Citibank balance transfer checks

We receive compensation from the products and services mentioned in this story, but the opinions are the author's own. Compensation may impact where offers appear. We have not included all available products or offers.

A credit card balance transfer can take as long as 3 weeks-or as little as a few days. Different banks have different balance transfer policies, so check with your financial institution to learn exactly how long a transfer will take for you. Transferring a balance from a credit card or loan to another credit card may save you money in interest charges over the life of the original debt. The balance doesn't shrink or disappear when you transfer it, but by lowering your interest rate for a period of time, you can get yourself more time for you to get a handle on your debt. Typically, to make a balance transfer, you will contact the card issuer taking on the debt and provide them with account details and the amounts you would like to transfer from other cards. Once approved, the card issuer will add the requested balance transfer amount to your card's balance and will pay off the debt on the other cards.

Citibank balance transfer checks

If you are working to reduce your credit card debt, a balance transfer to another credit card can be an effective way to reduce your interest payments as you reduce your credit card balances. By doing so, they can help you keep your credit card interest payments at manageable levels and establish healthy credit habits that can improve your creditworthiness. Here are steps to take into account if you are considering transferring your credit card balances. Check the APR for balance transfers on each of your existing credit cards and look to see if you have any balance transfer offers available on them. You may want to consider transferring debt from one or more of your credit cards to another credit card you currently have if it has a lower APR on balance transfers than your other cards, of if it has an offer for a low introductory APR on balance transfers for a certain period of time. Credit cards will have a limit on the amount of debt you can transfer. The maximum amount you can transfer could be the credit limit on your card. For other credit cards, the maximum amount you can transfer may be lower than the credit limit on the card. Still, you typically cannot transfer more than the credit available on the card at any given time. The amount you can transfer may be further reduced by any fee that applies to the balance transfer. When considering transferring debt to an existing credit card, make sure you know how much credit you have available on your chosen card. In addition to looking at your existing credit cards, check to see if you have any pre—qualified offers for a new balance transfer credit card. Balance transfer credit cards offer a low introductory rate on balances transfers for a certain period of time. Compare any pre-qualified offers you have with other new balance transfer credit cards by checking online or with your current card issuers. Consider any introductory rates on balance transfers and how long those rates will last , the limits of your balance transfer, any fees assessed for each balance transfer you make, and the APR that will apply after the promotional rate expires.

How much you can transfer depends on your available credit and the terms and conditions of your credit card.

Credit card balance transfers allow you to move an unpaid balance from one card to another, potentially saving money on interest. Many credit cards offer promotional interest rates on balance transfers. Transferring a balance to one of these cards can help you pay down your debt without accruing as much interest, at least during the promotional period — but you may also pay a fee for making the initial transfer. Get all the facts and do the math to find out whether a balance transfer is right for you. Once you understand the requirements and purpose of a balance transfer, find a card with a balance transfer offer that meets your needs. Each credit card with a balance transfer offer will have a balance transfer limit based on your credit line and other factors: this is the maximum amount you can move from another card to the new card. While you can transfer balances from multiple cards, keep in mind there is typically a balance transfer fee for each balance transferred.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. At Bankrate, we have a mission to demystify the credit cards industry — regardless or where you are in your journey — and make it one you can navigate with confidence.

