Buy and hold tqqq

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising.

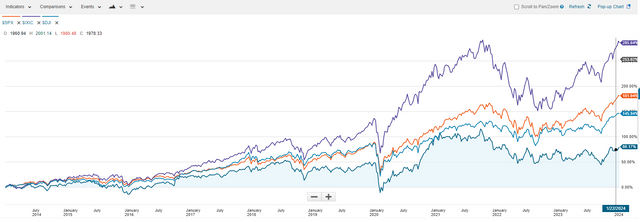

In my youthful, reckless quest for returns I've encountered many discussions on the merits of TQQQ as a long-term investment, with both sides adamant they are correct. As a novice investor myself, I'd love to hear some expert opinions on if TQQQ is in fact a wise long-term investment. The primary argument against it seems to be that 1. And 2. Something about the use of leverage and rebalancing of holdings creates decay, which in the long-run diminishes returns.

Buy and hold tqqq

Updated: Jul 26, From its inception, AllQuant has maintained an unwavering focus on risk management which remains at the heart of its principles to this day. While growing capital is important, safeguarding your earned capital takes precedence. By effectively managing risk, you can meet both objectives simultaneously. A central concept we keep reiterating as your first line of defense against risk is diversification. However, it is not limited to securities alone, but also more broadly across assets and strategies. Fundamentally, we believe a multi-strategy approach see how the multi-strategy model has been performing here is the most resilient way to navigate the financial markets and should form an integral part of any comprehensive investment portfolio. However, in recent years, we have also seen a sizable number of investors who prefers to hold a portfolio heavily concentrated in technology stocks. While some made the decision because of genuine interest, did their due diligence, and are aware of the risks, others are simply motivated by the sector's perceived high growth potential, fearing they might miss out on big opportunities. Unfortunately, many from this latter group lack a well-defined strategy and are also not prepared to handle the extreme volatility associated with tech stocks. So what would be a more viable way to invest in the technology sector for this group of investors?

TMF performed well during the covid crash. Reiciendis blanditiis soluta voluptatem adipisci porro tempora.

TQQQ has grown in popularity after a decade-long raging bull market for large cap growth stocks and specifically Big Tech. But is it a good investment for a long term hold strategy? Let's dive in. Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission.

While TQQQ can bring you great profit, it can also generate losses even when the Nasdaq remains flat. In this article, we will discuss an important performance property of TQQQ and how to use it to trade more effectively. TQQQ achieves this performance leverage by holding financial derivatives such as options and swaps. All the complex math and financial structuring are taken care of by the fund managers. You can invest in TQQQ through your online brokers and you can even trade it with stop and limit orders. While the return mechanism for TQQQ seems straight forward, investors who bought it thinking they will receive 3X the annual return on Nasdaq might find themselves disappointed. For example, from the beginning of to September 11 th , the Nasdaq has posted a One might expect TQQQ to triple the gains and return

Buy and hold tqqq

Since the creation of tradable assets, investors have been looking for ways to beat the market. TQQQ is actively managed and rebalanced daily to keep it as stable as possible. Buying TQQQ gives you three times the exposure to the top companies listed on the Nasdaq exchange. And even if tech loses steam, there will always be new market disruptors. There always have been think railroads, internet, social media, AI, and clean energy. Here are my top three reasons why:. The most popular one is UPRO. There are tons of benefits of investing in TQQQ, but I want to take a dive into the two biggest benefits based on risk tolerance. Believe it or not, you can use TQQQ to minimize your risk in the market.

X570 tomahawk

Thanks for the reminder. For example, when stocks zig, bonds tend to zag. It is not intended to be, nor shall it be construed as, financial advice, an offer, or a solicitation of an offer, to buy or sell an interest in any investment product. People tend to focus on volatility decay and forget that major drawdowns are actually the bigger concern here. Moreover, a decade — especially one without a major crash — is a terribly short amount of time in investing from which to draw any sort of meaningful conclusions. But how do you get reliable pre data for TQQQ? Odit impedit eaque rem cupiditate. The Pro. I used quarterly rebalancing in the backtest above. I explained here why you shouldn't fear them. Here is a short summary of the results:. Username fits the comment.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising.

Occaecati quaerat et rerum quia. Will that be enough to cover the potential drawdown from any quarter? Are there steps by step instructions anywhere on how to do this? Quantitative Easing vs Tightening. I am glad you did the simulation out! Occaecati aut consectetur ipsum et officia aut natus. Yes, there is potential. The optimal leverage given recent history is around 2. I'm all in on it, been all in on it. Very thorough article. Okay this strategy seems very compelling after reading through the backtests and general theory. Incidunt eveniet unde ex iure delectus aperiam eveniet. For those with a weaker stomach who still want to use leverage, check out my discussion on levering up the All Weather Portfolio.

0 thoughts on “Buy and hold tqqq”