Asx wbc dividends

The next Westpac Banking Corp dividend is expected to go ex in 3 months asx wbc dividends to be paid in 4 months. The previous Westpac Banking Corp dividend was 72c and it went ex 4 months ago and it was paid 2 months ago.

Market data is provided and copyrighted by Thomson Reuters and Morningstar. Click for restrictions. All rights reserved. ASX shareholders. Our Board. Corporate governance. Media centre.

Asx wbc dividends

Looks you are already a member. Please enter your password to proceed. Forgotten password? Click here. Please make sure your payment details are up to date to continue your membership. Please contact Member Services on support investsmart. It may take a few minutes to update your subscription details, during this time you will not be able to view locked content. If you are still having trouble viewing content after 10 minutes, try logging out of your account and logging back in. Registration for this event is available only to Eureka Report members. View our membership page for more information.

Upgrade Today. Market Report.

Top Analyst Stocks Popular. Bitcoin Popular. Gold New. Unusual Options Activity Popular. Research Tools. Economic Indicators. Inflation Rate Unemployment Rate.

This takes the annual payment to 5. Check out our latest analysis for Westpac Banking. We like a dividend to be consistent over the long term, so checking whether it is sustainable is important. Before making this announcement, Westpac Banking was paying out a fairly large proportion of earnings, and it wasn't generating positive free cash flows either. We think that this practice can make the dividend quite risky in the future. The next year is set to see EPS grow by

Asx wbc dividends

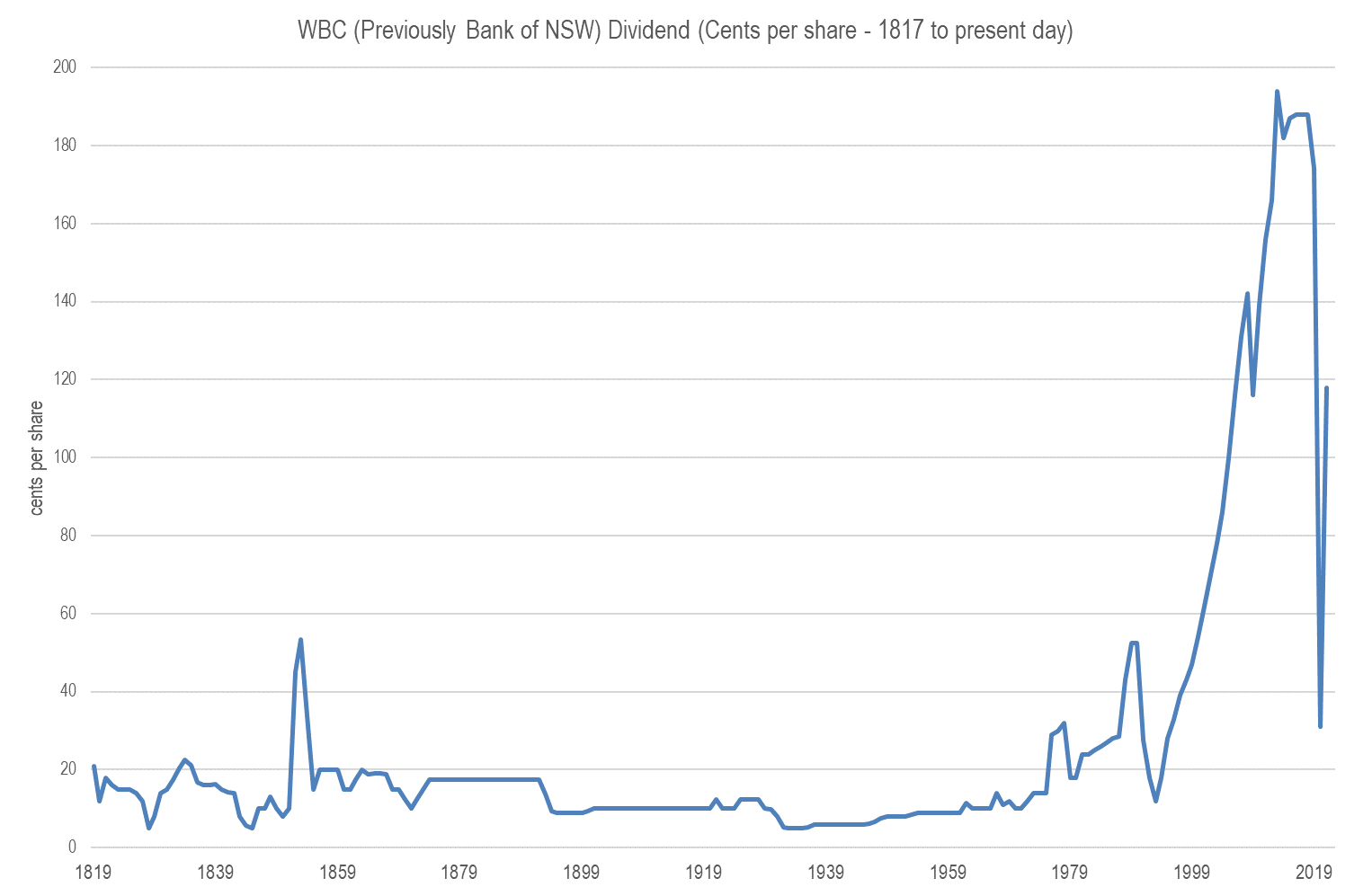

Getting to an analyst valuation is one of the more popular questions or topics our senior investment analysts get asked by Australian investors, especially those seeking dividend income. In Australia, ASX bank shares are particularly favoured by dividend investors looking for franking credits. However, sometimes shares are priced to perfection for a reason! That compares to the banking sector average PE of 24x. The dividend discount model or DDM is different from ratio valuation like PE because the model makes forecasts into the future, and uses dividends instead of profit. Because the banking sector has proven to be relatively stable with regards to share dividends, the DDM approach can be used. However, we would not use this model for, say, technology shares. Basically, we need only one input into a DDM model: dividends per share.

Exiting pxe rom lenovo

Penny Stock Screener. What emails do members receive? Enter the number of Westpac Banking Corp shares you hold and we'll calculate your dividend payments:. Please enter the code below. All DividendMax content is provided for informational and research purposes only and is not in any way meant to represent trade or investment recommendations. DLT as a Service. Nov 06, Sign up for free No credit card required. Compare Stocks. Westpac Banking's previous ex-dividend date was on Nov 09, Purchase order. Roundup of ASX market movements.

Looks you are already a member. Please enter your password to proceed. Forgotten password?

Price at review. Year Amount Change 0. Purchase order. What emails do members receive? You now have access to Intelligent Investor Free Insights. Email must be a valid email. Connectivity services. Dividend Calendar. You've recently updated your payment details. You must accept the terms and conditions.

Full bad taste