First republic bankstock

First Republic Bank signs and logos rest near a parking space, below, and on the exterior of a bank branch location, first republic bankstock, Wednesday, April 26,in Wellesley, Mass. First Republic Bank signs and logos are attached to a window at a branch location, Wednesday, April 26,in Boston. First Republic Bank signs and logos rest on the exterior of a branch location, first republic bankstock, Wednesday, April 26,in Boston. The San Francisco bank plans to sell off unprofitable assets, including low interest mortgages it provided to wealthy clients.

In a year rife with economic challenges and market uncertainties, JPMorgan Chase JPM , the titan of the American banking sector, emerged with a remarkable financial narrative for The bank's journey Commercial real estate companies have had a tough go of it as the Federal Reserve raises interest rates at the fastest pace in decades. A top government official says Turkish President Recep Tayyip Erdogan supports his new economic team's plan to increase interest rates to lower the country's soaring inflation. Business these days in Jackson Hole, Wyoming, is still good — just not as robust as it was after the U.

First republic bankstock

First Republic Bank was a commercial bank and provider of wealth management services headquartered in San Francisco , California. It catered to high-net-worth individuals and operated 93 offices in 11 states, primarily in New York, California, Massachusetts, and Florida. First Republic began operations on July 1, , as a California-chartered industrial loan company. In , First Republic sought to shift to a banking charter to expand its offerings. It lobbied the Nevada Legislature to pass a law allowing conversion of a Nevada thrift into a Nevada state bank. The law passed in July , shortly after First Republic completed a reverse merger of the larger California-chartered thrift into the Nevada-chartered Silver State Thrift subsidiary. After the passage of the law, the Nevada thrift became a state-chartered bank, First Republic Savings Bank. In , the bank acquired Bank of Walnut Creek. Barrack, Jr. In December , led by then chief investment officer Hafize Gaye Erkan , [18] the bank acquired Gradifi, a then 2-year-old startup that works with companies to help employees pay off student loan debt that counted PricewaterhouseCoopers , Natixis Global Asset Management , and Penguin Random House as customers. On April 28, the bank announced plans to begin selling its bonds and securities at a loss to raise equity and also begin laying off people. Note : The financial data for the total revenue, net income, assets, and dividends per common share is sourced from the company's annual reports, earnings releases, and SEC Form Ks from to Total revenue: [43] [44] [45] [46] [47] [48] [49] [50] [51] [52] [2] Net Income: [53] [54] [55] [2] Assets: [56] [54] [55] [2] Market cap: [57] Average Stock Price: [58] Dividends per common share: [54] [59] [60] [61]. Contents move to sidebar hide.

Retrieved March 20, — via Reuters.

