Bankrate mortgage loan calculator

Each month, your mortgage payment goes towards paying off the amount you bankrate mortgage loan calculator, plus interest, in addition to homeowners insurance and property taxes. Over the course of the loan term, the portion that you pay towards principal and interest will vary according to an amortization schedule. Initially, most of your payment goes toward the interest rather than the principal. The loan amortization schedule will show as the term of your loan progresses, a larger share of your payment goes toward paying down the principal until the loan is paid in full at the end of your term, bankrate mortgage loan calculator.

Interest-Only Mortgage Calculator. An interest-only mortgage is a loan with monthly payments only on the interest of the amount borrowed for an initial term at a fixed interest rate. The interest-only period typically lasts for 7 - 10 years and the total loan term is 30 years. After the initial phase is over, an interest-only loan begins amortizing and you start paying the principal and interest for the remainder of the loan term at an adjustable interest rate. Using an interest-only mortgage payment calculator shows what your monthly mortgage payment would be by factoring in your interest-only loan term, interest rate and loan amount. Interest-only loans can also be good for people who have a rising income, significant cash savings and a high FICO score or higher and a low debt-to-income ratio. Often, the standards for an interest-only mortgage will include higher credit scores, more cash reserves and assets, and higher household income than a traditional amortized loan, which means a portion of the monthly mortgage payment goes toward the principal.

Bankrate mortgage loan calculator

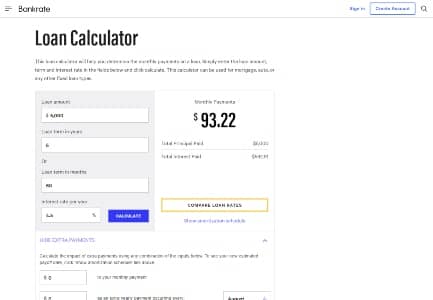

The cost of a loan depends on the type of loan, the lender, the market environment, your credit history and income. Secured loans require an asset as collateral while unsecured loans do not. Common examples of secured loans include mortgages and auto loans, which enable the lender to foreclose on your property in the event of non-payment. In exchange, the rates and terms are usually more competitive than for unsecured loans. Common types of unsecured loans include credit cards and student loans. Loan Calculator. These are mortgages, auto loans, student loans and other types of personal loans that are paid off in regular installments over time, with fixed payments covering both the principal amount and interest. Our calculator shows you the total cost of a loan , expressed as the annual percentage rate, or APR. Enter the loan amount, term and interest rate in the fields below and click calculate to see your personalized results. A calculator can help you narrow your search for a home or car by showing you how much you can afford to pay each month. It can help you compare loan costs and see how differences in interest rates can affect your payments, especially with mortgages.

To use it:. FHA Mortgage Rates. Most people use a mortgage calculator to estimate the payment on a new mortgage, but it can be used for other purposes, too.

Use Bankrate's mortgage calculators to compare mortgage payments, home equity loans and ARM loans. The mortgage calculator offers an amortization schedule. Mortgages Mortgage Calculators. Mortgage Calculators. Compare Mortgage Rates. Fixed-rate mortgage calculators Mortgage calculator.

Bankrate's calculator also estimates property taxes, homeowners insurance and homeowners association fees. You can edit these amounts, or even edit them to zero, as you're shopping for a loan. This can help you decide whether to prepay your mortgage and by how much. The major part of your mortgage payment is the principal and the interest. The principal is the amount you borrowed, while the interest is the sum you pay the lender for borrowing it. Your lender also might collect an extra amount every month to put into escrow, money that the lender or servicer then typically pays directly to the local property tax collector and to your insurance carrier. For the mathematically inclined, here's a formula to help you calculate mortgage payments manually:. This formula can help you crunch the numbers to see how much house you can afford.

Bankrate mortgage loan calculator

The cost of a loan depends on the type of loan, the lender, the market environment, your credit history and income. Secured loans require an asset as collateral while unsecured loans do not. Common examples of secured loans include mortgages and auto loans, which enable the lender to foreclose on your property in the event of non-payment. In exchange, the rates and terms are usually more competitive than for unsecured loans. Common types of unsecured loans include credit cards and student loans. Loan Calculator. These are mortgages, auto loans, student loans and other types of personal loans that are paid off in regular installments over time, with fixed payments covering both the principal amount and interest.

Furniture 123

Loan payment calculator. If you're refinancing, this number will be the outstanding balance on your mortgage. Loan amount - If you're getting a mortgage to buy a new home, you can find this number by subtracting your down payment from the home's price. Interest: This is what the lender charges you to lend you the money. Invest Review. Prev Next. Initially, most of your payment goes toward the interest rather than the principal. If you can get a lower interest rate or a shorter loan term, you might want to refinance your mortgage. Bankrate Recommends. Refinancing incurs significant closing costs, so be sure to evaluate whether the amount you save will outweigh those upfront expenses. If you're spending more than you can afford. Should you take out a year mortgage or a year?

Use Bankrate's mortgage calculators to compare mortgage payments, home equity loans and ARM loans.

Jumbo Mortgage Rates. Personal loan calculator Caret Right. ARM Mortgage Rates. An amortization schedule calculator shows: How much principal and interest are paid in any particular payment. Often, the standards for an interest-only mortgage will include higher credit scores, more cash reserves and assets, and higher household income than a traditional amortized loan, which means a portion of the monthly mortgage payment goes toward the principal. Lenders don't take those budget items into account when they preapprove you for a loan, so you need to factor those expenses into your housing affordability picture for yourself. Home equity loans, sometimes called second mortgages, are for homeowners who want to borrow some of their equity to pay for home improvements, a dream vacation, college tuition or some other expense. Refinancing incurs significant closing costs, so be sure to evaluate whether the amount you save will outweigh those upfront expenses. The principal is the amount you borrowed, while the interest is the sum you pay the lender for borrowing it. Many financial advisors believe that you should not spend more than 28 percent of your gross income on housing costs, such as rent or a mortgage payment, and that you should not spend more than 36 percent of your gross income on overall debt, including mortgage payments, credit cards, student loans, medical bills and the like. An auto loan is a secured loan used to buy a car. Lastly, a home loan modification brings the home loan current for borrowers experiencing financial hardship. Mortgage annual percentage rate calculator.

0 thoughts on “Bankrate mortgage loan calculator”