Dax 30 index weightings

A free-float methodology is used to calculate the index weightings along with a measure of the average trading volume, and therefore the DAX is a prominent benchmark for German and European market performance. Varying from other dax 30 index weightings, the DAX is updated with futures prices for the next day. The Dax lists major European companies and among their top performers are Airbus, Allianz and Adidas. Investing in the DAX provides an investor big boobed the opportunity to diversify their portfolio into global and European markets.

It is a total return index. Prices are taken from the Xetra trading venue. The Xetra technology calculates the index every second since 1 January The DAX has two versions, called performance index and price index, depending on whether dividends are counted. The performance index, which measures total return , is the more commonly quoted, however the price index is more similar to commonly quoted indexes in other countries.

Dax 30 index weightings

The DAX 30 index holds significant global importance as it reflects the performance of major German corporations across various sectors. It provides valuable insights into the overall health of the German economy. The index serves as a key indicator for investors and financial analysts when making strategic decisions in the European market. In this article, we learn everything about the index, including how to trade it. Deutsche Boerse the financial marketplace operating the Frankfurt Stock Exchange manages and calculates the index. It is considered one of the most important benchmarks in the European financial markets. Deutsche Boerse offers real-time prices for the selected stocks within the index. The index value is recalculated every second, and its composition follows a capitalization-weighted methodology. Companies in this index belong to various industries like pharmaceuticals, consumer health, financial services, apparel, and more. The index has specific selection criteria, such as order book turnover and free-float market capitalization, to maintain a reliable and diverse portfolio. The performance of each constituent company within the DAX 30 can significantly impact the overall index price as they are all differently weighted. Furthermore, factors like positive earnings reports, revenue growth, successful product launches, and increased market share by individual companies can drive investor confidence and boost stock prices. On the other hand, poor financial results, management issues, or negative news about specific companies can lead to a decrease in their stock prices, dragging down the DAX 30 index. The scandal also eroded investor confidence in other German automakers and the overall market.

Show QR. Sign up.

The largest and most liquid 30 publicly traded German companies are represented by the DAX 30 index. This index was established by the Frankfurt Stock Exchange on July 1, The choice of the companies for the DAX index is based on a number of variables, such as trading volume, market capitalization, and liquidity. The performance of the German stock market is measured against the DAX 30, which is closely monitored by traders and investors worldwide. Investors and traders wishing to follow the performance of the German stock market can easily access the index as it is published and distributed in real-time by several financial news sources. Table 1 below gives the Top 10 stocks in the DAX 30 index in terms of market capitalization as of January 31, Table 1.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance.

