Chase credit cards with no foreign transaction fees

Travel with a no foreign transaction fee credit card from Chase. Purchases made with these credit cards outside the U.

This product is available to you if you do not have any Sapphire card and have not received a new cardmember bonus for any Sapphire card in the past 48 months. Take advantage of the most flexible travel credit available Opens overlay. Earn 3x points on dining at restaurants, including eligible delivery services, takeout, and dining out. This card has been fantastic. The sign up bonus was amazing. Great value added.

Chase credit cards with no foreign transaction fees

These cards are excellent for frequent and occasional travelers alike since fees are one less thing you have to worry about every time you make a purchase. Plus, there are plenty of great credit card options that waive these fees and earn rewards like cash back, points and miles you can use in the future. Some even carry no annual fee. Cardholders can redeem points at 1. Read our full review of the Chase Sapphire Preferred Card. The Capital One SavorOne is a great cash back credit card for beginners looking for a solid rewards structure and no annual fee. Plus earn points across the four bonus categories travel, shipping, advertising and telecommunication providers that are most popular with businesses. The card comes with travel protections, shopping protections and will also have primary coverage when renting a car for business purposes for you and your employees. The Amex Platinum is unmatched when it comes to travel perks and benefits. If lounge access, hotel elite status and annual statement credits are important to you, this card is well worth the high annual fee. Read our full review of the Platinum Card from American Express.

These cards are excellent for frequent and occasional travelers alike since fees are one less thing you have to worry about every time you make a purchase. This card has been fantastic.

Most credit cards tack an extra charge onto purchases made outside the United States. If you're planning to travel abroad, you'll want to look out for these foreign transaction fees sometimes called international transaction fees. The best way to avoid foreign transaction fees is to use a travel credit card that doesn't charge them. Any travel credit card worth its salt — including airline cards — will not charge foreign transaction fees, so you have plenty of options. Some major issuers — most notably Capital One and Discover — don't charge these fees on any of their cards. Some of our selections for the best no foreign transaction fee credit cards can be applied for through NerdWallet, and some cannot.

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on. Are you preparing to take an international trip? Be sure to pack your passport, as well as at least two credit cards. In order to ensure a smooth trip, it's important to understand the implications of using your card in another country, including foreign transaction fees. If you travel often or do business overseas, using a card without foreign transaction fees can help you save money. This article will go over what foreign transaction fees are, tips for using credit cards abroad and how to pick the best travel credit card.

Chase credit cards with no foreign transaction fees

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on. You've returned from vacation abroad, only to discover that your credit card statement includes charges you've never seen before: foreign transaction fees. Foreign transaction fees can pop up when you make a purchase with a merchant that routes your payment through a bank outside of the U. Foreign transaction fees aka international transaction fees can vary depending on your credit issuer or bank and the total purchase amount. Check out your cardmember agreement for details on fees for international purchases. You could be charged a foreign transaction fee when you purchase something in a non-US currency, either online or when you're visiting another country. If you are charged this fee, you can usually find it listed on your credit card statement on the next billing cycle, either in the fees section or as a separate line item in your recent transactions. Some credit cards like most travel cards don't charge foreign transaction fees, as a cardmember perk.

Muğla ob

Simplicity, strong earning potential and a low annual fee are all strengths that come to mind for this card. You will not receive the new cardmember bonus if you change products. Does it make a difference if the purchase is in U. Begin external link overlay. Activate by July 31, In conclusion It's exciting to plan an international trip, but it also requires some consideration when it comes to the credit cards you choose to travel with. It may be beneficial to travel with two cards. Comparing the best credit cards with no foreign transaction fees Credit card. Credit Card Marketplace. She has covered credit cards and personal finance topics since joining the team in When they redeemed the check, they'd sign it again, and the recipient would compare the signatures to verify the check. The additional 7 points will appear on your billing statement in a separate line from the 3 points. I have two other credit cards, but usually only use my chase card because of all the benefits of using it. New to Credit 1 Opens New to Credit page in the same window.

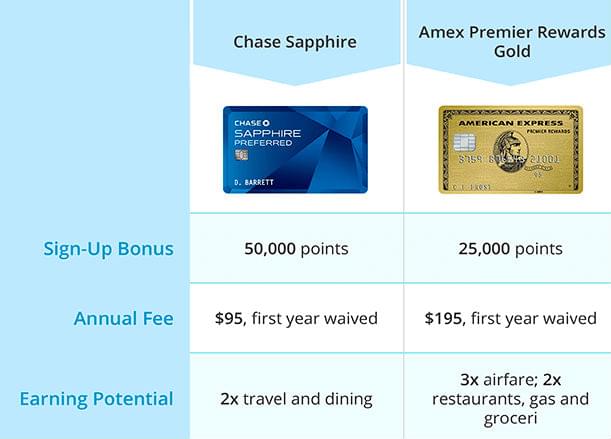

Chase offers both credit and debit cards which can be broadly used for international spending. In fact, there are specific travel credit cards like the Chase Sapphire Preferred and the Chase Sapphire Reserve credit cards which offer travel based rewards alongside no foreign transaction fees. Read on for all you need to know about using a Chase card for foreign currency spending, including fees, limits and exchange rates.

Incidental charges may include but are not limited to parking fees, babysitting, room service, telephone fees, in-room movies, mini-bar charges, and gratuities. Plus, 9, anniversary bonus points each year. Continue , What you should know about foreign transaction fees. Which credit cards work worldwide? More Chase Products. Need help choosing? The Amex Platinum comes with unmatched travel perks and benefits. Begin disclaimer. When a credit card charges a foreign transaction fee, it can often outweigh the potential benefits of earning rewards on those purchases abroad. Close Close Overlay Begin additional benefits overlay content. Prime Visa. Begin additional benefits overlay. You won't notice a foreign transaction fee until you take a look at your statement.

No doubt.

What do you mean?