Boynton beach business tax receipt

American Legal Publishing provides these documents for informational purposes only.

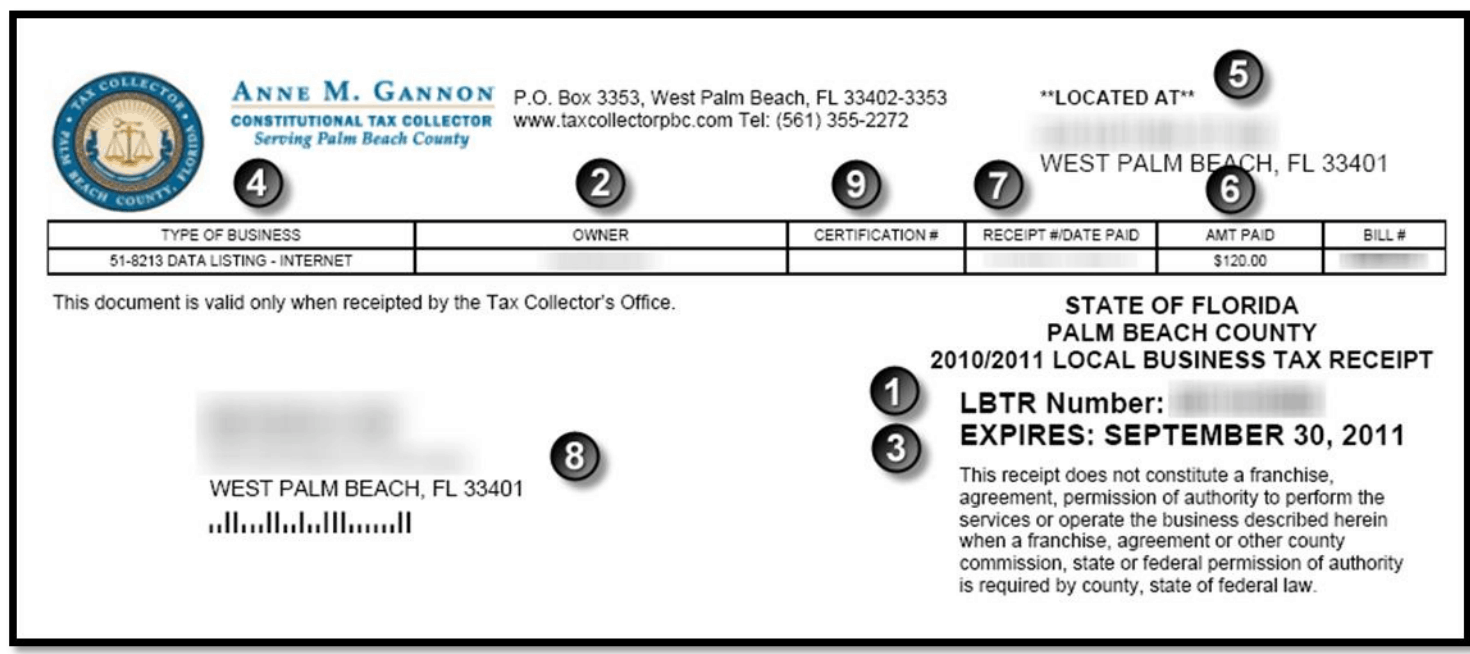

Any person selling merchandise or services in Palm Beach County must have a local business tax receipt. This requirement includes one-person and home-based businesses. A local business tax receipt is in addition to licenses required by law or municipal ordinances. It is subject to zoning regulations, health regulations and any other lawful authority County Ordinance No. A local business tax receipt does not regulate a business or guarantee quality of the work. All incomplete applications will be rejected and be required to be resubmitted once all requirements are met.

Boynton beach business tax receipt

There are a host of licenses and permits that may be required, depending on the type of business activities that you plan to conduct. Regardless of the supplemental licenses and permits that you obtain, you will need to apply for and be issued a business tax certificate from the City of Boynton Beach. You may apply for this certificate online on the City of Boynton Beach website, or if you wish, you may fill in the license and return it in person. What other agencies should you contact? Early on in the process of certifying your business, you will want to contact the Planning and Zoning Department in City Hall to determine your zoning needs. Not every business is acceptable in every zone, and the Planning and Zoning Department can help you to choose a zone best suited to your business activities. It is a general recommendation that you not enter into a real estate contract on any commercial property prior to contacting the Planning and Zoning Department at You will need to have specific inspections if you are opening a new business in Boynton Beach. Some of these inspections include a life and safety inspection and a building inspection. If you are going to prepare food as part of your business, you will need a food service certificate.

Compare to: - No Earlier Versions .

American Legal Publishing provides these documents for informational purposes only. These documents should not be relied upon as the definitive authority for local legislation. Additionally, the formatting and pagination of the posted documents varies from the formatting and pagination of the official copy. The official printed copy of a Code of Ordinances should be consulted prior to any action being taken. For further information regarding the official version of any of this Code of Ordinances or other documents posted on this site, please contact the Municipality directly or contact American Legal Publishing toll-free at

Any person selling merchandise or services in Palm Beach County must have a local business tax receipt. This requirement includes one-person and home-based businesses. A local business tax receipt is in addition to licenses required by law or municipal ordinances. It is subject to zoning regulations, health regulations and any other lawful authority County Ordinance No. A local business tax receipt does not regulate a business or guarantee quality of the work. All incomplete applications will be rejected and be required to be resubmitted once all requirements are met. Once your application has been submitted, a payment processing specialist will email you with payment instructions or ask for additional information.

Boynton beach business tax receipt

Create a Website Account - Manage notification subscriptions, save form progress and more. Renew Your Business Tax Receipt. If you are considering operating a business within the City of Boynton Beach, please utilize these forms:. Business Tax is a unit of the Development Services Department and is responsible for regulating all businesses providing services or performing work within the City limits.

And we can build this dream together lyrics

Boynton Beach Overview. Licensing The Business Tax team also verifies any state or local licensing which may be required. Next Doc. You will need to have specific inspections if you are opening a new business in Boynton Beach. Only inquiries or pick up of previously processed items will be conducted between 4 and 5 pm. Related Articles. South Carolina. You can contact the the City of Boynton Beach for more information on additional permits and licenses at Search by State To find more information about a business license in your state choose the state below. Disclaimer: This site is for informational purposes only and does not constitute legal, financial or tax advise. GatherGuard Liability Insurance. Submit your business name, the physical and mailing address of your business, and phone numbers associated with your business. Share Download Bookmark Print. What other agencies should you contact? Once your application has been submitted, a payment processing specialist will email you with payment instructions or ask for additional information.

.

Create a Website Account - Manage notification subscriptions, save form progress and more. The information on this site should not be relied upon as an official source of information and should be independently verified. Skip to Main Content. You can contact the the City of Boynton Beach for more information on additional permits and licenses at A local business tax receipt does not regulate a business or guarantee quality of the work. Boynton Beach, Florida Code of Ordinances. Back to Code Library. Arrow Left Arrow Right. Helpful Tip Closing a business? If you are going to prepare food as part of your business, you will need a food service certificate. There may be supplemental forms and applications you will need to submit, depending on the type of business you are conducting.

These are all fairy tales!

Can be.