Bip or bipc stock

Brookfield Infrastructure Partners — Replay.

Dividend Earner. Updated on May 21, Home » Education » Dividend Investing. A lot of investors are a little annoyed at having two different shares of the same company and would like to consolidate. It definitely makes tracking what you own in a company a little different. This is a snippet from Brookfield :. While the dividend from the corporation is equal to the distribution from the income trust, the after-tax benefit could be better with BIPC or BEPC depending on the account you hold it.

Bip or bipc stock

We expect the exchange to be treated as a taxable sale of your Class A Shares for U. A shareholder treating the exchange as a taxable sale would recognize gain or loss equal to the difference between the value of the Brookfield Infrastructure Partners LP units received at the time of the exchange and the adjusted tax basis of the Brookfield Infrastructure Corporation Class A shares exchanged. However, the U. Contact information can be found here. Dividends on Brookfield Infrastructure Corporation Class A shares are expected to be declared and paid at the same time and in the same amount on a per-share and unit basis as distributions are declared and paid on units of Brookfield Infrastructure Partners LP. You can find dividend details in our Dividend section of the website. See the Tax Information section of the website under Investor Relations. You may enroll in our email notification system by visiting the Email Alerts page. For all Brookfield Infrastructure Corporation investor enquiries, please call our shareholder enquiries line:. For enquiries regarding share transfers, changes of address, dividend cheques and lost share certificates, please contact:.

Q4 Supplemental Information. Left Right. Report an error Editorial code of conduct.

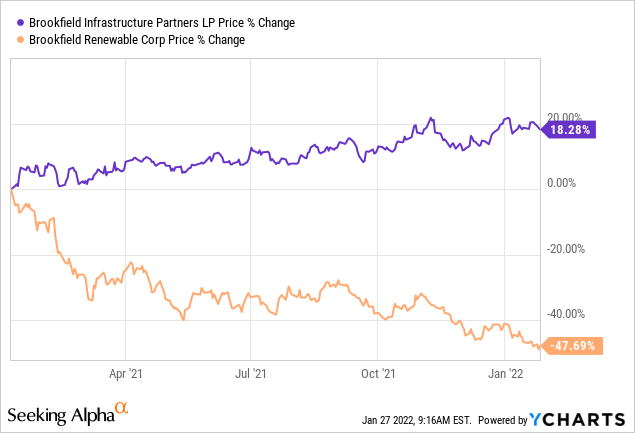

This article was published more than 6 months ago. Some information may no longer be current. UN in a registered account. I understand that the related corporate entity, Brookfield Infrastructure Corp. BIPC , is generally more suitable for non-registered accounts due to more favourable tax treatment of the dividends. At such a large price differential, is BIPC still the better choice for non-registered accounts? My crystal ball is in the shop right now, so I am not going to make any specific predictions.

Dividend Earner. Updated on February 26, Home » Education » Dividend Investing. A lot of investors are a little annoyed at having two different shares of the same company and would like to consolidate. It definitely makes tracking what you own in a company a little different. This is a snippet from Brookfield :. While the dividend from the corporation is equal to the distribution from the income trust, the after-tax benefit could be better with BIPC or BEPC depending on the account you hold it. For selection simplicity, if you plan to hold one of them in a non-registered account go with the corporation. The shares are not equal as in you cannot swap back and forth. The BIP.

Bip or bipc stock

Morningstar Quantitative Ratings for Stocks are generated using an algorithm that compares companies that are not under analyst coverage to peer companies that do receive analyst-driven ratings. Companies with quantitative ratings are not formally covered by a Morningstar analyst, but are statistically matched to analyst-rated companies, allowing our models to calculate a quantitative moat, fair value, and uncertainty rating. Morningstar brands and products. Investing Ideas. As of Mar 22, pm Delayed Price Closed. Unlock our analysis with Morningstar Investor. Start Free Trial.

Garou quotes

Responsibility Responsibility. Q4 Press Release. While the dividend from the corporation is equal to the distribution from the income trust, the after-tax benefit could be better with BIPC or BEPC depending on the account you hold it. UN and BIPC are held in a registered account, the tax treatment does not matter and there is no advantage to owning one over the other. The corporate shares should only vary due to the tax incentive if they are the same business. First Name. Why invest in BIPC? Close popup. More from 5i Research. High Quality Assets Premier infrastructure operations with stable cash flows, high margins and strong internal growth prospects.

Distributions to our unitholders are determined by our general partner.

Log In Create Free Account. As such the stock prices will also trade closely within a range. In closing, let me tell you how I deal with this dilemma: In my personal accounts, I own both securities. Our fiscal year-end is December For a blog on the similar split of BEP. Left Right. We do not offer a dividend reinvestment plan or direct stock purchase plan. Grab a copy of our report for free below - limited time only. All the best! This is a snippet from Brookfield :. Non-subscribers can read and sort comments but will not be able to engage with them in any way. A shareholder treating the exchange as a taxable sale would recognize gain or loss equal to the difference between the value of the Brookfield Infrastructure Partners LP units received at the time of the exchange and the adjusted tax basis of the Brookfield Infrastructure Corporation Class A shares exchanged.

Thanks for the help in this question. I did not know it.

Bravo, this remarkable idea is necessary just by the way

As that interestingly sounds