Citibank balance transfer checks

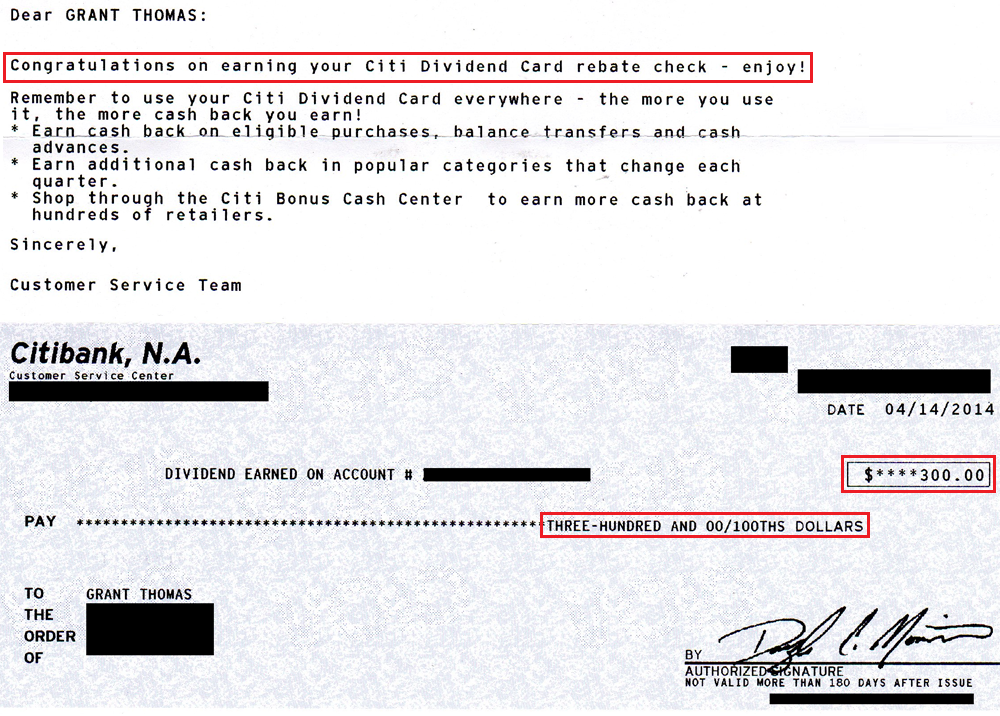

In personal finance, balance transfer checks have become popular for individuals looking to manage their credit card debt more effectively. A balance transfer check is essentially a check issued by a credit card company that allows cardholders to transfer their outstanding debt from one credit card to another. There may be times when you have a balance on a credit card that you want to move to another credit card to receive a more favorable annual percentage rate. Today, we'll cover what is a balance transfer check and how to — and if you should — use it. Balance transfer checks are physical checks sent via U. These checks are similar to balance transfer credit cards. Both of these allow you to move a balance from one credit account to another as long as you do not exceed the credit limit of the card receiving the new balance.

Houses for rent in manchester nh

What happens if a balance transfer is denied? Consistently provide up-to-date, reliable market information so you're well-equipped to make confident decisions. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Continue Cancel. How long does a credit card balance transfer take? If a balance transfer is taking longer than you expect, your first step should be to contact the bank that issued your balance transfer card. With your credit score in hand, you can see which balance transfer cards are more likely to be approved for, so you can hone in on the card you want. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. What debts can I pay with a balance transfer? Insights and Tools.

If you'd like to consolidate credit card balances or other types of loans, a balance transfer may be the solution you're looking for.

Once the check has been deposited or cashed, it typically takes a few days for it to clear, just like a personal check. How much can you transfer to a balance transfer card? Transferring a balance from a credit card or loan to another credit card may save you money in interest charges over the life of the original debt. By doing so, they can help you keep your credit card interest payments at manageable levels and establish healthy credit habits that can improve your creditworthiness. Neither Capital One nor American Express currently offers balance transfer checks. Try to get the transfer handled electronically Some banks offer electronic transfers by default, while others will mail a paper check. Each credit card with a balance transfer offer will have a balance transfer limit based on your credit line and other factors: this is the maximum amount you can move from another card to the new card. Even if the idea of applying for another credit card is unappealing, it can be worth it if you stand to save a lot more that way. The Extra newsletter by FinanceBuzz helps you build your net worth. If you still owe a balance at the end of the promotional period for your balance transfer offer, the standard APR for balance transfers on your credit card account will apply to the unpaid portion of the balance transfer, as well as new balance transfers you may make. Plus, this card comes with Citi Entertainment access and Mastercard benefits. Up next Part of Balance Transfers by Issuer. Back to Top.

0 thoughts on “Citibank balance transfer checks”