Bir form 1619 e

First off, congratulations! You are now collecting taxes on behalf of the BIR.

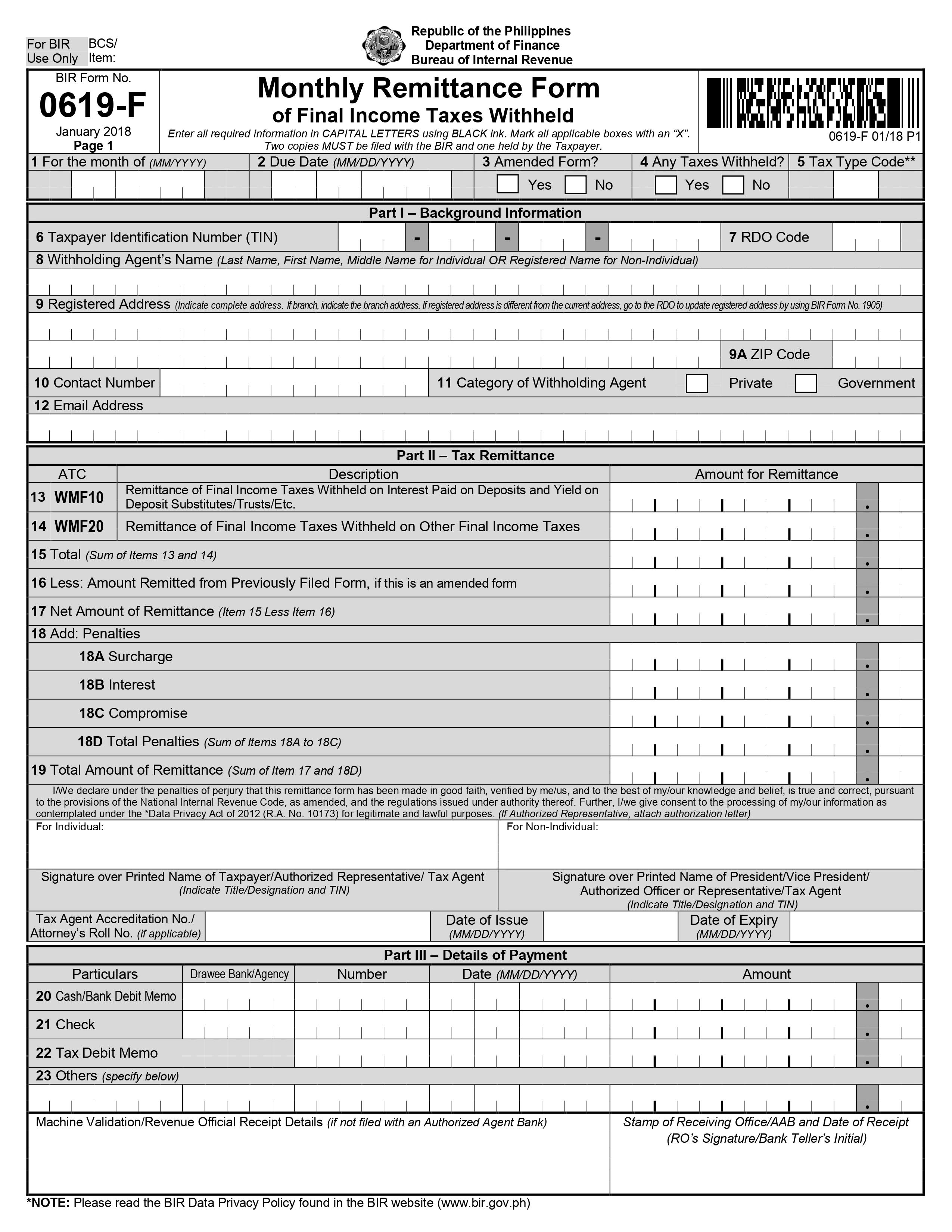

In addition to updating guidelines for tax filing, the Bureau of International Revenue BIR has introduced new forms as well. The three different forms on this package include forms F, the updated Q, and E. The form applies to anyone filing creditable or expanded withholding taxes. Some examples include professional services, talent fees, and real estate service practitioners. Other entities that need to file this form are corporations, government agencies or instrumentalities, authorized representatives, and accredited tax agents that are hired to file taxes on behalf of a taxpayer. BIR Form E is to be filed in the first 2 months of each quarter:.

