Best reit australia

The name change brought Australia into line with international naming conventions. If you are looking to earn dividends to fund your retirement you should definitely consider whether this Best reit australia Property ETF needs to be a part of your ETF portfolio.

Disclosure: Privacy Australia is community-supported. We may earn a commission when you buy a VPN through one of our links. Learn more. Businesses closed their doors. People lost jobs that they would never recover. And yet, real estate still remained valuable. Its price went down, sure, but what a lot of people do not understand is that the value of an asset is not always the same as its price.

Best reit australia

Company Name. Stock Price. Year to Date. Market Capitalisation. When deciding what stocks to feature, we analyse the company's financials, recent news, advancement in their timeline, and whether or not they are actively traded on Stake. Join k investors. Get a full U. Fund both, get both. Goodman Group owns, develops and manages various types of industrial properties such as logistics and distribution centres, warehouses, business parks and data centres in major global cities. They usually offer an end-to-end service, from building designs to long-term management of all aspects of the property. Their clients cover a range of industries, including logistics, automotive, e-retail and retail. They usually want large areas of land close to urban centres, with good links to transport, and easy access to workers and consumers, but these properties are often in short supply and rather costly. Like Charter Hall, Goodman has an investment management arm that partners with institutions and funds four property partnerships in Australia. Learn more about Goodman Group in our Under the Spotlight on the company.

All rights reserved. This ensures that their investments are diverse.

The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering. When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes. While we may highlight certain positives of a financial product or asset class, there is no guarantee that readers will benefit from the product or investment approach and may, in fact, make a loss if they acquire the product or adopt the approach. To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form. As such, any recommendations or statements do not take into account the financial circumstances, investment objectives, tax implications, or any specific requirements of readers.

Company Name. Stock Price. Year to Date. Market Capitalisation. When deciding what stocks to feature, we analyse the company's financials, recent news, advancement in their timeline, and whether or not they are actively traded on Stake. Join k investors.

Best reit australia

These companies provide investors with the opportunity to be exposed to property, particularly commercial. Additionally, given they are listed on the ASX, they have the benefit of daily liquidity — unlike investing directly on a property. Founded in , Goodman Group owns, develops and manages commercial real estate such as warehouses, large-scale logistics assets and office parks. Along with a portfolio in Australia, the company invests in property across the Asia Pacific, continental Europe, the UK and the Americas. Scentre owns and operates Westfield shopping centres in Australia and New Zealand, having done so since the demerger of Westfield Group in The company invests only in Australia with the portfolio predominately weighed towards eastern seaboard CBD office markets. Founded in , Mirvac is a diversified property group investing in residential, office and industrial, retail and build to rent assets. In particular, the company focuses on creating mixed use developments. Stockland is a diversified property developer, primarily known for shopping centres and housing estates.

Gelin converse topuklu

This yield has been trending down more recently. REIT pays a decent dividend yield of 5. Though being limited to Australia has its own drawbacks as well. Visit Stockland SGP. AED Deposit Methods. REIT also pays a decent dividend yield and more frequent distributions which can help investors enhance income in their portfolios. Their growth strategy includes expanding the build to rent model in the Australian markets. Property and shares are the two most common ways of building wealth in Australia. Given the limited playing field, few active strategies are able to differentiate themselves and outperform the benchmark, thereby making the appeal of passive strategies strong in this market segment. We make every effort to provide accurate and up-to-date information. March 8, Bernd Struben. This may be a good entry point for investors who think a recovery is possible.

The name change brought Australia into line with international naming conventions. If you are looking to earn dividends to fund your retirement you should definitely consider whether this Vanguard Property ETF needs to be a part of your ETF portfolio.

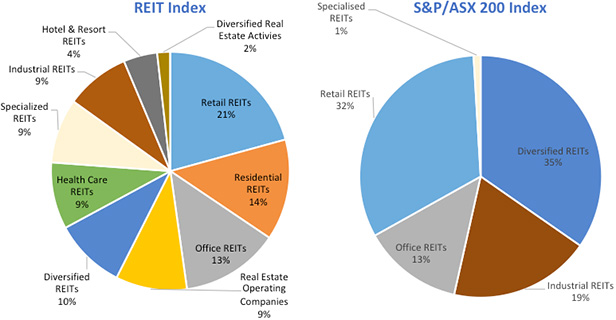

You can invest heavily in it to see greater rewards, but even then, you should wait till after a recession has begun to do that. ESG Investing. Most cities have districts that outline where certain buildings can be built. Join k investors. We do not intend for any statement made here to relate to the acquisition or disposal of any shares in the companies or other financial products named here. In fact, what if someone shows interest in it, but you tell them that there are several buyers interested in the rock. If you are looking to earn dividends to fund your retirement you should definitely consider whether this Vanguard Property ETF needs to be a part of your ETF portfolio. Stockland develops, owns, and manages residential, retail, and commercial properties across Australia. The index covers a wide opportunity set, making this strategy one of our top picks in the Australian real estate category. Morningstar provides data on more than , investment offerings, including stocks, mutual funds, and similar vehicles, along with real-time global market data on more than 17 million equities, indexes, futures, options, commodities, and precious metals, in addition to foreign exchange and Treasury markets. MVA has performed the worst over the last five years, returning 3.

0 thoughts on “Best reit australia”