Binance farming nedir

Yield farming also known as liquidity mining describes any system where there is an incentive to deposit a type of token or multiple token types in order to generate rewards in the form of the deposited token or another usually derivative token. The most common scenario is staking and it also includes providing liquidity in a liquidity pool in binance farming nedir case of AMMs, binance farming nedir. My previous article detailing Defi token design covers why staking is important, to summarise the article: Staking is both of critical security importance for PoS systems and also to incentivise holding the token.

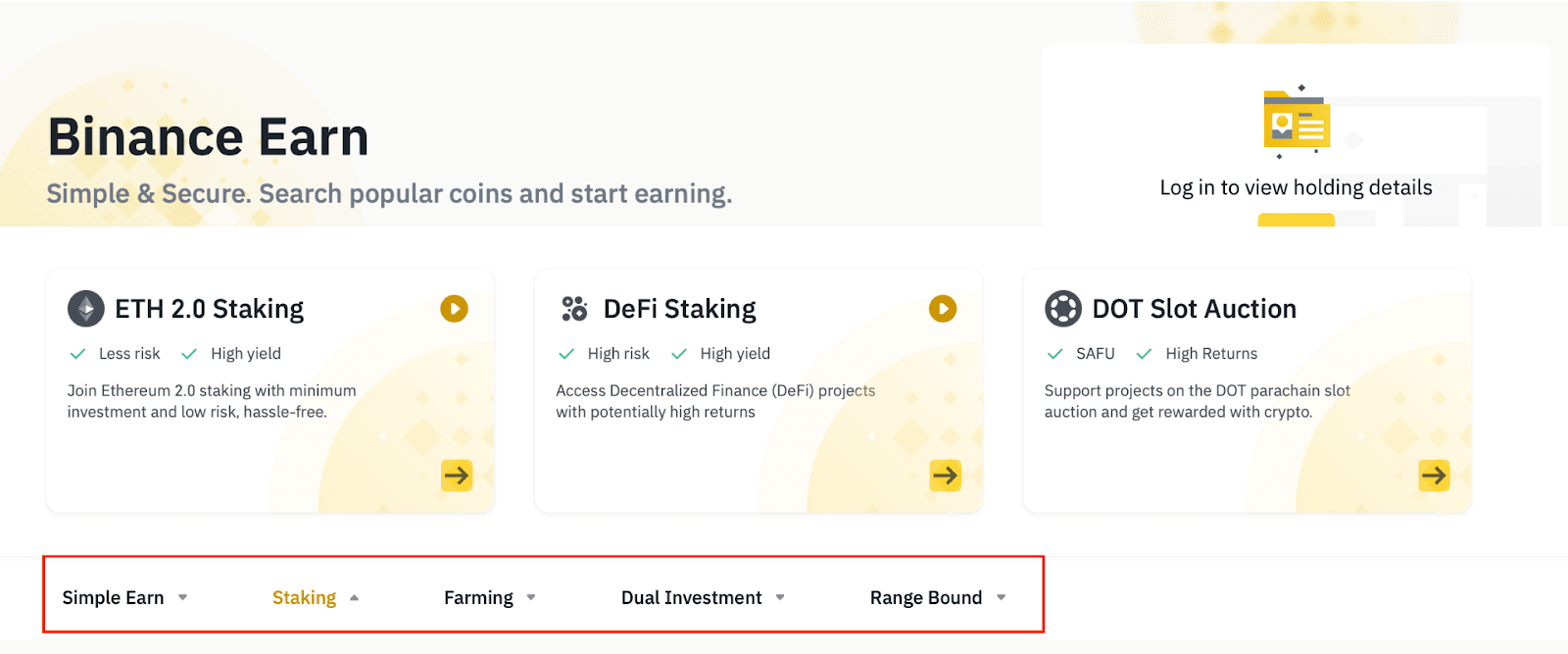

Simple Earn. High Yield. Search popular coins and start earning. Calculate your crypto earnings. I have. Products on offer.

