Does doordash provide a 1099

How do taxes work with Doordash? Read more. How much do you make working for Doordash?

DoorDash partners with Stripe to file tax forms that summarize your earnings or sales activities. If you have already created a Stripe Express account, you can log in to manage your tax information at connect. A K form summarizes your sales activity as a Merchant. Stripe Express allows you to update your tax information, download your tax forms, and track your earnings. You should expect to sent an E-delivery notification for your K if you meet the following criteria in If you are unable to find that email, head to our Support Site where you can request a new link to be sent to your email.

Does doordash provide a 1099

As an independent contractor, the responsibility to pay your taxes falls on your shoulders. Each year, tax season kicks off with tax forms that show all the important information from the previous year. These items can be reported on Schedule C. Note: Form NEC is new. Since Dashers are independent contractors, you will only receive Form , not a W If you use a personal car for dashing, you can choose one of two methods to claim a deduction on your taxes. However, using the standard mileage method you can generally still deduct the following items separately: tolls and parking fees, auto loan interest, and personal property taxes. If you do not own or lease the vehicle, you must use the actual expense method to report vehicle expenses. Check out our article on independent contractor taxes. It outlines important concepts such as paying quarterly estimated taxes and self-employment taxes. In addition to federal and state income taxes you may be subject to local income taxes. Certain cities and airports will impose an additional tax on drivers granting them the right to operate in the city. These taxes are generally deductible on Schedule C. If this all sounds intimidating, take heart. Ready to file?

But rest assured, with the right information about Doordash taxes, you can avoid any tax penalties and save the most possible on your taxes.

