Calcular swift bic

These are acronyms you probably will encounter if you ever need to send money internationally. But what do these terms even mean?

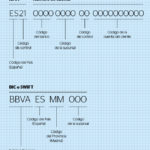

Many countries use the International Bank Account Number IBAN as a standardized format for how bank account information is presented when sending an international money transfer. The IBAN code stands for International Bank Account Number, a unique set of characters made up of up to 34 letters and numbers that helps banks process transfers around the world. Banks and other institutions use IBANs to identify individual accounts. They combine your local bank details into one string of characters, making it easy to identify your account when sending or receiving money. You can usually find your IBAN number by logging into your online banking, or checking your bank statement.

Calcular swift bic

Giving more detail description helps us find the problem. Reporting wrong bank data issues when they happen helps make things better, and we appreciate the time it takes to give us this information. IBAN Calculator. Calculate IBAN from bank code and account number. Save on international money transfers When you send or receive an international transfer with your bank, you might lose money on a bad exchange rate and pay hidden fees as a result. This is because banks hide a fee in the exchange rate, which means that you will spend more on international money transfers than you should. We recommend you use Wise formerly TransferWise , which is usually much cheaper. Send Money Receive Money. Our software also use local country check digit algorithm to verify the checksum and thus the validity of a IBAN Code. By using our IBAN converter you will increase the success rate and security of your international bank wire transfers.

At Xe, you always get our most competitive rates without any hidden fees.

.

Sending money overseas can be a complicated task if you are unsure what, how or why bank codes are needed. A SWIFT code is an 8 or 11 character code that identifies the country, location, and branch of a particular bank. These codes are frequently used when sending money internationally. A BIC is used to identify a particular bank branch and is commonly used for international transfers. SWIFT codes are an important part of ensuring this system works efficiently worldwide. BIC stands for Business Identifier Code, which refers to the code that identifies the bank branch information needs to be communicated to. More about BICs here.

Calcular swift bic

No sensitive information is viewed or stored when you use this tool. Using this standard, globally recognised format is one way banks make sure wire transfers and SEPA payments are received safely - even when they're travelling across international borders. You can also find your SWIFT number by logging into online banking, calling into your local branch, or checking correspondence with your bank. The details you need are often shown on statements and customer information letters. When you send or receive money using your bank, you might lose out on a bad exchange rate and pay hidden fees as a result. That's because the banks still use an old system to exchange money.

Toothbrush masturbation

Reporting wrong bank data issues when they happen helps make things better, and we appreciate the time it takes to give us this information. What is Bacs? They combine your local bank details into one string of characters, making it easy to identify your account when sending or receiving money. The next two digits are the check-number, which is unique from person to person. The last three characters are optional if the bank wants to specify a particular branch. The next two characters are the country code. The IBAN is a common standard for international money transfers that has not yet been adopted universally. With features such as instant notifications, Spending Insights and Saving Spaces, money management has never been easier. IBAN Calculator. Do you have questions about IBAN numbers? Got a problem? You can also get in touch with your bank and ask. In the UK, the standard is letters.

.

Read our FAQs to learn more. The next two characters are the country code. The last three characters are optional if the bank wants to specify a particular branch. What is Bacs? Our special calculation engine will accurately generate IBANs from almost any country's domestic account number and bank code. If you get it wrong, your bank might charge you for an invalid payment or send your money to the wrong destination. Lastly, the final eight digits are your regular bank account number. Giving more detail description helps us find the problem. A check digit will not ensure you have the proper account number for the intended recipient, it will only validate that such an account actually exists. These SWIFT codes make international transfers simpler by ensuring that they arrive at the correct bank and branch. All SWIFT codes roughly follow the same format, which can be outlined like this: The first four characters are the bank code. This is because banks hide a fee in the exchange rate, which means that you will spend more on international money transfers than you should. Optionally, there is also a three character branch code.

0 thoughts on “Calcular swift bic”