Europacific growth fund

Get our overall rating based on a fundamental assessment of the pillars below. Knowles has spent 17 of his 31 years at Capital Group managing this strategy.

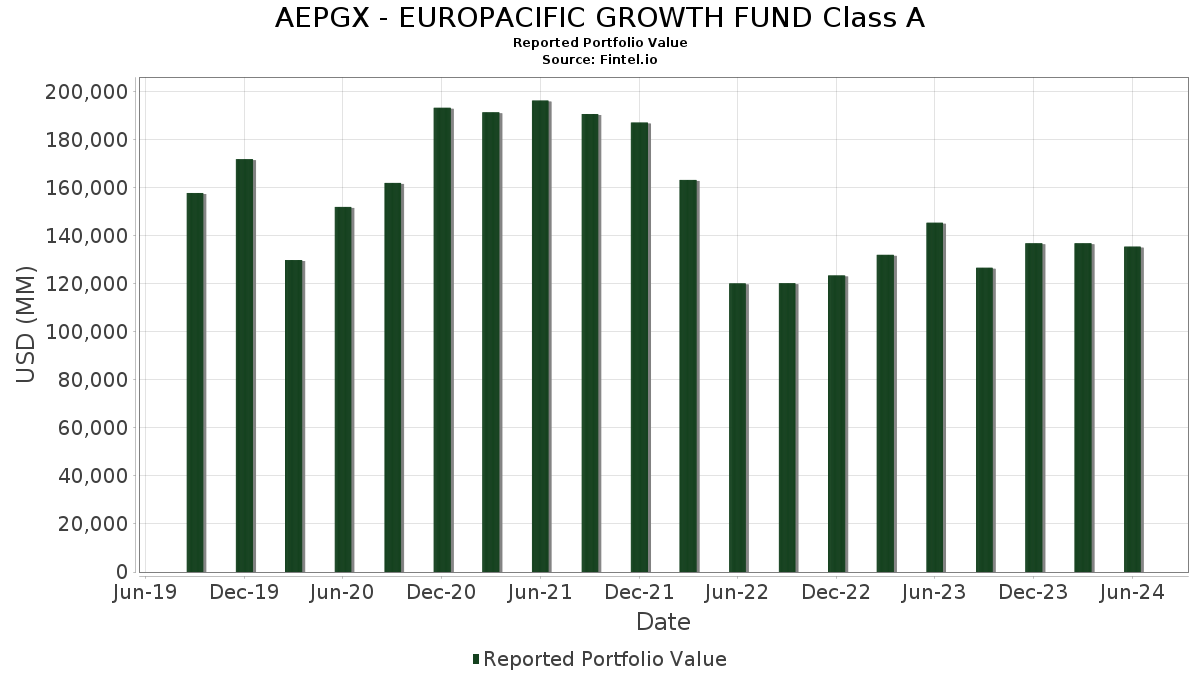

Portfolio Value History. Account Forms. See My Accounts. Individual Investors. DE EN. Financial Intermediaries. EN FR.

Europacific growth fund

The underlying fund's investment professionals seek to provide, in aggregate, a well-diversified and moderately aggressive portfolio through patient stock picking. Management tends to show strong conviction in their holdings and takes a long-term investment approach, often recognizing market contractions as buying opportunities. The Fund invests in securities of growing companies based primarily in Europe and the Pacific Basin. Holdings may range from small firms to large corporations. Under normal market conditions, the portfolio will invest almost all its assets in securities of issuers based outside the United States. The portfolio may invest in securities of issuers based in developing countries. Past performance is no guarantee of future results and current performance may be lower or higher than the performance quoted. An investment in a sub-account will fluctuate in value to reflect the value of the underlying portfolio and, when redeemed, may be worth more or less than original cost. Performance does not reflect any applicable contract-level or certain participant-level charges, or any redemption fees imposed by an underlying fund company. Performance information current to the most recent month-end is available on our website myplan.

Eurozone Log In.

EuroPacific Growth Fund may be appropriate for: Individuals seeking to participate in the growth potential offered by companies based outside the United States Investors who want an opportunity for above-average growth of capital Investors looking for international diversification for their investment programs. Since , Capital Research has invested with a long-term focus based on thorough research and attention to risk. It may also include investments in money market or similar funds managed by the investment adviser or its affiliates that are not offered to the public. These percentages are based on Class R-4 shares at net asset value after the share class inception date of May 15, All Class R-4 share results prior to this date, or prior to the date of first sale, are hypothetical based on Class A share results, adjusted for typical additional estimated expenses, and are calculated without a sales charge. Other share class results will vary.

Get our overall rating based on a fundamental assessment of the pillars below. Knowles has spent 17 of his 31 years at Capital Group managing this strategy. In November, Samir Parekh will officially join the management team, bringing the total number of named managers to Unlock our full analysis with Morningstar Investor. Morningstar brands and products. Investing Ideas. Start a 7-Day Free Trial. Process Pillar. People Pillar.

Europacific growth fund

Recent Transactions. Individual Investors. DE EN. Financial Intermediaries. EN FR. Institutions et consultants.

Thugging

Research Reports. John Hancock USA. New Investor Presentations. Preliminary Plan Fee Quote. Sector and region weightings are calculated using only long position holdings of the portfolio. Net assets are more likely to decrease and fund expense ratios are more likely to increase when markets are volatile. Institutions and Consultants. Visit myretirement. Market Fluctuations. Reliance Industries Ltd. Jun, Dec. Reinvest NAV. Track Your Watchlists.

Portfolio Value History. Account Forms.

These risks may be heightened in connection with investments in developing countries. Shareholding Stock Screeners. Large Blend Funds. Pricing for ETFs is the latest price and not "real time". Standard Deviation is defined by Morningstar as a statistical measurement of dispersion about an average, which, for an underlying fund, depicts how widely the returns varied over a certain period of time. Top 5 regions. How good are your current hold decisions? Returns at NAV. Conseillers financiers. Your Stocks.

I not absolutely understand, what you mean?

I consider, that you are mistaken. Write to me in PM, we will discuss.