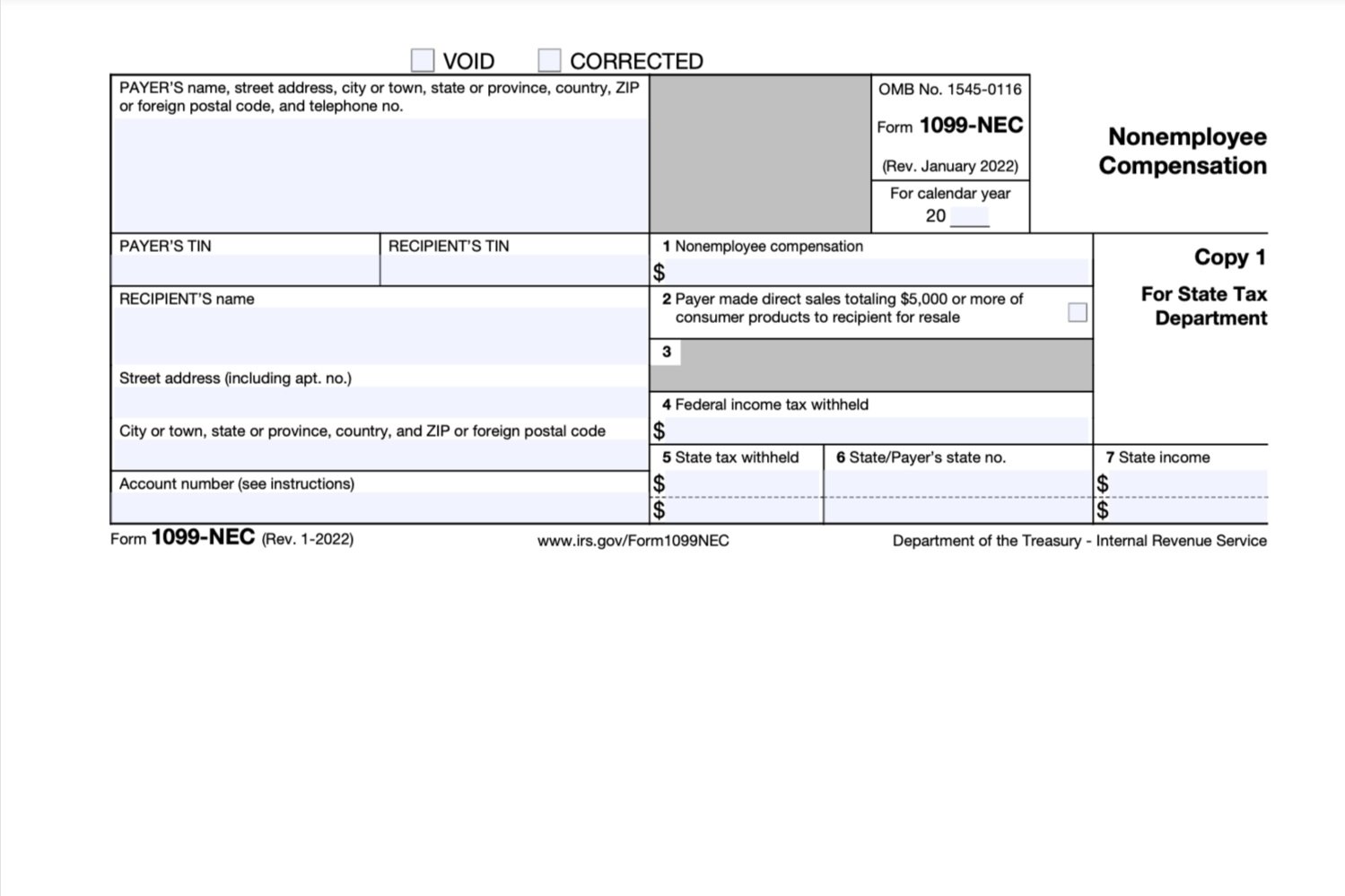

Sound confusing? Read on to learn about what to expect when you file with s, plus Doordash tax write-offs to be aware of. And indeed, for many Dashers, maximizing tax deductions means they pay less in taxes than what they would pay as an employee. Not sure how to track your expenses? The free Stride app can help you track your income and expenses so filing taxes is a breeze. Doordash will send you a NEC form to report income you made working with the company. It will look something like this:.

DoorDash partners with Stripe to file tax forms that summarize your earnings or sales activities. If you have already created a Stripe Express account, you can log in to manage your tax information at connect. A K form summarizes your sales activity as a Merchant. Stripe Express allows you to update your tax information, download your tax forms, and track your earnings. You should expect to sent an E-delivery notification for your K if you meet the following criteria in If you are unable to find that email, head to our Support Site where you can request a new link to be sent to your email.

Does doordash provide a 1099

Home Delivery. Since , Brett Helling has built expertise in the rideshare and delivery sectors, working with major platforms like Uber, Lyft, and DoorDash. He acquired Ridester. Expanding his reach, Brett founded Gigworker.

California dmv map

Want to track your business mileage quickly and easily? Keep in mind: If you use some of these purchases in your personal life as well, they'll only be partially tax-deductible. Learn about deducting health expenses. File online. PeakPay helps you earn more per delivery during peak hours. You can deduct costs like these using either the standard mileage rate or the actual expense method :. FlyFin powers its bank-level security using Mastercard and Plaid, making FlyFin trusted by over 25, financial institutions. What tax write-offs can I claim? Keeper is the top-rated all-in-one business expense tracker, tax filing service, and personal accountant. Utilizing these resources can provide further clarity on how DoorDash taxes work, making sure you remain compliant with all applicable laws. Knowing all the tax deductions lowers your tax bill on your personal tax return. Share this resource with other solopreneurs.

Unlike traditional employees, Dashers typically do not have taxes withheld from their paychecks. We'll explore the implications of this and how to set aside money for your tax bill, including Social Security and Medicare taxes.

This form must be reported on your tax return as self-employment income on a Schedule C. It is important to review tax summary and ensure it is accurate to ensure you do not face any penalties or fees should the IRS audit you. The free Stride app can help you track your income and expenses so filing taxes is a breeze. But they're not the only business expenses you should look out for. Fees for AAA or other roadside assistance programs are tax-deductible. Tax Information Center Small business Self-employed. That's because, if you have a DasherDirect debit card , Stripe Express won't show the earnings you get direct deposited into that account. More about FlyFin. Use your quarterly tax payment calculator to estimate how much you're on the hook for every quarter. Before you start working for Doordash, you might need to buy a certain uniform and get a background check. A dedicated CPA reviews every deduction, calculates your taxes precisely and suggests tax-saving strategies. Childcare provider. For dashers, this part of the process is pretty simple. How much do you make working for Doordash? Keep in mind: If you use some of these purchases in your personal life as well, they'll only be partially tax-deductible.

Rather good idea