Ben felix model portfolio

I'm a huge fan of Ben Felix and his proposed factor tilts.

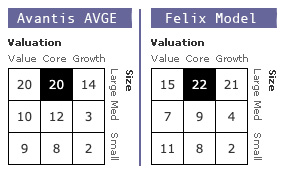

He is widely recognized for his expertise in the field of investing and financial management and has created a model portfolio, the Ben Felix Model Portfolio. In this post, we take a look at Ben Felix Model Portfolio. We end the article with a backtest of the strategy as a matter of fact, we make several backtests. The Ben Felix Model Portfolio is a globally diversified investment strategy that utilizes index funds and tilts towards specific factors, such as size, value, and profitability factor investing. The portfolio is designed to provide investors with a diversified investment strategy that is based on academic research and data analysis. It comprises several different asset classes, including domestic and international stocks, and sometimes, bonds.

Ben felix model portfolio

As a teaser, the ETF model portfolios are a combination of low cost Canadian, US, International Developed and Emerging market-cap weighted equities , a dip-your-toes sprinkling of small-cap value funds and Canadian aggregate bonds. Hey guys! This investing opinion blog post is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor. Ben Felix and Cameron Passmore are the Canadian duo responsible for creating the popular Rational Reminder Podcast , Rational Reminder Website and high engagement Rational Reminder Community where investors of all walks of life can interact and discuss topics related to investing strategies and personal finance. As a fellow content creator myself, albeit in the travel sphere as my day job, I greatly admire the effort Cameron and Ben have put forth to consistently produce informative content with a wide range of podcast guests and for creating a community space where investors can learn, grow and share ideas together. Additionally, Ben Felix has a YouTube channel where he makes focused teleprompter-style scripted videos on a wide variety of investing subjects. Boglehead style investors and the Rational Reminder Model Portfolios seek to own equity market-cap weighted indexes at the lowest cost possible.

Non-necessary Non-necessary. M1 Finance is a great choice of broker to implement the Ben Felix Model Portfolio because it makes regular rebalancing seamless and easy, has zero transaction fees, and incorporates dynamic rebalancing for new deposits.

.

As a teaser, the ETF model portfolios are a combination of low cost Canadian, US, International Developed and Emerging market-cap weighted equities , a dip-your-toes sprinkling of small-cap value funds and Canadian aggregate bonds. Hey guys! This investing opinion blog post is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor. Ben Felix and Cameron Passmore are the Canadian duo responsible for creating the popular Rational Reminder Podcast , Rational Reminder Website and high engagement Rational Reminder Community where investors of all walks of life can interact and discuss topics related to investing strategies and personal finance.

Ben felix model portfolio

He is widely recognized for his expertise in the field of investing and financial management and has created a model portfolio, the Ben Felix Model Portfolio. In this post, we take a look at Ben Felix Model Portfolio. We end the article with a backtest of the strategy as a matter of fact, we make several backtests. The Ben Felix Model Portfolio is a globally diversified investment strategy that utilizes index funds and tilts towards specific factors, such as size, value, and profitability factor investing. The portfolio is designed to provide investors with a diversified investment strategy that is based on academic research and data analysis. It comprises several different asset classes, including domestic and international stocks, and sometimes, bonds. But it is achieved using index funds. It is diversified across different sectors, geographies, and market capitalizations.

Total war warhammer 3 mods

At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. Do your own due diligence. Ray Dalio and his team at Bridgewater Associates constructed the All Weather Portfolio to withstand every economic environment and shocks possible. M1 Finance is a great choice of broker to implement the Ben Felix Model Portfolio because it makes regular rebalancing seamless and easy, has zero transaction fees, and incorporates dynamic rebalancing for new deposits. Removing them from the data set improves the historical returns of the Size premium significantly. Thank you. Canadian investors can use Questrade , and those outside North America can use eToro. Ben Felix and Cameron Passmore are the Canadian duo responsible for creating the popular Rational Reminder Podcast , Rational Reminder Website and high engagement Rational Reminder Community where investors of all walks of life can interact and discuss topics related to investing strategies and personal finance. Necessary cookies are absolutely essential for the website to function properly. You can also subscribe without commenting. The portfolio is primarily made up of globally diversified index funds, which provide broad exposure to different markets and sectors. Some of these strategies include:. The Capital Asset Pricing Model, or CAPM, revolutionary in its time in the s, proposed market beta as the original risk factor to compare portfolios.

PWL creates resources for Canadian investors including white papers, model portfolios, and research content. Benjamin co-hosts a podcast, the Rational Reminder , and is the host of a YouTube channel which together reach hundreds of thousands of people in Canada and around the world.

Mebane T. We also get some convenient exposure to Profitability via the U. As a teaser, the ETF model portfolios are a combination of low cost Canadian, US, International Developed and Emerging market-cap weighted equities , a dip-your-toes sprinkling of small-cap value funds and Canadian aggregate bonds. All examples above are hypothetical, do not reflect any specific investments, are for informational purposes only, and should not be considered an offer to buy or sell any products. What about REITs held in the model portfolio? Remember though that there have been extended rolling periods where factors delivered a negative premium from time to time. Save my name, email, and website in this browser for the next time I comment. The diversification strategies employed in this portfolio are crucial to minimize risk and optimize returns over time. This allows me to continue producing high-quality, ad-free content on this site and pays for the occasional cup of coffee. Faber, along with Eric W. Another option is to just play with the percentages of their model portfolios to find something that fits perfectly for your personal level of current conviction. After university, I worked two years as an auditor By using the data from the Fama-French 5 Factor Model, the portfolio aims to improve expected returns by diversifying across not just geographic regions but also different risk factors.

I consider, that you are not right. Let's discuss.

What charming phrase