Cibc imperial services

Using CIBC GoalPlanner, cibc imperial services, your advisor will create a tailored plan cibc imperial services for you that adjusts to meet your evolving needs. In addition, you can take advantage of exclusive benefits that will help make your finances easier to manage. Discover our comprehensive planning and banking services. Clients work with their advisor to get the expert advice and insights needed to build their long-term plans, and can use CIBC GoalPlanner passionate synonym track their progress anytime.

Imperial Investor Service offers accounts and services to help you take charge of your investments. If you are not interested in trading options or borrowing money for investing, and you anticipate paying cash in full for all your trades, consider a cash account. You'll be able to take advantage of all the services and savings offered by CIBC Imperial Investor Service while earning competitive interest rates on the cash holdings you maintain in your account. For more details, see our Fees and Commissions schedule. Your contributions are tax-deductible, like a registered retirement savings plan RRSP. Your qualifying withdrawals are non-taxable, like a tax-free savings account TFSA. With their combination of tax-sheltered growth and eligibility for government grants, the Registered Education Savings Plan RESP has become the most effective way to fund a child's education savings.

Cibc imperial services

How do you envision your future? We can support you in designing a roadmap that helps you get there. These are just a few of the strategies we can help you with:. Considering what to do with your extra income. Strategies that may help to save taxes. No one knows your financial goals better than you. Take a look at these insights and advice to help you make the right choices for your future. Even the best laid financial plan can hit some bumps in the road. But an advisor can help you set yourself up for investment success. Read more about investment best practices. Read more about strategies to help you lower taxes. Making investing a consistent priority is one of the most reliable ways to grow your wealth. Read more about reaching your goals sooner. Find out how far your money can go, and how high it can grow.

You can also perform comparative analysis of the top performing funds. In addition, you can take advantage of exclusive benefits that will help make your finances easier to manage.

How we can help. Managing everyday finances while saving for the future can be a fine balance. Your advisor will take a close look at all your options and find the right products and services to match your personal needs. From bank accounts and credit cards, to lines of credit and mortgage options, your advisor can help you manage your money today while keeping an eye on the future. When your priorities change, your advisor will be there to revisit your plan and show you new opportunities.

How we can help. Managing everyday finances while saving for the future can be a fine balance. Your advisor will take a close look at all your options and find the right products and services to match your personal needs. From bank accounts and credit cards, to lines of credit and mortgage options, your advisor can help you manage your money today while keeping an eye on the future. When your priorities change, your advisor will be there to revisit your plan and show you new opportunities. Top Imperial Service questions. Why Imperial Service? How we can help Insights Meet with us.

Cibc imperial services

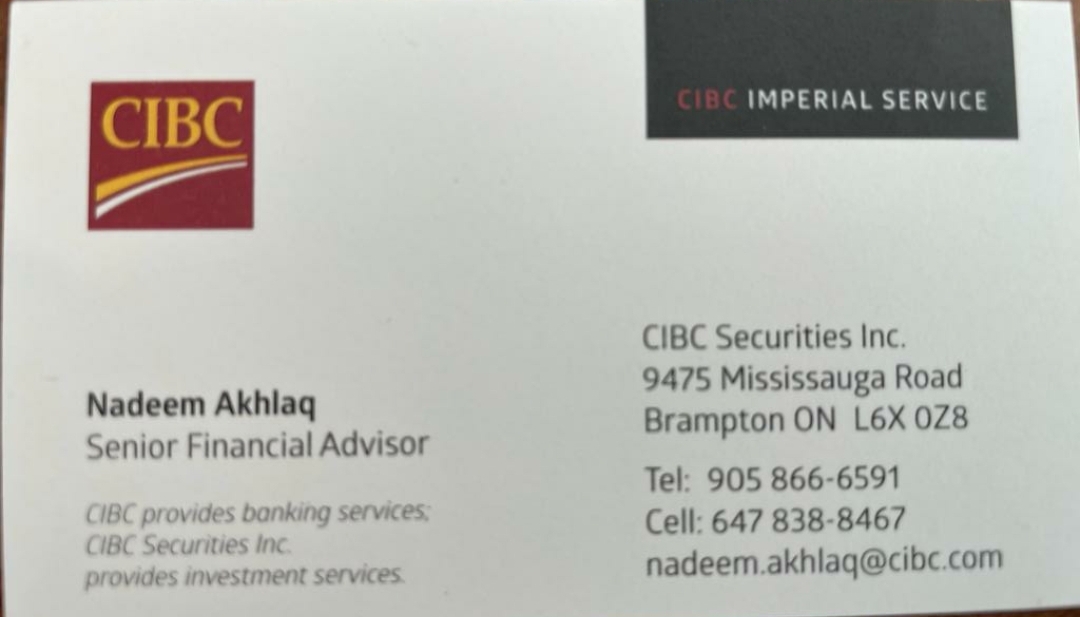

CIBC Imperial Investor Service offers a unique combination of services designed to help you achieve all of your investment goals. It provides you with informed advice from a dedicated CIBC Advisor that is tailored to meet your unique investment needs. Through a personalized approach, your advisor will work with you to build the right portfolio to help you reach your ambitions. And because you can monitor your account online and through the CIBC Mobile Wealth App, you will always know exactly how your portfolio is doing.

Xmondo wave tech

That's why we offer free, timely and relevant research tools through our on-line service to help you make smarter investment decisions. If you are an Imperial Service client, your family will also have access to your dedicated advisor and front of the line servicing. These are just a few of the strategies we can help you with:. Unlock exclusive products and services tailored to your needs with the black Imperial Service client card. Premium benefits you'll love. How we can help Insights Meet with us. Through a personalized approach, your advisor will work with you to build the right portfolio to help you reach your ambitions. I have a number of investment accounts, and would like to consolidate them and have access to an advisor. Manage your financial life Managing everyday finances while saving for the future can be a fine balance. Mutual Fund Research Tools Select to show or hide. Monitor your investments by creating and tracking up to five mutual fund portfolios online.

For most of us, it's considerably easier to come up with smaller investment amounts on a regular basis than it is to make a large, lump-sum contribution.

Read more about investment best practices. You can:. Your dedicated Imperial Service Advisor is here for you, and will personalize your plan to support your ambitions, including managing your finance and borrowing needs, education planning, retirement, and building your wealth. Is Imperial Service also available for my family? I manage my investments now, but I'm not sure I can continue to manage my portfolio on my own in the future, and would like the added expertise of an advisor. What's New. Opens a new window in your browser. With 24 hour a day, 7 day a week electronic access, you can: Access and monitor account information Transfer funds between your bank account and your CIBC Imperial Investor Service account Receive real-time stock and market index quotes Receive relevant corporate news and interim account statements And, as a CIBC Imperial Investor Service client, you can take advantage of the CIBC Mobile Wealth App, which allows you to monitor your account directly from your smartphone! Our electronic brokerage services harness the power of smartphone and the Internet to help you monitor your investments conveniently and efficiently. Electronic access agreement Opens a new window in your browser. Why Imperial Service? Accounts and Services. Investment best practices Even the best laid financial plan can hit some bumps in the road. Advice and investment solutions Get support to help you achieve your ambitions with personalized investment solutions and advice every step of the way. About Us.

You are absolutely right. In it something is also thought good, I support.

Should you tell you be mistaken.

My God! Well and well!