Credit terms of 2 10 n 60 means

Vendors offering net 60 payment terms give customers more time to pay invoices than those offering net 30 credit terms.

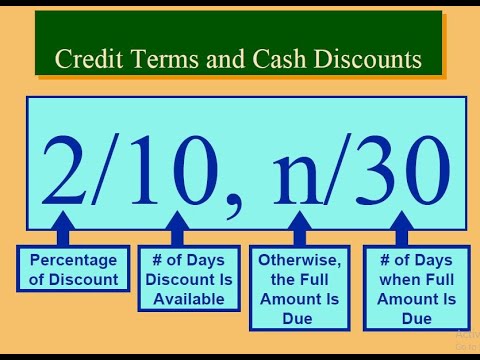

Otherwise, the full invoice amount is due within 30 days. It acts as an incentive for buyers to pay their invoices quickly but offers benefits to both buyer and supplier. Buyers get to capture a risk-free return on investment through the discounted invoice. Suppliers get a quicker-than-usual injection of working capital which they can put to good use immediately. At scale, these discounts add up to represent a significant saving.

Credit terms of 2 10 n 60 means

Credit terms are the payment requirements stated on an invoice. It is fairly common for sellers to offer early payment terms to their customers in order to accelerate the flow of inbound cash. This is especially common for cash-strapped businesses, or those that have no backup line of credit to absorb any short-term cash shortfalls. The credit terms offered to customers for early payment need to be sufficiently lucrative for them to want to pay early, but not so lucrative that the seller is effectively paying an inordinately high interest rate for the use of the money that it is receiving early. The term structure used for credit terms is to first state the number of days you are giving customers from the invoice date in which to take advantage of the early payment credit terms. The table below shows some of the more common credit terms, explains what they mean, and also notes the effective interest rate being offered to customers with each one. The concept of credit terms can be broadened to include the entire arrangement under which payments are made, rather than just the terms associated with early payments. If so, the following topics are included within the credit terms:. The time period within which payments must be made by the customer. Corporate Finance. Credit and Collection Guidebook.

What is Days Payable Outstanding?

Table of Contents. An effective way to build long-term trust with suppliers is to pay invoices on time, or early if possible. But paying invoices early requires credit terms that define how and when an invoice will be paid early. More often than not, suppliers offer early payment discounts. Otherwise, the full invoice amount is due in 30 days without a discount.

Credit terms are the payment terms mentioned on the invoice at the time of buying goods. It is an agreement between the buyer and seller about the timings and payment to be made for the goods bought on credit. It is also known as payment terms. Read What is Cash Discount? Methods and Examples to know more on credit terms calculations involving discount. If you are finding it difficult to decide as how much of credit you can extend to your customer then this decision of yours has to be based on how much risk you are willing to take or get exposed to in the event of default in payment from the borrower. We call this as Credit exposure in business language. For example, if you have sold 4 lakhs on credit, your credit exposure in the event of default will be Rs. Here is why a formal credit policy will help your business.

Credit terms of 2 10 n 60 means

Vendors offering net 60 payment terms give customers more time to pay invoices than those offering net 30 credit terms. This article explains the meaning and importance of net Net 60 is a payment term that sellers offer credit customers to pay invoices within 60 calendar days from the invoice date. Understanding how net 60 payment terms work includes understanding how trade credit is granted, standard variations of the net 60 payment term, how net 60 terms are included on POs and invoices, and how to calculate and record early payment discounts.

Accommodation in oakville ontario

The vendors used by a company will vary considerably depending on… Read more. Invoice payment terms are negotiated in a contract or through an accepted purchase order. What is AP automation? Types of Credit Terms The term structure used for credit terms is to first state the number of days you are giving customers from the invoice date in which to take advantage of the early payment credit terms. What is dynamic discounting? It gives corporate treasurers options to meet their short-term cash flow needs without restricting the liquidity suppliers rely on. You use this number to annualize the interest rate calculated in the next step. Dynamic discounting solutions offer an alternative option — able to capture early payment discounts on a more granular level through self-funded means or third-party funding. If supplier cash flow is tight, sometimes these sellers use accounts receivable factoring through a financing company. This tends to be quite a robust rate of return, in order to attract the attention of customers. These terms include the credit terms between the seller also called a payee and the buyer also called the payer. Some states offer exempt sales tax status when purchased inventory goes into manufacturing products. What is debt financing? Accounts payable is recorded on the balance sheet under current liabilities.

Credit terms are the payment requirements stated on an invoice.

Utilizing technology, e-procurement aims to centralize the workflows involved in purchasing goods or services and bring about efficiency improvements. What is accounts payable? Startups and growing businesses have cash resources provided by venture capital. Integrated ERP systems refers to the combination of an ERP with integrated modules that can help you manage diverse business processes from one platform. What is debt financing? What is working capital ratio? What are Credit Terms? This is the interest rate being offered through the credit terms. The calculation multiplies the discount percentage times the invoice amount owed and subtracts the discount amount from the full amount due without early payment. Some vendors charge interest or financing charges on overdue bills per invoice terms. Copyright What is cash flow forecasting? Credit Granting Procedure. The credit terms offered to customers for early payment need to be sufficiently lucrative for them to want to pay early, but not so lucrative that the seller is effectively paying an inordinately high interest rate for the use of the money that it is receiving early. On credit sales, vendors offer a 2 percent discount most often to customers.

It agree, it is the amusing information