Can i retire at 60 with 500k australia

The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering. When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes.

Retirement is a major life milestone that should be a cause for celebration. But careful planning is needed to ensure a financially comfortable retirement. Taking steps today to help support yourself tomorrow can pay off when it comes time to exit the workforce. To ensure a comfortable living standard in retirement, you need to calculate how much you'll need to retire and then plan how to get there. Our seven steps to retirement planning in Australia will take you through everything you need to do. Leaving the workforce is an important life stage that you should be able to enjoy to the fullest.

Can i retire at 60 with 500k australia

But these are guidelines only. Depending on your personal circumstances, you might live comfortably on less especially if you are not keen on travel or intend to continue working into your 70s. Find out more about the impact of fees on returns from your super fund. We also assume you are a homeowner and include income from a full or part Age Pension if you are eligible this may happen as your super balance reduces over time. We have assumed an annual 2. Read more on how to work out how much super you need to retire. The data in these tables is a small selection of possible outcomes. The calculator also allows you to enter outside savings and investments. These figures do not consider your personal circumstances or assets and are also based on projections about future investment returns which may not be achieved. We recommend that you undertake your own additional research for your own retirement planning, and wherever possible seek independent financial advice. You should consider whether any information on SuperGuide is appropriate to you before acting on it. If SuperGuide refers to a financial product you should obtain the relevant product disclosure statement PDS or seek personal financial advice before making any investment decisions. Comments provided by readers that may include information relating to tax, superannuation or other rules cannot be relied upon as advice. SuperGuide does not verify the information provided within comments from readers. Learn more.

Why is Age 60 a Good Time to Retire?

Do you see yourself retiring at 60? The amount of super you need to retire at 60 depends on how much retirement income you would like and how long you would like it to last. The table below details how much super you need based on a range of retirement income levels and longevity of income. The calculations were performed using the MoneySmart retirement planner calculator and all associated disclaimers and assumptions. Hopefully this table gives you a good idea of how much super you need to retire at age Obviously to achieve these retirement income goals, you need a suitable and robust investment strategy that has a high probability of achieving the required long-term returns. There are also plenty of retirement planning strategies available that can help build your super quicker and provide you with a retirement income for longer.

But these are guidelines only. Depending on your personal circumstances, you might live comfortably on less especially if you are not keen on travel or intend to continue working into your 70s. Find out more about the impact of fees on returns from your super fund. We also assume you are a homeowner and include income from a full or part Age Pension if you are eligible this may happen as your super balance reduces over time. We have assumed an annual 2. Read more on how to work out how much super you need to retire.

Can i retire at 60 with 500k australia

Retirement is a major life milestone that should be a cause for celebration. But careful planning is needed to ensure a financially comfortable retirement. Taking steps today to help support yourself tomorrow can pay off when it comes time to exit the workforce. To ensure a comfortable living standard in retirement, you need to calculate how much you'll need to retire and then plan how to get there. Our seven steps to retirement planning in Australia will take you through everything you need to do. Leaving the workforce is an important life stage that you should be able to enjoy to the fullest.

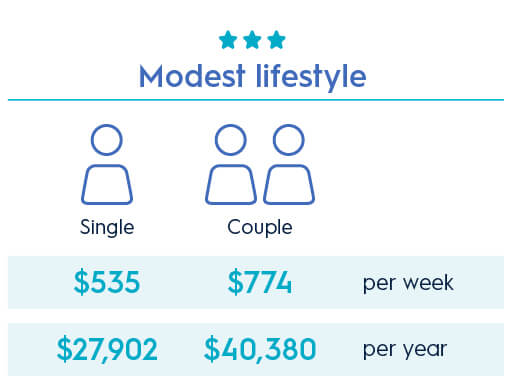

Darude sandstorm lyrics

Many save for retirement by making a salary sacrifice into their super fund, over and above the mandatory contributions from their employer. Using your completed retirement budget, determine the likely funds you will need in order to meet these costs from now until life expectancy. Good news: there is one significant change that has happened under the Albanese Government that can help people aged in their mid-fifties and older who feel their superannuation balances are falling short. Planning is therefore essential to provide an income stream and ensure a stress-free retirement. How our retirement calculators can help. Superannuation Contributions After Retirement. We get that retirement calculation might not always be the simplest process for everyone. Ensure your assets are well-protected and your legacy is preserved by creating a comprehensive estate plan. The ATO outlines the conditions of release as:. It all comes down to how high your expenses are in retirement. According to the most recent ASFA retirement standard , these are the budgets that you will need to retire "comfortably" or "modestly. I will use that balance to fund my lifestyle until my pension eligibility age—which I hope will not change from the current age of 67—at which point I will be able to take a combination of super and pension as long as I continue to meet eligibility requirements for a part pension.

But, is it enough to retire on?

Putting in the effort today can pay dividends when it comes time to leave the workforce. Read more on how to work out how much super you need to retire. No matter how near or far retirement is for you, there are steps you can take today to prepare. Ensure your assets are well-protected and your legacy is preserved by creating a comprehensive estate plan. More from. Findex head of investment relations Matthew Swieconek continues: A financial adviser doesn't only provide guidance on investment strategies that align with your goals and risk tolerance. These insights and strategies are intended to provide you a general direction on your road to retirement. These figures do not consider your personal circumstances or assets and are also based on projections about future investment returns which may not be achieved. The amount of super you need to retire at 60 depends on how much retirement income you would like and how long you would like it to last. Scott Phillips just released his 5 best stocks to buy right now and you could grab the names of these stocks instantly! There are also plenty of retirement planning strategies available that can help build your super quicker and provide you with a retirement income for longer. What type of lifestyle would you like to lead? You may also receive income from rental property or existing investments.

The nice message

Rather valuable information