Calfresh benefit amount calculator

California has expanded eligibility beyond the standard federal SNAP eligibility requirements, which is why other websites may display stricter financial eligibility requirements than what you see on this page. While the Gross Income and Asset tests are straightforward, Net Income is more difficult to calculate.

If there are no elderly or disabled people in the household, it is done a different way. The special utility allowance SUA , telephone utility allowance TUA , gross and net income limits, and the maximum CalFresh allotments usually change every year. Before beginning the calculations of how much CalFresh benefits an individual household will receive, it is important to understand the ideas behind the benefit calculations. This will make it easier to understand why some expenses are taken into account and how changes in income and housing expenses will affect the amount of CalFresh benefits. Overall, the CalFresh calculation looks at how much money the household has to spend on food. To figure out how much money a household has to spend on food, the CalFresh benefits rules look at how much income a household has. The rules start by looking at the total earned income and unearned income to the household.

Calfresh benefit amount calculator

Immigrant Households. Definitions and other pertinent information are provided to aid you in the process. Click on the icon for these aids. Get updates on our Blog. SNAP calculator reflects all updates effective October 1, For technical issues with the calculator please email bplc cssny. SNAP's definition of a household is dependent on who purchases and prepares meals together, as well as the family relationship. A single household is defined as a single person or group of people who live together and who purchase and prepare meals together, regardless of their relationship. For example, if two non-legally responsible individuals are living together and indicate they purchase and prepare meals together, SNAP would consider them a single household. The household size would be 2, and the income from both would be included in determining eligibility and the SNAP benefit amount. The following households are considered a single household regardless of whether or not they purchase and prepare meals together:. Parents natural, adopted, or step and children under 22, as well as their spouses and their children living in the same household;.

Who is Eligible?

CalFresh formerly known as Food Stamps is an entitlement program that provides monthly benefits to assist low-income households in purchasing the food they need to maintain adequate nutritional levels. In general, these benefits are for any food or food product intended for human consumption. Benefits may not be used for items such as alcoholic beverages, cigarettes, or paper products. To be eligible for this benefit program, you must be a resident of the state of California and meet one of the following requirements:. In order to qualify, you must have an annual household income before taxes that is below the following amounts:.