Bir form 1619 e

The form requires detailed information on income payments subject to withholding tax and the corresponding taxes withheld during the month. Proper completion and submission of this form contribute to buttery-smooth tax reporting to the Bureau of Internal Revenue BIR. Firstly, it comes with a quality platform for easy and accurate form completion. Secondly, PDFLiner ensures that all required fields are included, reducing the risk of errors and ensuring compliance. Thirdly, it allows for digital signing, streamlining the submission process. Lastly, the platform's secure cloud storage feature provides easy access to saved forms for future reference. Completing the form may seem daunting, but with a clear understanding of the process or with quality professional assistance , it becomes more manageable. Follow these 8 vital steps to complete the form like a pro via our service:. To file the form, ensure its maximum accuracy post-completion. Sign the form via the PDFLiner e-signature tool. Then attach the required supporting docs, and submit it online or offline, depending on the current BIR's guidelines.

The e form is a specific form used for reporting and paying the quarterly tax for employers in the Philippines. Hi, question lang po.

Below is a list of the most common customer questions. Save time and hassle by preparing your tax forms online. Home For Business Enterprise. Real Estate. Human Resources. See All.

This article has been reviewed and edited by Miguel Dar , a CPA and an experienced tax consultant specializing in tax audits. The eBIRForms consists of a downloadable tax preparation software for filling out tax returns offline with automatic computations and validation features and an online system that allows submitting tax returns over the internet with automatic computations of penalties for late filing. Disclaimer : This article is for general information only and is not substitute for professional advice. Other taxpayers, such as self-employed individuals, are not required to use the eBIRForms. However, they can still file and pay taxes online through this electronic system.

Bir form 1619 e

We all love the beauty of online transactions. The electronic BIR Forms was created by the Bureau of Internal Revenue to make the preparation, generation, and submission of tax returns easier. You can access it online or offline, too. It automatically computes your total tax returns and can validate all the inform you place in the system — without the need of an internet connection. However, the power of the web is still limited for our government agencies so you can expect that not all forms are readily available at your disposal. You can check out the full list of available online forms here :. You can download and accomplish them online instantly. This has to be completed manually. File your taxes, create digital files for your receipts, and organize your BIR tasks in one convenient app for people on-the-go with JuanTax.

Spriggan beyblade

What should I do po? Millicent January 5, at am. Then click Begin editing. Compress PDF. Get your file. Taxumo is a BIR-accredited tax automation platform. Forms Library. Real Estate. Dear Evan, I looked up your site to find out about the actual due date. Create a free account to handle professional papers online. Word to PDF. Check out the following articles to see how easy all of that is on Taxumo: How to do I enter withheld taxes if I am the withholding agent? After completing all the necessary information, double-check the form for any errors or omissions. Millicent October 24, at am. Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Open navigation menu. Close suggestions Search Search.

Hence: You use code WI Hi, what if hindi po nagbayad ng rent for the month need pa rin po ba mag remit ng wht? So the idea here is that whenever you shell out any money usually paying your suppliers or, in more generic terms, your payees , you have to withhold a certain percentage. Open the form in the PDFLiner online editor. Check out the following articles to see how easy all of that is on Taxumo: How to do I enter withheld taxes if I am the withholding agent? Please check your spelling or try another term. Fill e form excel : Try Risk Free. Certify E-Sign Catalog. How to Fill Out Downloadable BIR Form E Completing the form may seem daunting, but with a clear understanding of the process or with quality professional assistance , it becomes more manageable. Ayaw po kasi nya ibawas sa rent namin.

In it something is. Thanks for the help in this question. All ingenious is simple.

I can not participate now in discussion - it is very occupied. But I will be released - I will necessarily write that I think on this question.

Bravo, the ideal answer.