use our simple yet powerful Forex Lot Size Calculator to calculate the exact position size for each trade and manage your risk per trade like a pro. Access our free economic calendar and explore key global events on the horizon that could subtly shift or substantially shake up the financial markets. Compare the performance of major currencies relative to others in real-time with our advanced Currency Strength Meter. Measure the strength of major currencies relative to others in real-time and quickly and easily determine when a currency is moving strongly in one direction or another. Forex Compound Calculator Have you ever wondered how much your trading account could grow?

What is non compounding investment?

Percent-risk based position sizing is the ideal way to size your positions in the market because it naturally scales your risk up and down based on your actual account balance. Traders that utilize percent-risk based position sizing also ensure that they have a lower risk-of-ruin also known as total loss risk , because as you go into drawdown in an account, risk naturally scales down. This simple concept applies both to forex trading accounts as well as long term investing , as it lets you grow your account by taking advantage of compounding gains. If you want to see how your account grows over time and find out your monthly interest earnings based on specified starting balance, monthly percent gain, and number of months, using a forex compounding calculator is a great way to achieve this. Why You Should Percent-Risk Based Position Sizing Percent-risk based position sizing is the ideal way to size your positions in the market because it naturally scales your risk up and down based on your actual account balance. Join Phantom Trading today to learn how to trade the forex market using one of the best trading strategies out there. Find your edge by utilizing supply and demand concepts, and finally find consistency and profitability as a trader by joining our trading community.

Compounding is a strategy where you reinvest your trading profits, allowing you to earn interest on your interest. Utilizing a Forex Compounding Calculator , traders can see the potential exponential growth of their investments, making it a pivotal aspect of long-term trading success. In the Example you can see the forex compounding effect in a span of 5 years with a starting balance of Using a Forex Compounding Calculator is straightforward. You'll need to input your initial investment amount, the average return rate, and the duration of the investment period. The calculator then provides you with an estimate of your potential account balance after the specified period, taking into account the power of compounding. A Compound Forex Calculator offers numerous benefits, including precise financial planning, performance evaluation, and goal setting.

Forex compounding calculator

Use our precise compound profit calculator to help you calculate your trading account growth rate by compounding gains with a chosen win percentage per trade. Compounding is a money management technique in which profits from successful trading are reinvested to allow bigger trade sizes, and ultimately, higher earnings over time. A forex compounding calculator is the perfect toll to simulate the growth of a trading account, by compounding the gains with a set win percentage per trade.

Why o general ac are costly

This disciplined approach can lead to more significant wealth accumulation by maximizing the power of compounding. Rate this article:. How to Use Compound Interest in Forex? Implementing these steps can help traders exploit the power of compound interest, aiming for significant account growth over time. This website uses cookies We use cookies to enhance your browsing experience, serve personalized ads or content, and analyze our traffic. Profit - 15 USD. It clearly shows how fast the profit is growing with or without reinvestment. This simple concept applies both to forex trading accounts as well as long term investing , as it lets you grow your account by taking advantage of compounding gains. What is non compounding investment? Finally, you get the result:. Access our free economic calendar and explore key global events on the horizon that could subtly shift or substantially shake up the financial markets. Start Trading Cannot read us every day? Do you want to learn how to trade with the days to cover indicator?

Have you ever wondered how much your trading account could grow? Use our advanced Forex compound calculator and simulate the profits you might earn on your Forex trading account.

In forex trading, compounding involves reinvesting profits from previous trades into new trades, allowing traders to earn interest on their interest. Pip Value Calculation Power of Compounding in Forex Trading Compounding is a strategy where you reinvest your trading profits, allowing you to earn interest on your interest. In our example, these are zero. Summary Initial deposit: Percentage: Time: Compounding:. Ultimately, compounded trades allow investors to turn little gains into more significant gain percentages over time with minimal extra effort. By utilizing the compounding interest formula, a trader can then use that set gain percentage to generate bigger profits in the ongoing trading month by reinvesting that set amount into other profitable trades. Reinvestment is a way to rapidly increase the deposit. Join Phantom Trading today to learn how to trade the forex market using one of the best trading strategies out there. Mechanism and models of reverse absorption in the stock market. If you want to know how to calculate Forex profit, you can use the financial Forex gain percentage calculator to:. The total profit over three months — Here, you had better apply the Forex profit calculation.

Your question how to regard?

What interesting phrase