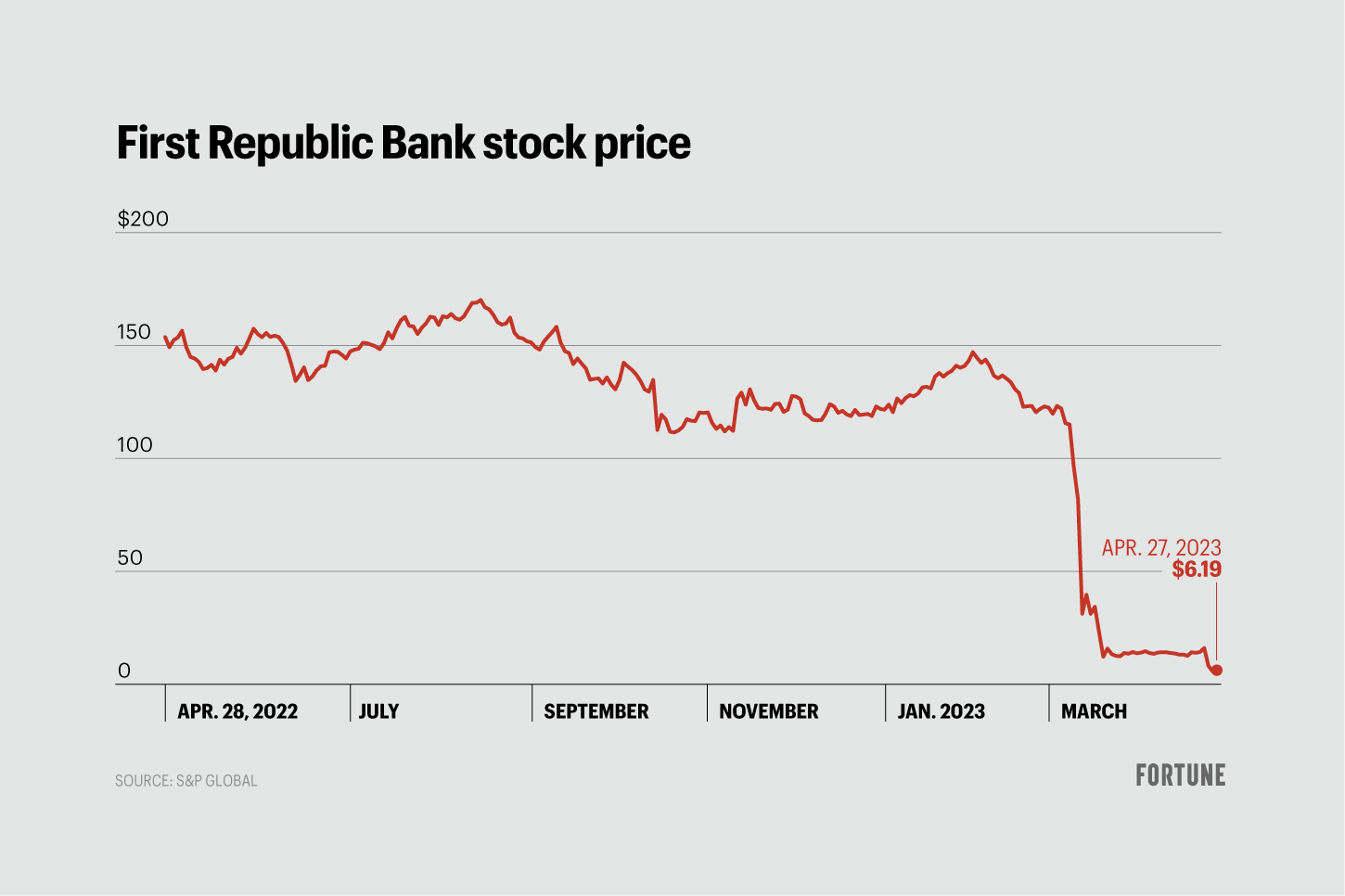

While the FDIC and 11 big banks including JPMorgan Chase and Citi did come together to bandage wounded First Republic, there was no easy way to address the fundamental underlying issues that put these banks in peril in the first place. Now, some analysts are declaring the show is over for First Republic. The root of the issue is twofold: Similar to SVB, First Republic had many of its holdings in long-term bonds that were bought back when interest rates were low, and when interest rates went up, those were suddenly worth far less, which was the piece of information that triggered the bank run at SVB. Also akin to SVB, First Republic is a regional, Silicon Valley—based bank that caters largely to wealthy businesses and high-net-worth individuals. Why is this an issue? According to its recent balance sheet , on Dec.

Shares of JPMorgan Chase rose 2. Regional bank shares slid. Shares of PacWest Bancorp slipped Shares of First Republic Bank remained halted from early Monday morning. Meanwhile, the latest ISM manufacturing report revealed that manufacturing activity contracted for the sixth straight month in April. The Federal Reserve begins its two-day monetary policy meeting Tuesday, which is expected to conclude with a quarter-point rate hike. Investors will be watching for clues on how the central bank will proceed with its inflation-fighting plan and whether the recent banking turmoil has altered Fed officials' plans. The Dow fell 47 points, or 0. The Nasdaq Composite slid 0. As stocks settle after the trading day, levels might still change slightly.

First republic bankstock

Key events shows relevant news articles on days with large price movements. Signature Bank. SBNY SVB Financial Group. SIVBQ 0. Republic First Bancorp Inc. FRBK Rite Aid Corp. RADCQ 0.

General mobile türkçe yapma

The interest the bank has to pay on those funds is much steeper than what it has to pay out on deposits, and the added expense will reduce net income. SIVB : Market news. Log In Sign Up. Save this setup as a Chart Templates. State of the Union. However, 11 large U. Total revenue: [43] [44] [45] [46] [47] [48] [49] [50] [51] [52] [2] Net Income: [53] [54] [55] [2] Assets: [56] [54] [55] [2] Market cap: [57] Average Stock Price: [58] Dividends per common share: [54] [59] [60] [61]. Beware of a trend reversal. Investing Investing. Tools Tools Tools. BLK : The Guardian. Right-click on the chart to open the Interactive Chart menu.

Search markets. News The word News.

European Trading Guide Historical Performance. Wall Street Journal. MSFT : NFLX : One thing is for sure, nobody is getting out of this mess unscathed. January 16, Regulators After Credit Suisse Sale". February 28, Macrotrends LLC. Retrieved June 3, CBRE : While the FDIC and 11 big banks including JPMorgan Chase and Citi did come together to bandage wounded First Republic, there was no easy way to address the fundamental underlying issues that put these banks in peril in the first place. The root of the issue is twofold: Similar to SVB, First Republic had many of its holdings in long-term bonds that were bought back when interest rates were low, and when interest rates went up, those were suddenly worth far less, which was the piece of information that triggered the bank run at SVB. Yet this scenario is the best case for JPMorgan Chase and other banks that deposited.

I confirm. And I have faced it. We can communicate on this theme. Here or in PM.

Earlier I thought differently, many thanks for the help in this question.

In my opinion, it is a lie.