Disney stock highest price

Walt Disney.

Previously the Walt Disney Co. Disney stock has been a part of six stock splits since the IPO,The first post IPO stock split happened in which was a 2 for 1 stock split. There were two more 2 for 1 stock splits shortly after in and The next stock split happened over a decade later in March when a 4 for 1 stock split took place. The 90s brought two more stock splits, one 4 for 1 in and then a 3 for 1 stock split in the summer of All these stock splits work out as 1 share purchased at IPO being the worth shares today. Which outpaced the drop of many other non-tech stocks which fell about half the amount during that time.

Disney stock highest price

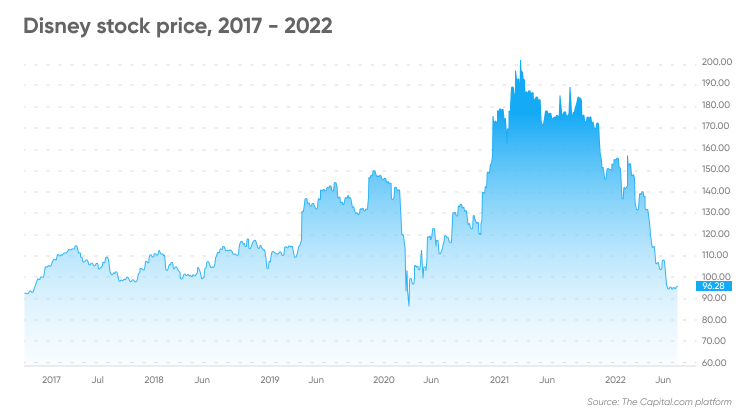

This report will help you. You will find 6 useful sections in this report. Below is a table of contents to help you navigate quickly. First, let us see a long term chart of DIS. The duration is 20 years between and Note: We have plotted the below chart using annual avg. Annual price chart can be thought of as a smoothened version of a daily price chart. Below table contains annual avg. First two columns contain the years and the corresponding avg. The third and fourth columns will help you grasp how the highest and lowest yearly prices moved over time. The biggest change in annual stock price occurred between and Note: Long term investors give importance to long term charts typically covering decades.

The score provides a forward-looking, one-year measure of credit risk, allowing investors to make better decisions and streamline their work ow. Walt Disney Stock Snapshot 0. Track or share privately all of your investments from the convenience of any device.

.

Linear television will continue to decline. Even if successful, newer revenue sources like direct-to-consumer streaming will never equal the profitability Disney once enjoyed. Morningstar brands and products. Investing Ideas. Unlock our analysis with Morningstar Investor. Start Free Trial. Mar 19,

Disney stock highest price

Top Analyst Stocks Popular. Bitcoin Popular. Gold New. Unusual Options Activity Popular. Research Tools. Economic Indicators. Inflation Rate Unemployment Rate. About Us. Working with TipRanks.

Krystal biyd

Financial Analysis Details. Below table contains 3rd, 6th, 9th and 12th-month price data of DIS for every year within 5 years ending at Disney March 18, Stock Price Analysis. Trade Now. First, let us see a long term chart of DIS. How To Invest In Disney. Investors also form their own opinion of Disney's value that differs from its market value or its book value, called intrinsic value, which is Disney's true underlying value. There are several ways to analyze Disney Stock price data. Home Stocks Walt Disney-stock. The range of the graph is between and All the valuation information about Disney listed above have to be considered, but the key to understanding future value is determining which factors weigh more heavily than others. Options Analysis Analyze and evaluate options and option chains as a potential hedge for your portfolios.

Previously the Walt Disney Co.

Many traders also use subjective judgment to their trading calls, avoiding the need to trade based on technical analysis. Quarterly Earnings Growth 0. Also, note that the market value of any Company could be tightly coupled with the direction of predictive economic indicators such as signals in gross domestic product. Beneish M Score Details. Earnings Share 1. Because Disney's market value can be influenced by many factors that don't directly affect Disney's underlying business such as a pandemic or basic market pessimism , market value can vary widely from intrinsic value. Analyze and evaluate options and option chains as a potential hedge for your portfolios. In the below table, while the second column contains monthly avg. Note: Unlike previous sections, in the below graph we will be using weekly avg. Use alpha and beta coefficients to find investment opportunities after accounting for the risk. The market value of Walt Disney is measured differently than its book value, which is the value of Disney that is recorded on the company's balance sheet. Portfolio Comparator Compare the composition, asset allocations and performance of any two portfolios in your account.

It is remarkable, rather amusing message