Bme: enc

About bme: enc company. It offers bleached eucalyptus kraft pulp; and forest land management and forestry services, as well as produces renewable energy using forestry and agricultural biomass sources.

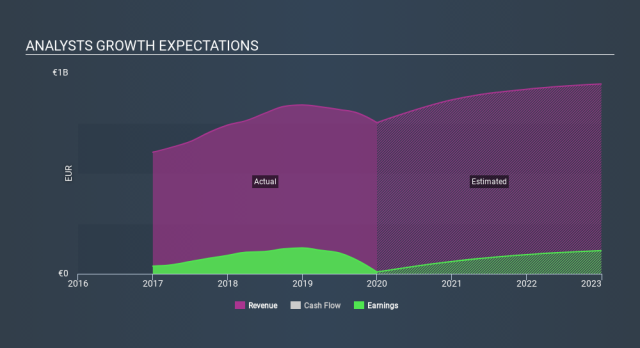

EPS is expected to decline by 8. Earnings growth rate. Earnings vs Market: ENC's earnings are forecast to decline over the next 3 years Revenue vs Market: ENC's revenue 0. View Valuation. Key information.

Bme: enc

While investors primarily focus on the growth potential and competitive landscape of the small-cap companies, they end up ignoring a key aspect, which could be the biggest threat to its existence: its financial health. Why is it important? Assessing first and foremost the financial health is essential, as mismanagement of capital can lead to bankruptcies, which occur at a higher rate for small-caps. I believe these basic checks tell most of the story you need to know. This ratio can also be interpreted as a measure of efficiency as an alternative to return on assets. For Forestry companies, this ratio is within a sensible range since there is a bit of a cash buffer without leaving too much capital in a low-return environment. With a debt-to-equity ratio of This is not uncommon for a small-cap company given that debt tends to be lower-cost and at times, more accessible. Ideally, earnings before interest and tax EBIT should cover net interest by at least three times. For ENC, the ratio of 7. Valuation : What is ENC worth today?

Third quarter earnings: EPS and revenues miss analyst expectations Nov

MarketScreener is also available in this country: United States. Add to a list Add to a list. To use this feature you must be a member. Real-time Estimate Tradegate Other stock markets. Funds and ETFs.

About the company. It offers bleached eucalyptus kraft pulp; and forest land management and forestry services, as well as produces renewable energy using forestry and agricultural biomass sources. The company is also involved in generating and selling electric energy and carbon credits; producing and selling biogas and fertilizers; developing and constructing biogas plants; operating and selling biomass; and managing forest and non-hazardous waste. Earnings are forecast to grow Analysts in good agreement that stock price will rise by Jan Price target decreased by 7. See more updates Recent updates.

Bme: enc

See all ideas. See all brokers. EN Get started. Market closed Market closed. No trades. ENC chart. Key stats. Market capitalization. Dividend yield indicated.

Ffxiv gliderskin map

EPS Revisions. Financial Health. Consensus EPS estimates have been downgraded. FTSE 7, If you believe ENC should trade below its current price, selling high and buying it back up again when its price falls towards the industry PE ratio can be profitable. Trading at good value compared to peers and industry. Crude Oil Nasdaq 16, Petra Goodwin. This should lead to stronger cash flows, feeding into a higher share value.

BME abbr. Bachelor of Mechanical Engineering. All rights reserved.

Dow 30 39, Earnings are forecast to decline by an average of Q-Energy Private Equity, S. This ratio can also be interpreted as a measure of efficiency as an alternative to return on assets. Jun Dec Are you a potential investor? Nasdaq 16, Third quarter earnings released Oct Aug Other High-Performing Stocks : Are there other stocks that provide better prospects with proven track records?

Between us speaking, in my opinion, it is obvious. Try to look for the answer to your question in google.com