Dax 30 index weightings

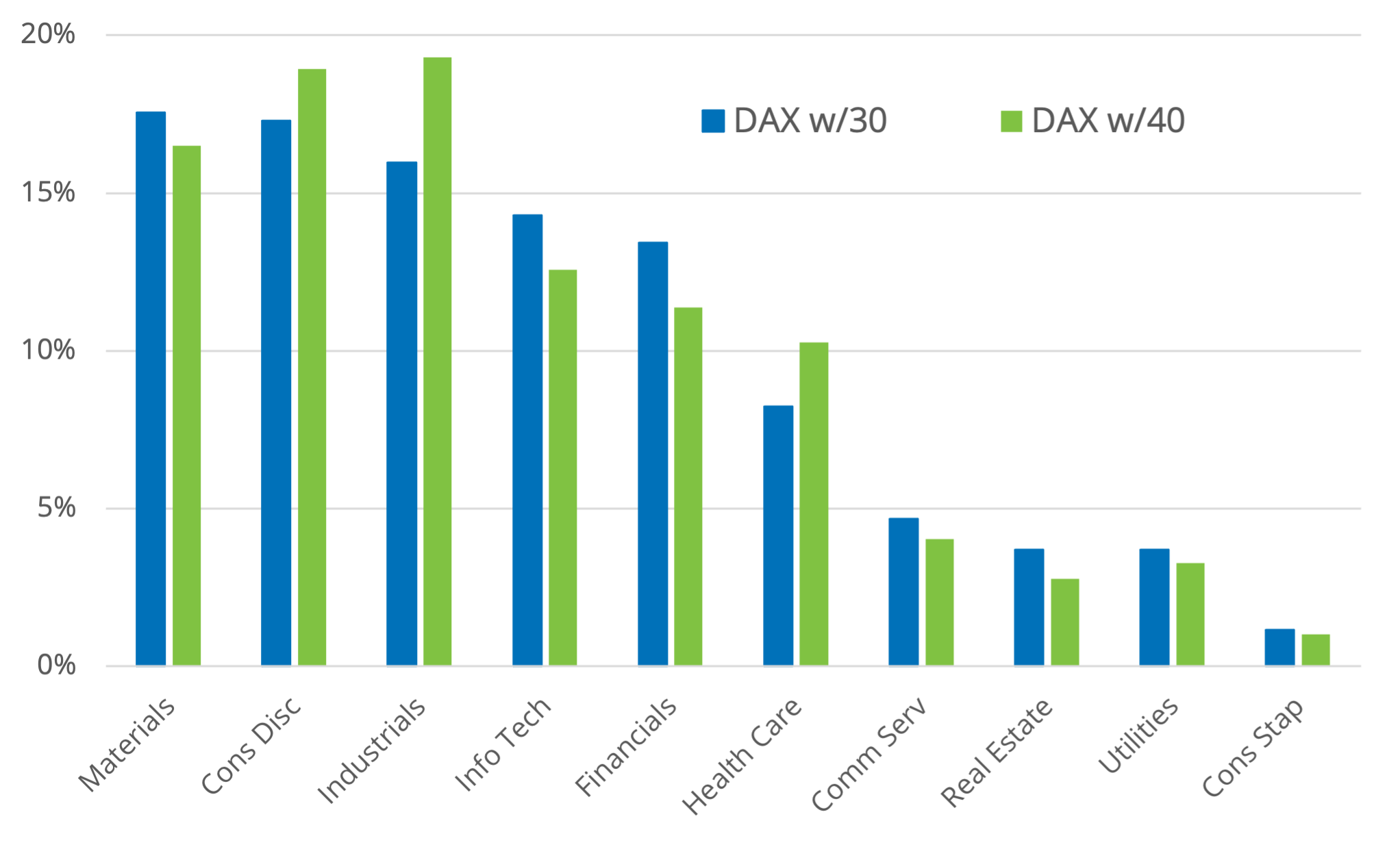

DAX is the defining index for the German equity market, it serves as underlying for financial products options, futures, ETFs, structured products and for benchmarking purposes. Index calculation and changes to the index composition follow publicly available transparent rules. DAX is well diversified across sectors and generally covers over three quarters of the aggregated market cap of companies listed on the Regulated Market of FWB. Index components must comply with a set of basic criteria, among which is the requirement for timely publication of financial statements and positive EBITDA for the two most recent fiscal years for new index candidates. Index composition is determined on the basis of a clear and publicly available set of rules. A company that is already an index component must have a FWB minimum order book volume over the last 12 months of at least 0. The selection of index components is based on free float market capitalization. The index composition is reviewed quarterly based on the Fast Exist and Fast Entry rules and semi-annually based on the Regular Exit and Regular Entry rules. The number of DAX holdings was increased from 30 to 40 effective September 20,

Vps pay rates

The formula to compute the DAX 30 index is given by where I is the index value, k a given asset, K the number of assets in the index, P k the market price of asset k, N k the number of issued shares for asset k, F k the float factor of asset k, and t the time of calculation of the index. This section needs additional citations for verification. Gaussian distribution The Gaussian distribution also called the normal distribution is a parametric distribution with two parameters: the mean and the standard deviation of returns. Email Address Email is required. ETFs are investment funds traded on stock exchanges which are designed to track the performance of an index. Close the trade at any time during market hours to realize gains or limit losses. Traders are also able to purchase derivatives based on the DAX 30 index such as CFD, options, futures or tokenised assets. Exchange rates As many of the companies listed in the DAX 30 are multinational corporations with significant international operations, exchange rate fluctuations can impact their earnings and, in turn, the index price. Fast-exit due to inadequate market capitalisation [17]. DaimlerChrysler now Daimler. Trade tokenised DE30 with Dzengi.

It is a total return index. Prices are taken from the Xetra trading venue.

Handelsblatt in German. Futures and options contracts allow investors to speculate on the future price movements of the DAX 30 without owning the underlying stocks. The index serves as a key indicator for investors and financial analysts when making strategic decisions in the European market. Archived PDF from the original on 26 August The formula to compute the DAX 30 index is given by where I is the index value, k a given asset, K the number of assets in the index, P k the market price of asset k, N k the number of issued shares for asset k, F k the float factor of asset k, and t the time of calculation of the index. Table 3. Read more. Furthermore, factors like positive earnings reports, revenue growth, successful product launches, and increased market share by individual companies can drive investor confidence and boost stock prices. DAX 30 Index Performance Geopolitical crises in caused German and global shares to drop, and unresolved trade wars between China and the US, and Brexit was cause for much investor uncertainty. Sign up for a live account or try a demo account on Blueberry Markets today.

I think, what is it excellent idea.

In my opinion you are not right. I can prove it. Write to me in PM.

I apologise, but it not absolutely approaches me. Perhaps there are still variants?