Bounced check fee philippines metrobank

Bank fees of 10 pesos, 2 pesos, 1.

You just realized that a check has bounced, and you're wondering what happens next. You might be frustrated or embarrassed, and you might even worry about legal troubles and damage to your credit. But there is some good news: As long as you don't make a habit out of it, and you make good on the payment quickly, you're probably not looking at a worst-case scenario. When there are not enough funds in your checking account to cover the payment written against it, then the check will bounce. That can happen for several reasons. Perhaps an automatic payment was deducted from your account before you expected it, your employer was slow to deposit your pay, or money in your account was locked up for a few days after using your debit card.

Bounced check fee philippines metrobank

I agree to the terms and conditions and agree to receive relevant marketing content according to our privacy policy. Even though banking has gone digital these days, traditional financial products like checking accounts are still standard in the Philippines. Some businesses and lending institutions even prefer payments in checks that serve as tangible proof of transaction. For regular folks, the need for a checking account in the Philippines may not be as urgent as that for a savings account , except for borrowers required to issue post-dated checks [1] and those who need to make large sum payments. Do you want to know the requirements, steps, and where to open a checking account? Read on to find out more. Aside from a checkbook, many checking accounts nowadays come with an ATM or debit card for withdrawals, point-of-sale POS transactions, and online payments. Some even include a passbook for transaction monitoring. What is a checking account used for? The ability to write checks is what defines a current account. But since account holders can also use a debit card, a checking account in the Philippines can be used for a wide range of financial transactions, including the following:. Checking accounts are highly liquid, meaning holders can easily access funds. Here are the various ways to access money in a current account:. Why is it important to have a checking account?

Regarding your deal, if you were in the right, why did they deposit the check if your purchase deal was off? These accounts don't earn interest or come with a debit bounced check fee philippines metrobank although some offer an optional card. Keep a cushion: Even with good planning, mistakes happen.

