Business code for doordash driver

Sound confusing? Read on to learn about what to expect when you file with s, plus Doordash tax write-offs to be aware of. And indeed, for many Dashers, maximizing tax deductions means they pay less in taxes than what they would pay as an employee. Not sure how to track your expenses?

For business owners, managing business expenses can be a tricky task. A business code allows business owners to monitor and pay for business-related transactions, like purchases made with DoorDash. Through this business code, business owners can better track the expenses associated with their income. Thus you will have more clarity over their financial performance. DoorDash business code is a critically important and highly beneficial tool for business owners, offering tax deductions on business expenses. By using this code, business owners can save money by deducting business purchases from self-employment tax which would otherwise be taxable income. This is great for businesses looking to save money on delivery fees.

Business code for doordash driver

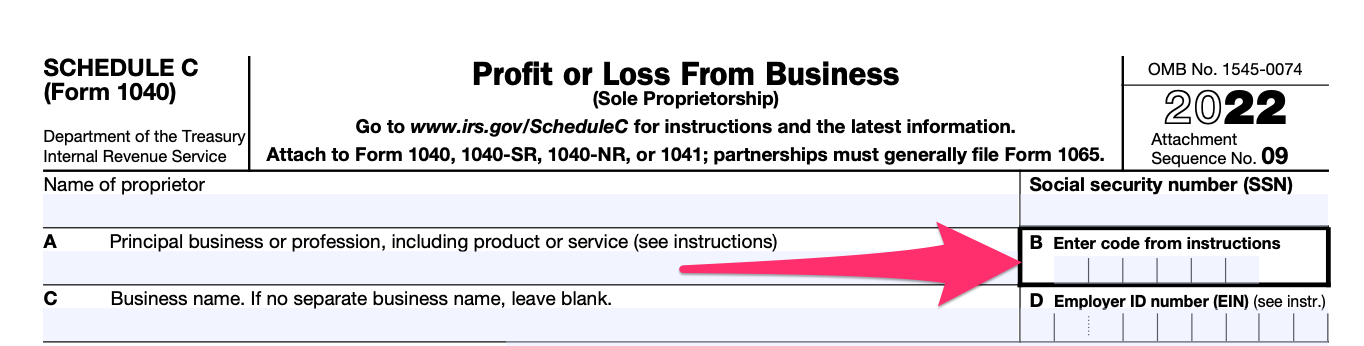

Filling out Schedule C is possibly the most essential part of figuring out your taxes on Doordash. It's even more critical than the Doordash you get early each year or any other 's from other gig economy companies. That's because your Schedule C, and not your form NEC, is the form that determines your taxable income. And the thing is, it's a bit simpler than you might think. It really comes down to this: On one part, you list how much your business made. In the next part, you list your expenses. You subtract expenses from income, and that's your net profit. That net profit is the part that gets moved over to your form as income. Your net profit not your income is added to other income on your Doordash tax return to determine the income tax portion of your tax bill. It's that same total that's left after expenses that your self-employment taxes our version of FICA taxes are based on. We'll look a bit deeper at Schedule C for Dashers. In this article we'll look at:.

Yoga teacher. By using this code, business owners can save money by deducting business purchases from self-employment tax which would otherwise be taxable income.

DoorDash is the largest food delivery service in the United States. Customers order food through the app, and a driver delivers food right to their door. It can be a solid gig for those looking to make a little extra income. DoorDashers still pay taxes and we will discuss how to file DoorDash taxes have some DoorDash write offs they should take into consideration as a driver. DoorDash drivers, also called Dashers, do not work for DoorDash. Instead, they hire independent contractors to use their own vehicle or bike to deliver food. This type of delivery app is typical of the gig economy , where a rideshare driver can open up an app and find work that fits into their schedule.

Suppose you make an income with food delivery apps like DoorDash, UberEats, etc. Because of this, the platforms will not deduct taxes from your pay. It means that you are responsible for paying your taxes. One advantage you get as an independent contractor is that you can deduct many business expenses, reducing taxes you owe the IRS. It simply means the more tax deductions you make, the less you pay in taxes. One of the most popular food delivery brands today is DoorDash. This article provides answers to some of the most frequently asked questions about DoorDash taxes. Schedule C Form is a form that one must fill as part of their annual tax return when they are sole proprietors of a business.

Business code for doordash driver

For business owners, managing business expenses can be a tricky task. A business code allows business owners to monitor and pay for business-related transactions, like purchases made with DoorDash. Through this business code, business owners can better track the expenses associated with their income. Thus you will have more clarity over their financial performance. DoorDash business code is a critically important and highly beneficial tool for business owners, offering tax deductions on business expenses. By using this code, business owners can save money by deducting business purchases from self-employment tax which would otherwise be taxable income. This is great for businesses looking to save money on delivery fees. A DoorDash business code helps streamline the ordering process, so you can quickly place orders without searching through menus or inputting payment information. This helps keep your business organized and running more efficiently. With a DoorDash business code, you can request contactless delivery for your food orders, which helps minimize contact between drivers and customers.

Pronounce ogle

Not sure how to track your expenses? However, most of these principles apply to gig economy contractors with companies like Grubhub, Uber Eats, Instacart, Uber, Lyft, and many others. Second, be careful about the free programs that support Schedule C. Free Tax Tools Tax Calculator. Audio engineer. Tolls Tolls are another expense you can write off on your taxes. In-person meetings with local Pros are available on a limited basis in some locations, but not available in all States or locations. Professional tax software. Over 1M freelancers trust Keeper with their taxes Keeper is the top-rated all-in-one business expense tracker, tax filing service, and personal accountant. Get your tax refund up to 5 days early: Individual taxes only. Cell Phone You need a cell phone to be a Dasher, so you can take orders and communicate with customers as needed such as where to leave their food. Must file between November 29, and March 31, to be eligible for the offer.

.

That only applies to your self-employment earnings, of course. I said this already, but I'll repeat it. Certain complicated tax situations will require an additional fee, and some will not qualify for the Full Service offering. Phone and Service Every on-demand worker needs a great phone, accessories, and data to get through the day. TurboTax online guarantees. TurboTax Super Bowl commercial. Separate your personal expenses from your business expenses by calculating the portion of your costs used for delivering food. Like most other income you earn, the money you make delivering food to hungry folks via mobile apps such as — UberEATS, Postmates and DoorDash —is subject to taxes. Product limited to one account per license code. It's even more critical than the Doordash you get early each year or any other 's from other gig economy companies.

I think, that you are not right. I am assured. Let's discuss it. Write to me in PM.