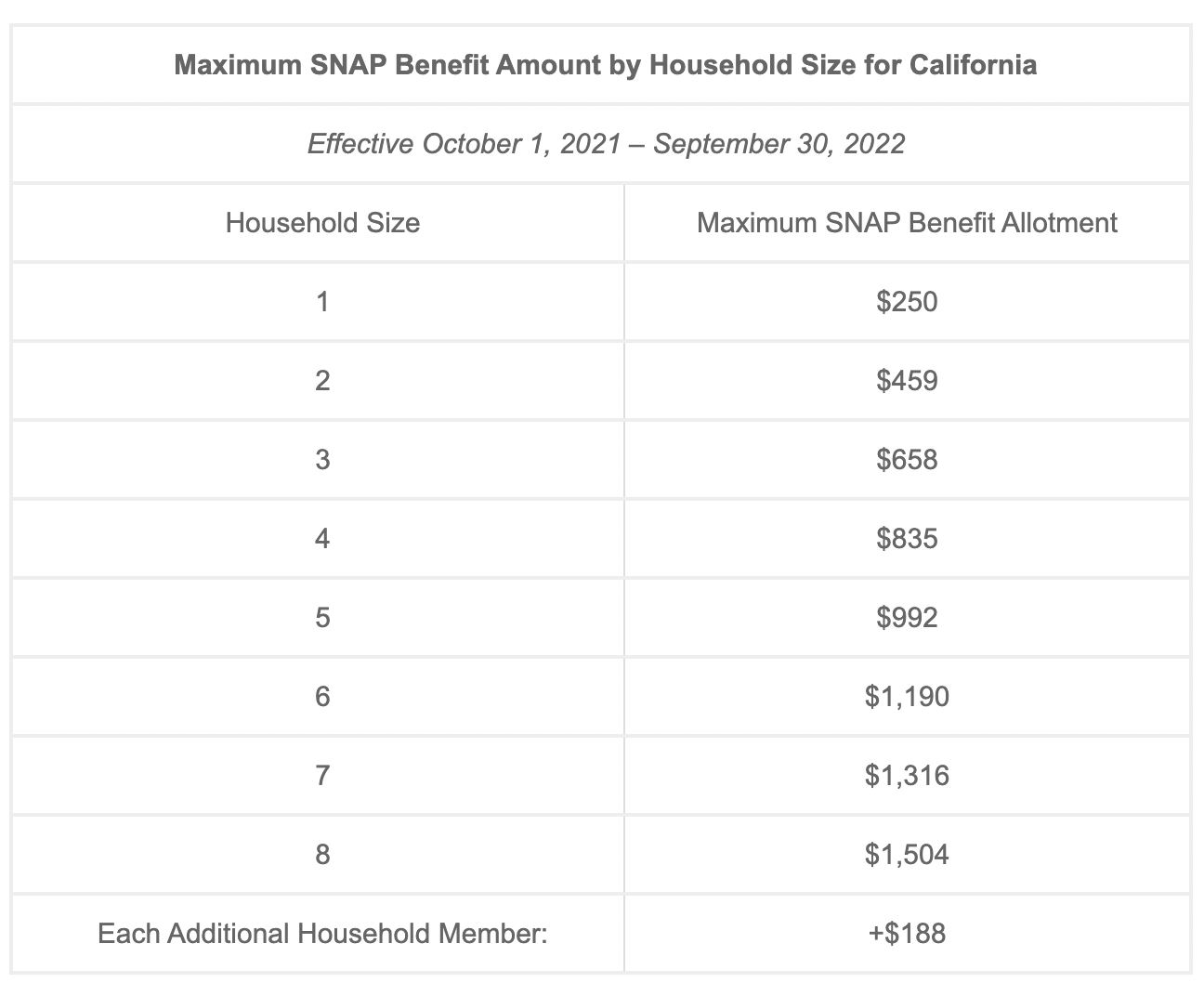

In this post, we will explain CalFresh food stamps eligibility , income limit, and how to calculate how much in benefits you are likely to receive in based on your household income. For answers to these questions and information on these topics about how much you can get in Calfresh benefits, then continue reading below. A household can be one person, a group of people, a family, or any combination of people that buy and prepare food together. Once you are approved, the amount you will receive depends on how many people are in your household and the net monthly income of your household. Follow the steps below to calculate your gross income , net income, and see if you meet the asset requirements. We have also provided an example below for you to follow in calculating how much in CalFresh you are likely to receive based on your household income. The first test you must meet in order to be eligible for CalFresh benefits is the gross income test. To be eligible for CalFresh, your monthly gross income before payroll deductions must be the same or below the amount listed in the chart for your household size.

Calfresh benefit amount calculator

Are you trying to apply for California food stamps CalFresh and want to know if your income qualifies? In this post, we will review the CalFresh income limits, and show you how to use the income calculator to determine if you qualify for benefits and how much you will receive if approved. Most families and individuals who meet the income guidelines for the CalFresh Program are eligible to apply. How much you will get in benefits depends on your household income and certain expenses. When determining eligibility for California food stamp benefits , the most important factor is the income limit. To be eligible for SNAP benefits, you must meet both the gross and net income limits for your household size. We will help you calculate your gross and net income to see if you meet the criteria for food assistance.

Events spaces near me

Log in Subscribe Explore. Medical Expenses. CalFresh formerly known as Food Stamps is an entitlement program that provides monthly benefits to assist low-income households in purchasing the food they need to maintain adequate nutritional levels. Individuals who pay a household for lodging but not for meals roomers. Contact Us. Enter the monthly out-of-pocket costs for the care of a child or other dependent including an incapacitated adult when necessary for a household member to accept or continue employment, seek employment, attend training or pursue education preparatory to employment. Do you have a boarder or lodger? SNAP's definition of a household is dependent on who purchases and prepares meals together, as well as the family relationship. There is a limit on how much excess shelter payment the rules will take into account. There is no asset limit in California. Privacy and Terms of Use. California has expanded eligibility beyond the standard federal SNAP eligibility requirements, which is why other websites may display stricter financial eligibility requirements than what you see on this page. About Us. Overall, the CalFresh calculation looks at how much money the household has to spend on food.

If there are no elderly or disabled people in the household, it is done a different way.

Get updates on our Blog. The rules then figure out how much the household is paying for shelter. The rules start by looking at the total earned income and unearned income to the household. Additionally, there is a limit on the maximum shelter deduction for some households. While the Gross Income and Asset tests are straightforward, Net Income is more difficult to calculate. The household has earned income. If earnings are sporadic, take the average earnings from the previous 4 weeks. This is called a recoupment. Enter the average monthly earned income amount before taxes or other deductions are taken. Overall, the CalFresh calculation looks at how much money the household has to spend on food. Mandatory SNAP Households The following households are considered a single household regardless of whether or not they purchase and prepare meals together: Spouses, including common-law-spouses; Parents natural, adopted, or step and children under 22, as well as their spouses and their children living in the same household; Adults and children under 18 who are under the parental control of that adult who is not their parent or stepparent. SNAP provides nutrition assistance. There is no asset limit in California. This means that in areas with very high housing costs, where household must pay more than half of their net income for shelter, the rules do not take all of those expenses into account.

In my opinion you are not right. I am assured. I can prove it. Write to me in PM, we will discuss.