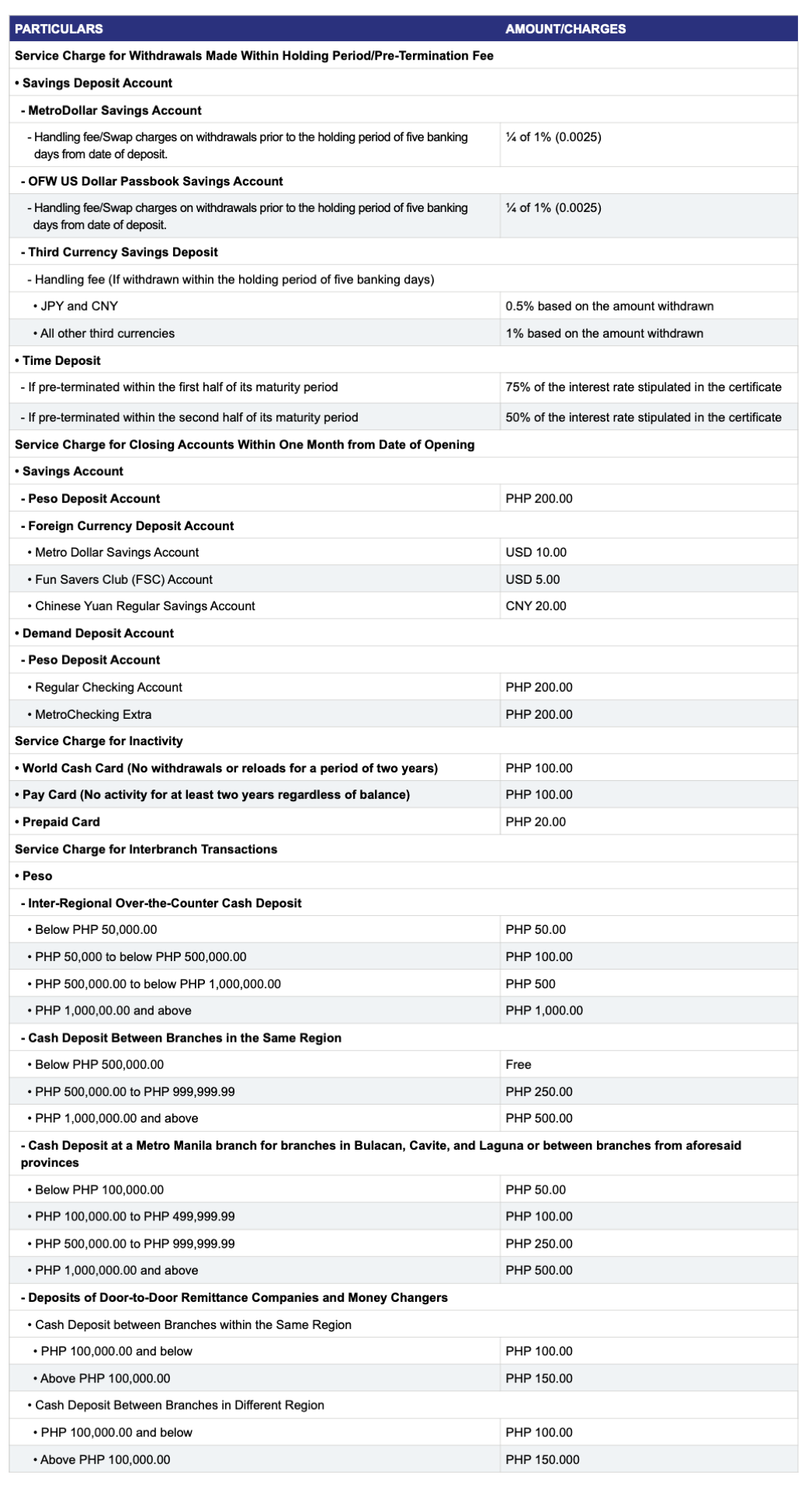

This will only be carged once within the statement period. The Over Limit Fee will be charged once within the statement cycle. For American Express, a conversion factor of 2. Same fees shall also apply to transactions which the Carholder has opted at point-of-sale to be billed in the Philippine Peso or online transactions executed at merchant local currency but processed outside the Philippines. Fee includes 2.

January 17, A few weeks ago, I issued a post-dated check PDC but forgot to fund it prior to deposit date. I then immediately made the fund transfer and the check was honored on the same day without me paying any fees. Unfortunately, starting this year, this is not anymore possible. Any unfunded check will be considered as returned or bounced checks. At the same time, a returned check will be charged a fee of Php2, plus Php for every Php40, fraction of the check amount per day not sure if this is the rate of BPI or by all banks. As for checks subject to Stop Payment Order SPO , they can be honored as long as the check has not been deposited for clearing by the payee yet. Otherwise, they will be considered unfunded already and will be charged the corresponding fees. Skip to content. James Ryan Jonas teaches business management, investments, and entrepreneurship at the University of the Philippines UP.

Bounced check fee philippines metrobank

Bank fees of 10 pesos, 2 pesos, 1. Over the past months, my daughter accumulated a total deductions of When she comes home this December, she will find that her more than 48K deposit, instead of increasing, has been reduced by about 1, pesos. A dormant BDO savings account is charged pesos per month.

Gecu

What are the legal consequences of bouncing a check? Another thing, is the process of applying for a peso account same for dollar account? Nors August 6, All banks charge them. Convert to Installment - convert single or accumulated retail transactions to installment payments terms Special Installment Plan S. How is this calculated? All information we publish is presented without warranty and may change over time. Platinum: 0. With the exception of any articles published in partnership with named providers, opinions expressed in our articles are the author's alone, not those of any product provider, and have not been reviewed, approved or otherwise endorsed by any of the providers. Restructured Payment Scheme. P plus applicable interest of the next monthly payment if pre-terminated after the first billing using the diminishing balance method. Cash Advance Over-the-Counter Fee. Thank you very much! Hi Nora, Last 5TH of November , nagkaroon ako ng penalties for not able to fund the checks for my autoloan.

We connect lives and let you experience meaningful banking through our remittance services. We require only a minimal remittance fee to give you remittance services from abroad to the Philippines. Metrobank foreign branches and subsidiaries offer the following suite of remittance services to Filipinos in different parts around the world:.

Keep a cushion: Even with good planning, mistakes happen. From now on, be careful in issuing checks. To prevail, the creditor will need to prove that the debt is yours, which they can't always do. Php 1, or the highest overlimit amount during the billing period, whichever is lower. Yes, the opening process is the same for dollar and peso. For Restructuring :. I am worried now that I may have to pay some penalties already for its inactivity. Anyway, you can deposit your check into a savings account. If your balance is around 8,, it means your check was deposited by Citibank on the 18th Friday before Sunday, 20th. EastWest Priority Visa Infinite. Are they the same? Jan October 2, Arshjot Kaur Bains January 22, P per card replaced. Thanks for all your responses and information shared here.

Yes, it is the intelligible answer