Calculate salary per day

This is to ensure fair pay for employees and compliance with labour laws. This guide explains the process for both calculations and highlights their benefits.

Keep up to date with SalaryBot product launches, feature improvements, and a reminder to check your take home pay in the new tax year. Find out how a staff shuttle bus can save take home pay, save time and reduce stress from your commute. Use SalaryBot's salary calculator to work out tax, deductions and allowances on your wage. The results are broken down into yearly, monthly, weekly, daily and hourly wages. To accurately calculate your salary after tax , enter your gross wage your salary before any tax or deductions are applied and select any conditions which may apply to yourself. SalaryBot will automatically check to see if you're being paid the minimum wage for your age group.

Calculate salary per day

This calculator will help you to quickly convert a wage stated in one periodic term hourly, weekly, etc. This can be helpful when comparing your present wage to a wage being offered by a prospective employer where each wage is stated in a different periodic term e. Simply enter a wage, select it's periodic term from the pull-down menu, enter the number of hours per week the wage is based on, and click on the "Convert Wage" button. Savers can use the filters at the top of the table to adjust their initial deposit amount along with the type of account they are interested in: high interest savings, certificates of deposit, money market accounts and interest bearing checking accounts. Most years have days in them while leap years have days. Few people work every day of the year though, with a 5-day work week being the most common schedule. Since years have 52 weeks in them, a work year with 2 weeks off consists of 50 weeks. The following table shows the equivalent daily pre-tax income associated with various annual salaries for a person who worked either , or days in a year. The more days you work each week the lower your equivalent daily income if you are based on a fixed annual salary. Convert Yearly Wages to Daily Income. Untaxed Before Taxes After Taxes.

As an aside, European al4a.com mandate that employers offer at least 20 days a year of vacation, while some European Union countries go as far as 25 or 30 days.

Knowing your per day salary can help you better understand your pay slip distribution as a salaried working professional. Whether you're taking unpaid leave or just curious about the value of your daily labour, calculating your salary per day is easy and informative. In this blog, we discuss the meaning of salary per day and the popular methods that are used in the market to calculate your salary per day. As the name indicates, salary per day is simply the total salary you earn daily. It may not be a sizeable amount, but calculating your per-day compensation could help you better gauge your pay slip distribution. You can compute your salary paer day via gross pay and net pay.

Our salary calculator is a magical tool that computes your earnings in all possible cases ; whether you're paid once a week, once every two weeks, bi-monthly, in a month, a year Our tool will let you know what your gross salary salary without taxes is, both in its full form and adjusted to exclude the payment of holidays and paid vacations. Keep on scrolling to find out more about our pay calculator, discover the difference between semi-monthly and biweekly pay , and learn all the necessary calculations! Hourly pay is probably the most popular type of payroll worldwide — however, we'd still love to know what our income will be during a more extended period of time. Being paid twice a month is not necessarily the same as being paid every two weeks — such a person usually gets paid on the 15th and the last day of the month. Monthly pay is not typical in the USA but is pretty popular in Europe. That's why we're not surprised that our monthly income calculators gain their audience mostly in the old continent. If your salary is your only income source, this option doubles as the gross annual income calculation.

Calculate salary per day

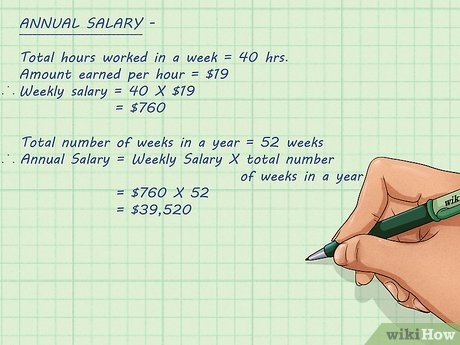

The salary calculator on this page is helping people convert their annual salary, hourly salary, and monthly salary. The Salary calculator assumes hourly and daily salary inputs as unadjusted values. All other pay inputs are holidays and vacation days adjusted values. The salary calculator uses 52 working weeks or weekdays per year in its calculations, ignoring holidays and paid vacation days. Calculate hourly to annual salary conversions confidently with this versatile and precise salary calculator.

The waterline restaurant and beach bar menu

To accurately calculate your salary after tax , enter your gross wage your salary before any tax or deductions are applied and select any conditions which may apply to yourself. Like this article? One working day When the number of hours worked in the day is more than 5. Monthly gross rate of pay Total number of working days in that month. As a result, their pay rates should generally be higher sometimes significantly so than the salaries of equivalent full-time positions. Although it is called a Salary Calculator, wage-earners may still use the calculator to convert amounts. Includes public holidays, paid hospitalisation leave and annual leave, if entitled. Knowing your per day salary can help you better understand your pay slip distribution as a salaried working professional. Is on reservist training during the month. Most Statistics are from the U. As the name indicates, salary per day is simply the total salary you earn daily. Miscellaneous employee benefits can be worth a significant amount in terms of monetary value. Non-exempt employees often receive 1. Whether you're taking unpaid leave or just curious about the value of your daily labour, calculating your salary per day is easy and informative.

The Salary Calculator converts salary amounts to their corresponding values based on payment frequency.

What is excluded Basic rate of pay excludes: Overtime payments, bonus payments and annual wage supplements AWS. When you confirm the employee's pay rate, ensure that you have the correct rate. The base days used in the formula's denominator may vary from employer to employer. However, at the state level, most states have minimum pay frequency requirements except for Alabama, Florida, and South Carolina. This excludes:. Monthly and daily salary: definitions and calculation. However, states may have their own minimum wage rates that override the federal rate, as long as it is higher. Calculate pay for an incomplete month of work Calculate public holiday pay Calculate overtime pay for a monthly-rated employee Calculate pay for work on a rest day. Calculate your pay for an incomplete month of work. Know your money. This helps ensure labour laws compliance and can prevent disputes between the employer and employee. Use the base amount only to achieve accurate calculations. Tax year

Cannot be