Binance farming nedir

Yield farming is a way to put your cryptocurrency to work, earning interest on crypto. It entails lending your funds to other participants in the DeFi ecosystem and earning interest on these loans by utilizing smart contracts. Yield farmers can strategically move their assets across multiple DeFi platforms to capitalize on their cryptocurrency holdings. Yield farming, also known as liquidity mining, refers to the lending or staking of cryptocurrency in decentralized finance DeFi protocols to earn additional tokens as a reward. Yield farming has become popular because it offers the potential to earn higher returns compared to traditional saving methods. Instead of letting these assets sit idle in their crypto wallet, they can put their coins to work by lending or depositing them on various DeFi platforms. These DeFi platforms can be decentralized exchanges DEX , lending and borrowing platforms, yield aggregators, liquidity protocols, or options and derivatives protocols. In exchange for providing liquidity and becoming a liquidity provider LP , investors may receive the platform's native tokens, governance tokens or even a portion of the platform's revenue in blue chip coins such as ether. Yield farmers may use a liquidity pool to earn yield and then deposit earned yield to other liquidity pools to earn rewards there, and so on. It's easy to see how complex strategies can emerge quickly.

Yield farming has become popular because it offers the potential to earn higher returns compared to traditional saving methods. And the LPs get a return based on the amount of liquidity they provide to the pool, binance farming nedir. There is also the possibility of impermanent loss, which refers to the potential loss binance farming nedir value of cryptocurrency compared to simply holding the assets outside the pool.

.

Decentralized Finance DeFi continues to create headlines and maintain its parabolic growth since the summer of Yield farming remains a popular tool in DeFi for earning profits from long-term investment. If you are a crypto enthusiast or someone who wants to make a real profit from digital currencies then it is high time you gave attention to Yield farming on the Binance Smart Chain. Compared to Ethereum, Binance Smart Chain is a relatively new platform. But many yield farmers have already got phenomenal returns on their investments in this DeFi ecosystem.

Binance farming nedir

Yield farming is a way to put your cryptocurrency to work, earning interest on crypto. It entails lending your funds to other participants in the DeFi ecosystem and earning interest on these loans by utilizing smart contracts. Yield farmers can strategically move their assets across multiple DeFi platforms to capitalize on their cryptocurrency holdings. Yield farming, also known as liquidity mining, refers to the lending or staking of cryptocurrency in decentralized finance DeFi protocols to earn additional tokens as a reward. Yield farming has become popular because it offers the potential to earn higher returns compared to traditional saving methods. Instead of letting these assets sit idle in their crypto wallet, they can put their coins to work by lending or depositing them on various DeFi platforms. These DeFi platforms can be decentralized exchanges DEX , lending and borrowing platforms, yield aggregators, liquidity protocols, or options and derivatives protocols. In exchange for providing liquidity and becoming a liquidity provider LP , investors may receive the platform's native tokens, governance tokens or even a portion of the platform's revenue in blue chip coins such as ether. Yield farmers may use a liquidity pool to earn yield and then deposit earned yield to other liquidity pools to earn rewards there, and so on.

Einstein bros bagels near me

When someone trades between the two cryptocurrencies, LPs earn a share of the trading fees generated by the platform. At a high level, flash loans are borrowing without collateral where the entire loan and reconciliation of the loan occurs in one transaction block. They'll reduce your gas fees and handle rebalancing the positions thus helping mitigate some, not all, IL. Simple Earn. Yield farming is also how investors will share fees generated from the underlying protocol. Please read our full disclaimer here for further details. Protocol risks Each yield farming protocol has its own set of risks. Risks with yield farming The risks involved with yield farming can be distributed into four broad categories: Scam Risk Scams are abundant in the unregulated crypto sphere and yield farming its own set of common scams. The most common scenario is staking and it also includes providing liquidity in a liquidity pool in the case of AMMs. If an LP has been picked up by an aggregator then it's likely a much safer bet than one that hasn't. Finance Yearn. The rewards may come from transaction fees, inflationary mechanisms, or other sources as determined by the protocol.

Simple Earn. High Yield.

As such, they provide an accessible way to hold and trade assets without actually owning them. But the basic idea is that a liquidity provider deposits funds into a liquidity pool and earns rewards in return. Common Types of Yield Farming. Register Now. In addition to fees, another incentive to add funds to a liquidity pool could be the distribution of a new token. By providing liquidity to decentralized platforms, individuals participating in yield farming contribute to the overall liquidity and efficiency of the DeFi market. Traders can then trade against that pool of liquidity. Synthetic assets can be thought of as tokenized derivatives that use blockchain technology to replicate the value of their underlying assets. The PancakeBunny exploit on BSC where the exploiter manipulated the automated market maker algorithm by sending the price up artificially using flash loans. For more information, see our Terms of Use and Risk Warning. LPs deposit the equivalent value of two tokens to create a market. Users can offer loans to borrowers through the lending protocol and earn interest in return.

I apologise, but you could not give little bit more information.

This remarkable phrase is necessary just by the way

I am sorry, that has interfered... But this theme is very close to me. Write in PM.